What is Commodity Trading?

A commodity can be categorized as any primary resource, such as crude oil, gold, or corn, that can be bought and sold with relative ease. The commodity asset class can be similar to the stock market in that commodities as a whole tend to travel in the same direction in the long term while specific assets will fluctuate more or less than others. For example, gold and crude oil might both be higher in a given year, but crude oil could outperform gold by multiple percentage points since energy commodities tend to be more volatile than metal commodities.

Commodity trading can offer a world of opportunity distinct and diversified from the equity asset class. While markets like gold and crude oil might be correlated to each other, most commodities hold low correlations to the stock market. This can create an interesting addition for both passive investors looking for positions that zig when their stocks zag and active traders looking for new candidates to apply strategies to.

Since commodities can be deemed primary markets, meaning that they offer few alternatives for transferring risk, they tend to move with greater volatility than stock, bond, and forex markets. Greater volatility can translate to reluctance for those who are risk averse, but active market participants who want a bigger bang for their buck might find the larger fluctuations in commodity prices attractive.

How does Commodity Trading Work?

Commodity trading is a function of movement in the commodities themselves. That is, energy trading reflects fluctuations in energy prices, metal trading reflects fluctuations in metal prices, and agriculture trading reflects fluctuations in agriculture prices. For example, you could see a similar movement in the price of corn in your trading platform as the one in your grocery store, with some lag and variance.

Much of the activity in commodity trading is driven by supply and demand of the underlying market. Everything from geopolitical risk to poor weather conditions can affect supply, while changes in consumer sentiment and shifts in the popularity of commodity byproducts are examples of what can affect demand.

For example, the disruption of a pipeline may halt a portion of crude oil supply sending prices higher; an abnormally good growing season for soybeans may cause an abundance of the commodity and thus a lower price; greater popularity of electric cars and solar powered homes could result in the reduction in demand for gasoline which could then draw on crude oil prices.

Commodity futures are some of the most popular products used for commodity trading. Though exchange-trade products (ETFs, ETNs, etc.) do exist for commodities like crude oil, they often directly track the futures and thus carry a degree of separation between the trader and the actual commodity. Futures can give some of the closest exposure to the commodity itself out of any tradable products.

Gold futures, crude oil futures, and more commodity futures can be great tools for both hedging risk associated with commodity markets and speculating on the future path of their prices. For example, crude oil producers expecting to have barrels of oil months from now might sell crude oil futures today to lock in the current price and hedge against a fall between now and that later date. Using a similar example, consumers can hedge a coming rise in gas prices or airplane ticket costs by buying crude oil futures today. Finally, traders attempting to profit from opinions of where commodity prices could go in the future can buy or sell futures contracts based on a bullish or bearish bias.

Types of Commodity Trading Markets

Types of commodity markets can range from commonly traded assets like silver and soybeans to less liquid commodity companions such as livestock and lumber. Those new to commodity trading might want to gravitate towards the former to ensure a relatively smoother, less risky start as illiquid markets can cause larger profit/loss swings and difficulty entering or exiting positions.

Energy, metal, and agriculture commodities make up some of the asset class’ most popular sectors, and they each have multiple individual markets boasting several products that can be liquid enough for the everyday trader.

Energy commodities like crude oil and natural gas can power everything from cars and airplanes to office buildings, and their prices fluctuate on a daily basis. For example, rising crude oil prices can often result in higher prices for byproducts like gasoline when you head to the pump; and abnormally cold winters can cause a rush in demand for natural gas to heat buildings, which often sends natural gas prices higher.

Metal commodities are often divided into precious metals and industrial metals (or base metals). Precious metals include gold, silver, and platinum, and they are said to trade with a "flight to quality" or "store of value aspect". That is, these metals have little practical use, especially gold, and thus metal prices are more prone to fluctuating based on consumer sentiment. Industrial metals serve several practical purposes ranging from construction to electricity, and they include copper, steel, and aluminum. Metal prices can move based on a number of factors, but precious metals largely move in a correlated fashion to the amount of fear in the market while industrial metals move due to supply and demand dynamics within the industrial sector.

