How Does Inflation Affect Markets

Jul 18, 2022

By Frank Kaberna

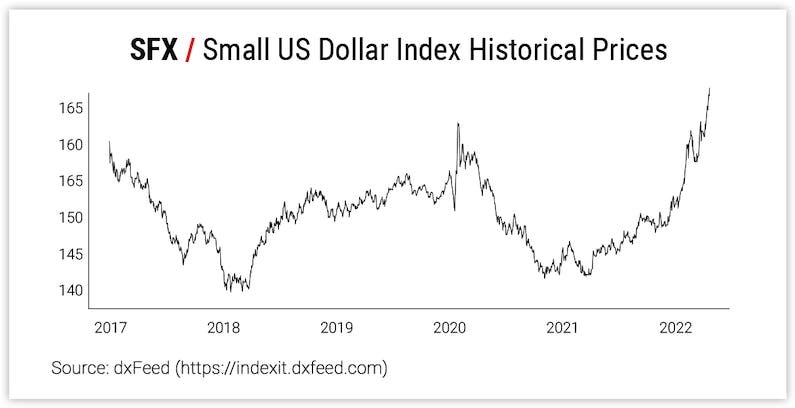

The highest inflation measure in more than 40 years has left many markets in utter disarray: Nasdaq is at its lowest since 2020, interest rates are their highest since 2007, and the US dollar is the strongest it’s been since the early aughts.*

Source: dxFeed

Though forex markets pose the largest extremes - EUR/USD lowest since 2002 and JPY/USD lowest since 1998 - inflation affects interest rates more than any other asset class.

How Inflation Affects Interest Rates and the Fed

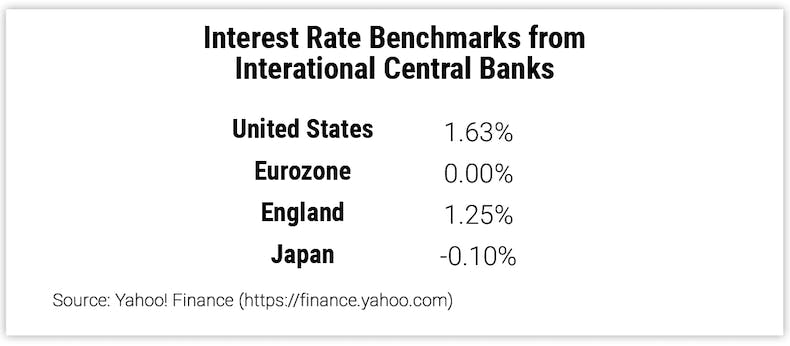

Extreme inflation rates are some of the top market forces that the Fed and other central banks work to mitigate outside of economic recessions. Broadly speaking, central banks raise interest rates when inflation is high to contract the economy, slow the exchange of money, and reduce prices for goods and services; conversely, rates are cut when inflation is low to inspire economic growth.

Source: dxFeed

The rise in inflation has played a significant role in US interest rates’ surge from near zero to multi-year highs; however, the Fed can only go so far in defending against its one major foe, inflation, without awakening the other, economic recession.

How Inflation Affects US Dollar and Exchange Rates

In a vacuum, rising inflation results in that region’s currency declining relative to foreign ones. In this more nuanced environment, US inflation and dollars are traveling in the same direction as the former creates fear and the latter acts as a flight-to-quality asset.

Source: Yahoo! Finance

Currencies are a game of relativity, so some currencies must perform positively even in an inflationary period. Since the United States is at the forefront of hiking interest rates in an effort to combat inflation, its relatively higher rates are translating to higher USD prices. (Relative interest rate values between two regions commonly translate directly to their relative exchange rate performance - higher rates means appreciating currency.)

How Inflation Affects the Stock Market

This leaves the stock market in an even more opaque position. While high inflation can mean higher interest rates that contract the economy moving equity valuations lower, at some point the stock market might slide enough to constitute an economic recession warranting lower interest rates. Such is the balancing act that faces the Fed ahead of what could be the most important rate decisions in decades.

Traders have a balancing act of their own to deal with as stock, bond, and forex markets all pose historical extremes: do you go with or against it?

Get Weekly Commentary on Small Markets!

Sign up to start receiving free analysis on everything from stocks and bonds to commodities and foreign exchange.

*All values in this article taken 7/14/22 Sources: US Bureau of Labor Statistics and Yahoo! Finance