- What is Cryptocurrency Trading?

- How does Cryptocurrency Trading Work?

- How to Invest in Cryptocurrency

- Basics of Buying and Selling Crypto

- How Does Cryptocurrency Derivatives Trading Work?

- How to Trade Cryptocurrency Futures

- How to Trade Cryptocurrency Options

- Bitcoin (BTC) Price History with Options Hedge Example

- Trade Cryptocurrency Futures with the Small Exchange

Cryptocurrency

- What is Cryptocurrency Trading?

- How does Cryptocurrency Trading Work?

- How to Invest in Cryptocurrency

- Basics of Buying and Selling Crypto

- How Does Cryptocurrency Derivatives Trading Work?

- How to Trade Cryptocurrency Futures

- How to Trade Cryptocurrency Options

- Bitcoin (BTC) Price History with Options Hedge Example

- Trade Cryptocurrency Futures with the Small Exchange

What is Cryptocurrency Trading?

Cryptocurrencies are digital currencies that can facilitate secure, low-cost online payments using a decentralized network based on blockchain technology. While cryptocurrencies currently account for only a fraction of retail transactions, the historical volatility and future potential of these assets have made them popular trading instruments.

Cryptocurrency trading is primarily based on the investment potential of these digital currencies. Many people buy cryptocurrencies seeking to hold them for the long-term potential of large returns. The relatively high volatility of cryptocurrencies like Bitcoin can make annual returns of 50% or higher possible, but as with any investment, crypto trading carries risk.

Bitcoin (BTC) Price History

Source: Yahoo! Finance

The introduction of cryptocurrency derivatives has greatly diversified access to cryptocurrency trading. Traders can buy and sell coins with ease thanks to cryptocurrency futures, and investors can manage risk effectively with cryptocurrency options on futures. Cryptocurrency volatility can both be mitigated for the everyday investor and utilized by the active trader.

How does Cryptocurrency Trading Work?

Cryptocurrency trading can range from passive buy-and-hold strategies accessing the coins themselves to active volatility-based strategies employing cryptocurrency futures and options. Passive investors buy and sell cryptocurrency coins like Bitcoin (BTC) or Ether (ETH) directly through cryptocurrency exchange venues. Active traders can buy and sell crypto exposure using derivatives markets like futures and options on futures when trying to profit from short-term price action. No matter the context, most cryptocurrency market participants attempt to profit from the large movements of this asset class.

What Affects Cryptocurrency Prices?

Cryptocurrency prices are primarily affected by supply of coins and demand for them, or investor sentiment. Though some cryptocurrencies have been around for many years, it is still early days for this burgeoning asset class relative to stocks, bonds, and traditional currencies; so, many of the large moves in crypto prices could simply be the result of news items that either promote or diminish adoption of these assets.

Regulatory approvals that advance the use of cryptocurrencies in countries like China or the United States could cause cryptocurrency prices to rise. On the other hand, stricter legislation that could hamper crypto’s progress in the future could cause prices to fall.

Since crypto coins are still predominantly purchased as an investment, cryptocurrency prices can fluctuate based on consumer sentiment much like stocks. If there is an overall optimism in the market, then investors might be more willing to put money into crypto which would thus move prices higher. If pessimism or fear is perceived, then institutions and everyday people alike could be pulling investments out of crypto which would send prices lower.

Individual cryptocurrencies can also move in price based on developments particular to them, such as adoption by a large exchange or a protocol collapse. This is known as specific risk, and it can be similar to earnings or CEO news relating to a public stock.

How to Invest in Cryptocurrency

One of the most popular ways to invest in cryptocurrency is to access the coins themselves using a cryptocurrency exchange venue like Crypto.com. You can open an account, deposit cash, and start transforming cash funds into cryptocurrency investments. Beginning investors will often construct a portfolio using the largest market capitalization coins, such as Bitcoin and Ether. From there, you can research coins that you think have significant upside and diversify your portfolio from the big names.

Cryptocurrency investors can also buy crypto exposure in more traditional trading platforms like tastytrade. Though this strategy does not allow you to use them for transactional functions, they can offer the same upside for buy-and-holders simply looking to make money on the investment.

