Are 0% Rates the New Normal?

Jun 14, 2021

By Frank Kaberna

Though they employ the same word, the two phrases “return to normal” and “new normal” are diametrically opposed. If you’ve witnessed a live television commercial break in the last month, then you’re probably aware of society’s return to normal; while interest rates, on the other hand, are threatening a new normal as they fail to lift off 0%.

Making a New Normal

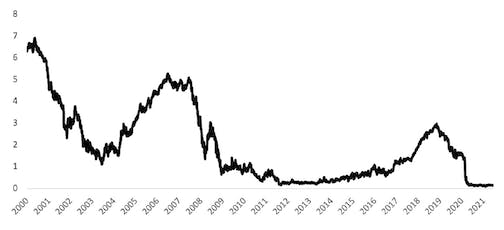

The 2YR yield currently rests around 0.15%, which is only 6 basis points higher than its all-time low of 0.09% made in February.* Since 2000, the 2YR has averaged 2.00%, but it’s spent more than 40% of this period below 1.00%.* Putting the magnifying glass on 2010 to present, 0% yields certainly seem more normal than those in higher positive territory.

2YR US Treasury Yield*

Source: US Treasury (treasury.gov)

Waiting for the New New Normal

As option traders who’ve watched implied volatility levels circle lows know all too well, new normals can permeate markets for extended periods. While rolling your reversion-to-normal play in Small 2YR Yield futures isn’t the worst thing in the world, most people probably want something that could pose quicker results.

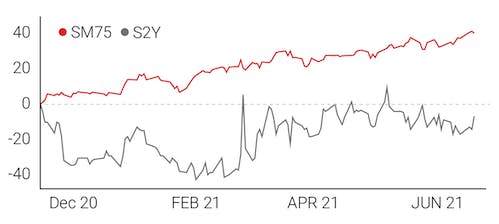

Yields can stay low for a long time, but they rarely do so without some turbulence from their highly correlated friends in the stock market. In the same time that short-term yields fell and sat around 0%, Small Stocks futures moved almost uninhibited to and through all-time highs. Trading SM75® from the short side against long S2Y could profit from either yields making up ground on stocks to the upside or stocks underperforming in a selloff.

Push In Yield, No Pull in Stocks

Source: dxFeed Index Services (https://indexit.dxfeed.com)

The notion of a new normal often alarms people, but the actual shift can happen without those same individuals even noticing. Low yields aren’t necessarily a reason for fear, but they do present a set of historically rare opportunities.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Values taken from treasury.gov as of 6/10/21