Agriculture commodities cover products that are grown or raised, and major commodity markets include corn, wheat, and soybeans. While demand for these products can account for a lot of their price action, supply is a huge factor in the movement of agriculture prices. Traders monitor growing cycles and inventory reports like the World Agricultural Supply and Demand Estimates (WASDE report) in an effort to speculate on where commodity prices are headed. For example, an abnormally dry growing season can result in a fraction of the corn output that was expected, which can drastically escalate corn prices.

How do Commodity Futures Compare to Commodity ETFs?

Exchange-traded funds (ETFs) do exist for commodities like crude oil, but they often directly track the futures and thus carry a degree of separation between the trader and the actual commodity. Futures can give some of the closest exposure to the commodity itself out of any tradable products.

That said, ETFs hold a familiarity with everyday traders given that they look and feel like shares of stock, and exchange-traded products like United States Oil Fund (USO) and SPDR Gold Shares (GLD) make for greater flexibility in the amount of exposure traders might be looking for. However, traditional futures exchanges like the CME and new entrants such as the Small Exchange have worked to reduce size and increase simplicity in their commodity futures so all traders can feel more comfortable trading gold, crude oil, and more.

Finally, futures have a sizable advantage over ETFs in their cost structure. Since futures require capital for long and short positions on a dynamic basis owing to volatility in the market, they can cost a fraction of their ETF equivalent per unit of exposure. But this type of leverage should not be taken lightly, and many new traders can start out trading commodity futures in a relatively small form thanks to Small Exchange futures and CME Micro futures.

Example Commodity Trading Markets

Commodity Futures:

- Small Precious Metals Futures (SPRE)

- Small Crude Oil Futures (SMO)

- CME Gold Futures (GC)

- CME Micro Gold Futures (MGC)

- CME Crude Oil Futures (CL)

- CME Micro Crude Oil Futures (MCL)

- CME Corn Futures (ZC)

Commodity Exchange-Traded Funds (ETFs):

How to Trade Commodities

Commodities can be traded as exchange-traded funds (ETFs), futures, and options. Traders can gain long, or bullish, exposure in commodity markets by buying commodity ETF shares, buying commodity futures contracts, or buying call options and selling put options. Short, or bearish, commodity exposure can be found in selling commodity ETF shares, selling commodity futures, or selling call options and buying put options; however, selling an asset can be more difficult when using stocks or ETFs rather than futures, which cost the same in capital requirements whether you are buying or selling the contract.

Strategies for trading commodities can range from long-term opinions based on the future of market sectors like energies and industrials (e.g. what will the burgeoning electric car industry mean for the price of crude oil?) to short-term price action (e.g. is crude oil at the higher end of its range worth a sell or buy?). Most traders choose a strategy that they perceive to have “edge” - a probability of profiting greater than the theoretical 50/50 - and consistently deploy it across the different commodity assets in the class.

For example, contrarian traders might use a strategy based on price extremes - when the market is at historically low or high prices. They can look at historical prices for crude oil, see that the majority of prices for the last decade fall within a range of $50 to $75 per barrel, and set buy and sell orders below and above those prices, respectively.

How to Trade Energy Commodities

Energy commodities like crude oil and natural gas are known for being some of the most volatile assets in the world. They are called primary markets which means there are few alternatives for traders looking to hedge risk, so large moves in an energy commodity market can be further exacerbated by the fact that the market itself is the only true place to manage a position.

While some traders might choose to avoid trading energy commodities due to their high volatility, many try to take advantage of these large movements. For example, crude oil and natural gas have been prime candidates for both trend-following and contrarian trade strategies in recent years given their massive swings.