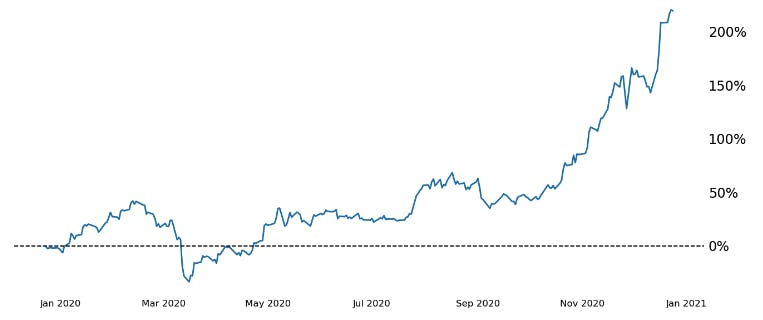

Bitcoin (BTC) Price Return in 2020

Source: Yahoo! Finance

Cryptocurrency investors may be intrigued by the potential to double their investment in a given year, while the stock market tends to return just single digits annually. For example, Bitcoin (BTC) appreciated by more than 200% in 2020.

Those same investors, however, might find cryptocurrencies' ability to lose 50% or more of their value reason enough to mitigate risk via reduced size or hedges in the derivatives market.

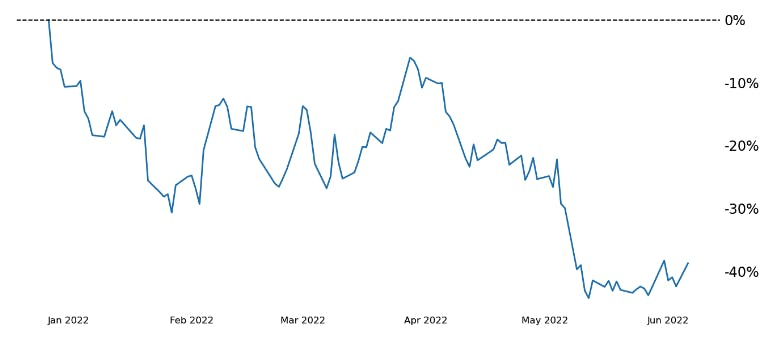

Bitcoin (BTC) Price Return in 2022

Data as of 6/6/22 Source: Yahoo! Finance

Basics of Buying and Selling Crypto

There are several ways to buy cryptocurrencies that include buying the coins themselves using a cryptocurrency exchange venue, gaining long exposure in crypto using a more traditional brokerage to access the cash market, or accessing derivatives on cryptocurrencies using futures and options on futures.

Cryptocurrency Exchanges, Trading Platforms, and Apps

Cryptocurrency exchange venues give you the ability to buy and sell actual crypto coins and other digital assets, and they tend to offer this access through both web-based platforms and downloadable applications. Crypto exchange venues each offer different experiences, including trading platforms, apps, educational resources, and coins available for trade. Some platforms include a digital wallet, a tool for storing crypto. If you choose a platform that doesn’t include a wallet, you’ll have to find your own method of storing your crypto.

While crypto exchange venues such as Crypto.com offer access to cryptocurrencies and other digital assets, traditional brokerages and applications like Robinhood have introduced cryptocurrency alongside other investment and trading options. This route often allows you to gain cryptocurrency exposure without actually purchasing the coins themselves. Though buying BTC or ETH using one of these platforms can give you an investment that moves one-for-one with the market, you can rarely commit any of the practical uses of your crypto such as transacting.

Cryptocurrency derivatives can give you easier access to gaining long or short exposure in the crypto market using futures and options on futures. Similar to the experience on traditional applications, you can trade crypto exposure, but futures and options on futures can be less capital intensive and an easier way to gain short exposure for either hedging or speculating purposes. Crypto derivatives are often present on both crypto exchange venues and futures brokerages as a companion to the cash, or spot, market.

Top Cryptocurrencies by Market Cap

There are thousands of different cryptocurrencies on the market today. Bitcoin and Ether are by far the most established by market capitalization, which is a measure of the current price multiplied by the circulating supply.