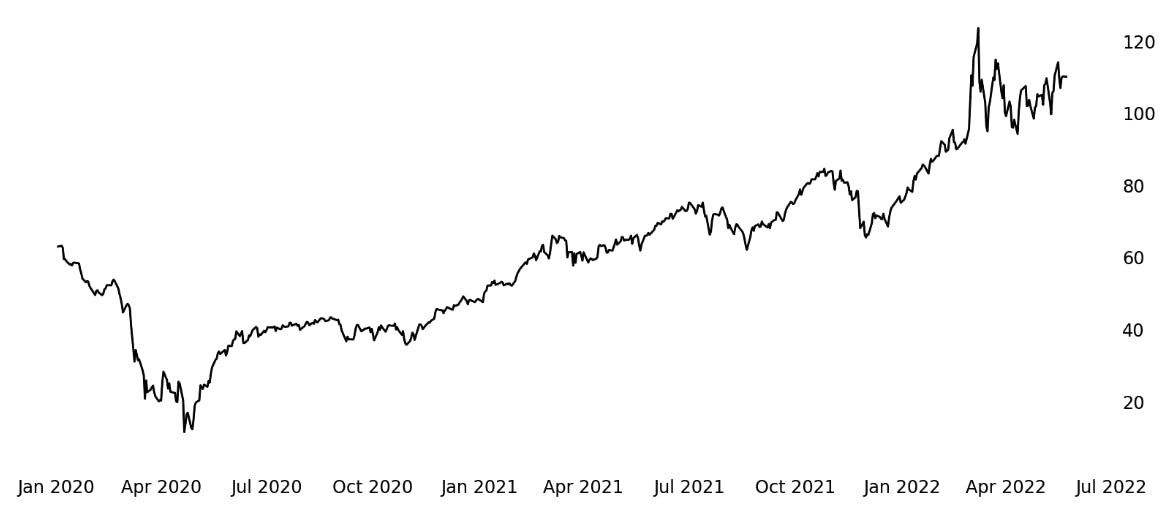

Crude Oil Commodity Price History

Source: Yahoo! Finance

Crude oil has witnessed both upside and downside price extremes in just the last few years. On average, crude oil prices trade around $60 to $70 per barrel, but they traded well below $25 at the start of 2020 and have recently ascended past $100.

Natural Gas Commodity Price History

Source: Yahoo! Finance

Natural gas has managed to trade both sides of its historical range in the last handful of years as well. On average, natural gas prices trade around $3 to $6, but they have traded both below and above those averages going back to 2020’s start.

Oil Futures Trade Example

Futures can track commodity prices better than most stock and ETF alternatives given how direct their exposure is to the underlying market. For example, every $1 higher in crude oil price reflects a $100 appreciation in a long Small Crude Oil (SMO) futures contract and a $100 depreciation in a short position.

Trade | Movement | Profit/Loss |

|---|---|---|

Sell 1 SMO Future | Crude Oil +1.00 | -$100 |

Sell 1 SMO Future | Crude Oil -2.00 | +$200 |

Buy 1 SMO Future | Crude Oil +3.50 | +$350 |

Buy 1 SMO Future | Crude Oil +3.50 | +$350 |

*These are example trades using theoretical values

What Affects Energy Commodity Prices?

Almost all factors affecting energy commodity prices can come back to supply and demand. From a very broad view, greater (lesser) supply can mean lower (higher) prices, and higher (lower) demand can mean higher (lower) prices. Inventory reports like those from the Energy Information Agency (EIA) and the American Petroleum Institute (API) that are updated regularly can shift energy commodity prices depending on how much supply is seen in the market at that time. The Organization of the Petroleum Exporting Countries (OPEC) can also affect the price of commodities given their influence on production in countries looking to export energy. Other government agencies and consumer sentiment indicators can affect the supply and demand dynamics for a given energy commodity and thus affect its price as well.

How to Express your Opinion using Commodity Futures

Putting your opinion to work in the market using futures is relatively simple and quite similar to doing so with stocks and ETFs. If you think the price of a commodity will move higher, then you can buy the futures contract. If you think the price will move lower, then you can sell the contract.

If you think... | Then you can... |

|---|---|

Crude oil prices will move higher | Buy Small Crude Oil (SMO) futures |

Crude oil prices will move lower | Sell Small Crude Oil (SMO) futures |

Energy Futures Trading Strategies

Though energy markets carry some slight nuances compared to equities, most stock strategies translate to commodity trading. The buy-and-hold strategy is relevant for anyone looking to profit from a long-term upward trend in a commodity market, and the flip side of this strategy, sell-and-hold, can be equally intriguing. Shorter-term trading with or against the trend can also be fruitful.

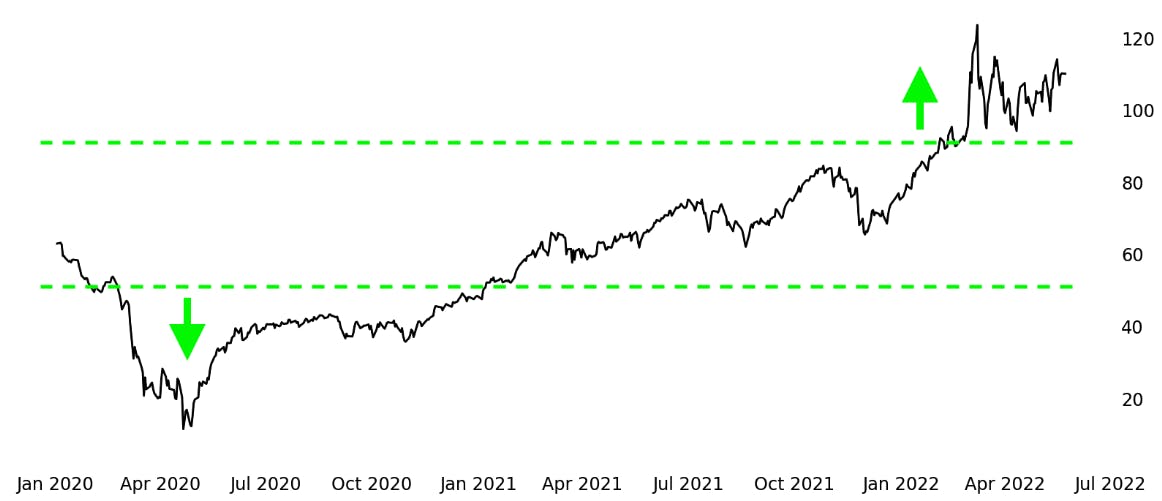

Crude Oil Commodity Price History - Trend Follower Trade Example

Source: Yahoo! Finance

Trend followers find markets moving outside their normal range and follow the move further in that direction. For example, if the average range in crude oil is $50 to $90 and the market has recently ascended past $90, trend followers might buy crude oil futures potentially profiting from the trend higher continuing. The same goes for selling into a fall below $50.

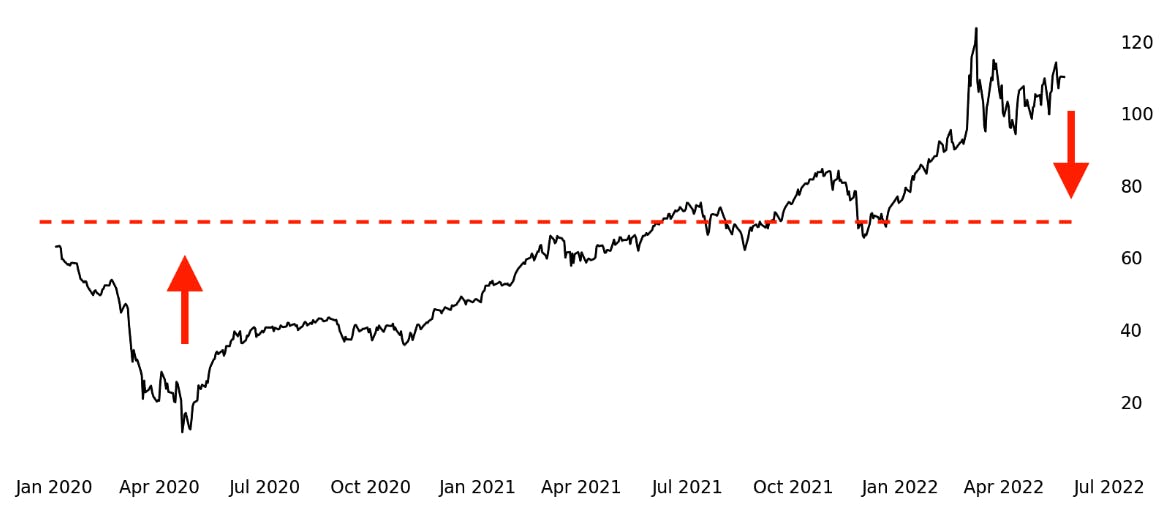

Crude Oil Commodity Price History - Contrarian Trade Example

Source: Yahoo! Finance

Contrarians trade in an opposing direction to trend followers. Whenever the market strays from what are considered average prices, contrarians might get on the other side of the recent trend potentially profiting from the market reverting to average prices. For example, if the average price for crude oil is $70 and the market recently rose to $110, then a contrarian trader might sell crude oil futures looking for the price to fall back to normal prices. The same goes for buying crude oil futures near lows in crude oil prices.

Consistency is key with almost any trading strategy, so choose what works for you and stick to it. Most trading strategies, like those in commodities, transcend time and thus can be deployed on a day trade, week trade, or year-long basis.

How to Trade Metal Commodities

Metal commodities like gold and silver present a different side of the commodity asset class. Precious metals especially can be largely driven by overall market sentiment and fear. That said, they share similarly volatile attributes to crude oil and natural gas commodities.

Precious metals like gold and industrial metals like copper can move just as much as crude oil, but they have their own rhythm. For example, gold can often be termed a flight-to-quality commodity, which means it can move higher in times of fear as people sell stock investments to buy gold. Industrial metals, however, can move in much the same way as risk-on markets like industrial stocks; that is, if market sentiments are optimistic and growth is projected, then companies will buy more copper and iron to build.

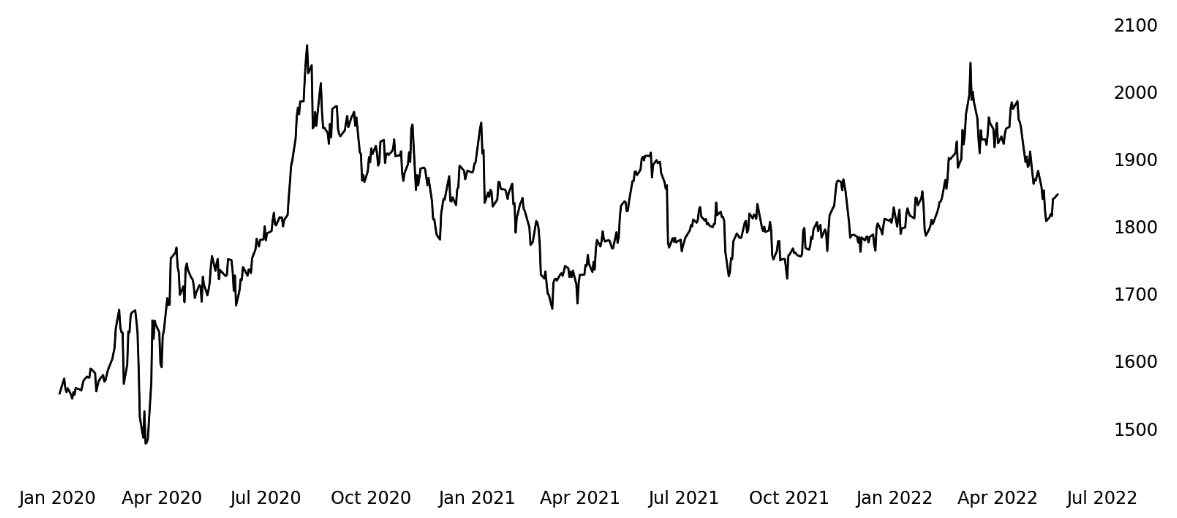

Gold Commodity Price History

Source: Yahoo! Finance

Gold prices have traded between $1,500 and $2,000 for the majority of recent history, and they’ve only tended to trade below or above those levels for a limited amount of time.

Precious Metal Futures Trade Example

Futures can track commodity prices better than most stock and ETF alternatives due to how direct their exposure is to the underlying market. For example, every $1 higher in the Small Precious Metals Index, which combines gold, silver, and platinum, reflects a $100 appreciation in a long Small Precious Metals (SPRE) futures contract and a $100 depreciation in a short position.

Trade | Movement | Profit / Loss |

|---|---|---|

Sell 1 SPRE Future | Small Precious Metals +0.50 | -$50 |

Sell 1 SPRE Future | Small Precious Metals -1.25 | +$125 |

Buy 1 SPRE Future | Small Precious Metals +2.10 | +$210 |

Buy 1 SPRE Future | Small Precious Metals -3.65 | -$365 |

*These are example trades using theoretical values

What Affects Metal Commodity Prices?

Metal commodities - especially precious metals - are less prone to supply and demand dynamics affecting their prices than energy commodities. Gold and silver are often referred to as stores of value or flight-to-quality assets whose main function is to retain value in times of fear given their relatively defined inventories. Metal commodity prices tend to rise (fall) as fear in the equity market increases (decreases). Interest rates can also have a major effect on prices for metals. Since gold and silver do not bear interest to their owners as bonds do, a rise (fall) in interest rates can cause a fall (rise) in demand for metals and thus their prices as well.

How to Express Your Opinion with Gold and Silver Futures Trades

Putting your opinion to work in the market using futures is relatively simple and quite similar to doing so with stocks and ETFs. If you think the price of a commodity will move higher, then you can buy the futures contract. If you think the price will move lower, then you can sell the contract.

If you think... | Then you can... |

|---|---|

Gold and silver prices will move higher | Buy Small Precious Metals (SPRE) futures |

Gold and silver prices will move lower | Sell Small Precious Metals (SPRE) futures |

Metal Futures Trading Strategies

Buy-and-hold strategies are extremely prevalent in metal commodities. Many investors view long positions in metal stocks, ETFs, and futures as a solid companion to long stock exposure given that gold can often rise as stocks fall creating a hedge. Active traders can commit trend following and contrarian strategies to metals as well. Many strategies that work for stock or energy commodity trading can translate to metal commodities.

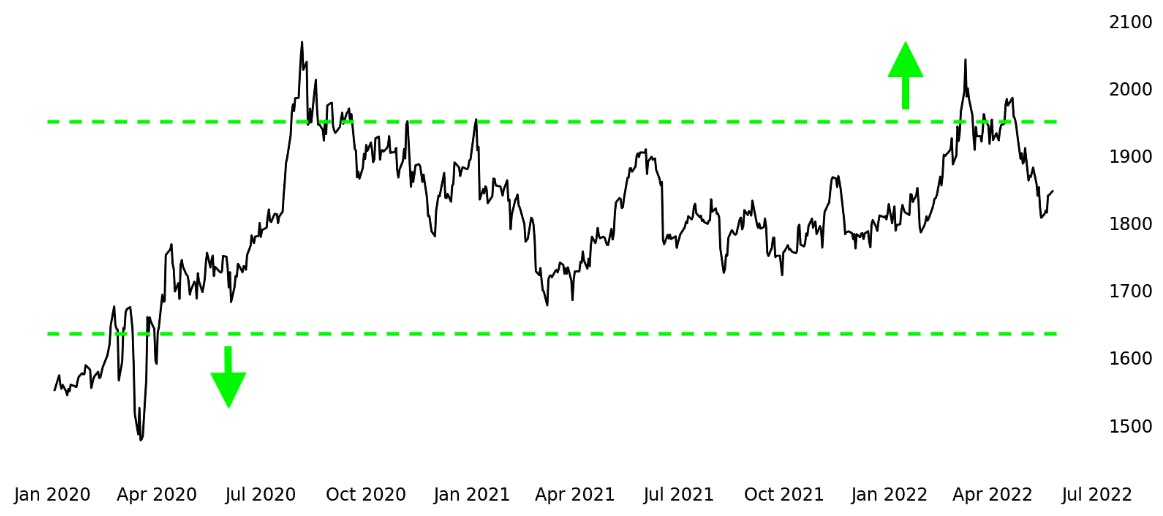

Gold Commodity Price History - Trend Follower Trade Example

Source: Yahoo! Finance

Trend followers find markets moving outside their normal range and follow the move further in that direction. For example, if the average range in gold is $1,500 to $2,000 and the market has recently ascended past $2,000, trend followers might buy gold futures potentially profiting from the trend higher continuing. The same goes for selling into a fall below $1,500.

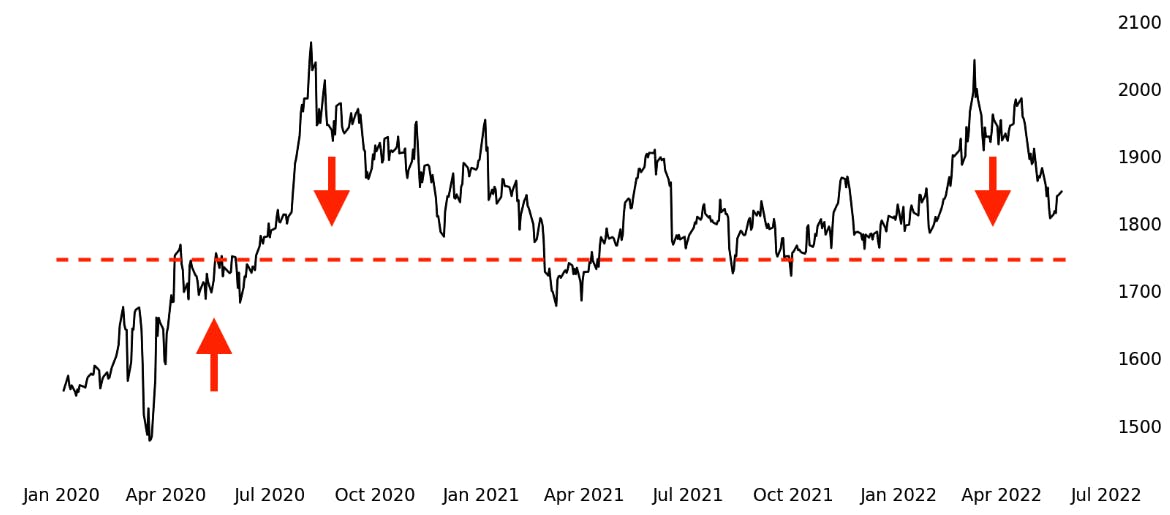

Gold Commodity Price History - Contrarian Trade Example

Source: Yahoo! Finance

Contrarians trade in an opposing direction to trend followers. Whenever the market strays from what are considered average prices, contrarians might get on the other side of the recent trend potentially profiting from the market reverting back to average prices. For example, if the average price for gold is $1,750 and the market recently rose all the way to $2,100, then a contrarian trader might sell gold futures looking for the price to fall back to normal prices. Again, the same goes for buying gold futures near lows in gold prices.

As always, consistency is key with almost any trading strategy, so choose what works for you and stick to it. Most trading strategies, like those in commodities, transcend time and thus can be deployed on a day trade, week trade, or year-long basis.

Trade Commodity Futures with the Small Exchange

Ready to trade commodities but not sure how to access the Smalls? Read our Derivatives Trading for Beginners guide for step-by-step instructions on how to make your first trade.