Here are some of the top cryptocurrencies by current market cap:

Source: Crypto.com as of 6/22/22

How Does Cryptocurrency Derivatives Trading Work?

Cryptocurrency derivatives include futures and options on futures on underlying crypto coins like BTC and ETH. These products offer many ways to buy and sell cryptocurrencies all in a way that can require less capital than the cash, or spot, market.

The majority of cryptocurrency options and futures are traded on offshore exchanges that can be difficult to access, but more and more cryptocurrency derivatives are being offered by traditional exchanges like the Small Exchange and CME Group. You can access options and futures on major coins like Bitcoin and Ether using a brokerage account offering crypto derivatives trading.

How to Trade Cryptocurrency Futures

Investors often use futures contracts to hedge their portfolios without having to uproot and sell out of their investments. For example, say you own 5 BTC and you’re worried that the market might fall in the short term. You can sell Bitcoin futures to hedge a certain percentage of that position depending on how many contracts you sell and their size. You can later buy back the futures without ever having to touch your initial 5 BTC investment. Advantages of using futures in this scenario include the relative ease with which you can buy or sell them and their relatively low cost.

Bitcoin (BTC) Price History with Futures Hedge Example

Source: Yahoo! Finance

Active traders use futures to profit from short-term speculations on the market, making use of the low capital requirements to trade futures and boost potential returns. For example, say you think Ether will rise in the next hour of trading. You can buy ETH futures that may afford you 50% off the total value of the coin and have a much lower entry fee compared to the cash market. Then, if ETH prices rise by 1% in the next hour, you can sell the futures back and return 2% on your capital.

Bitcoin (BTC) Price History with Futures Active Trade Example

Source: Yahoo! Finance

Crypto Futures Trade Example

Crypto futures yield profit and loss according to movement in the underlying cryptocurrency market. For example, buying a Bitcoin futures contract should result in profits if the price of Bitcoin moves higher and losses if the price of Bitcoin falls. The opposite relationship exists for those selling Bitcoin futures.

Trade | Movement | Profit/Loss |

|---|---|---|

Buy 1 Bitcoin Future | +1,000 | +$1,000 |

Buy 1 Bitcoin Future | -500 | -$500 |

Sell 1 Bitcoin Future | +800 | -$800 |

Sell 1 Bitcoin Future | -1,250 | +$1,250 |

*These are example trades using theoretical values.

How to Express your Opinion with Crypto Futures Trades

You can express your opinion on cryptocurrencies like Bitcoin and Ethereum using crypto futures in much the same way you might use the cash, or spot, crypto market. If you think the price of a cryptocurrency will move higher, then you can potentially profit from buying a cryptocurrency futures contract. If you think the price of a cryptocurrency will move lower, then you can potentially profit from selling a cryptocurrency futures contract.

If you think... | Then you can... |

|---|---|

Bitcoin will move higher | Buy Bitcoin futures |

Bitcoin will move lower | Sell Bitcoin futures |

How to Trade Cryptocurrency Options

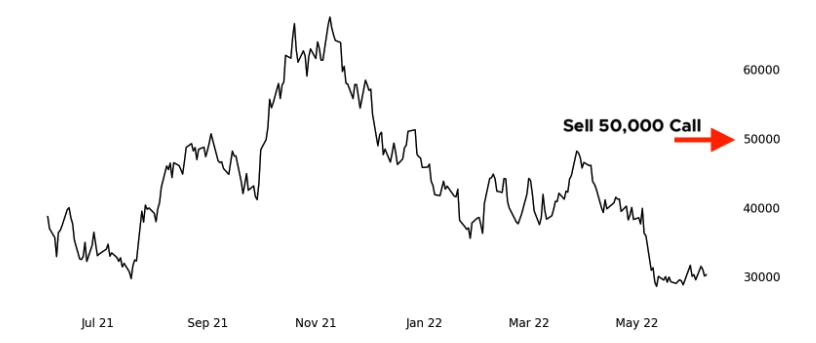

Investors can use options to help reduce risk and potentially profit when the market moves sideways or even lower. Call options offer their buyer the opportunity to own the underlying asset—Bitcoin, in this example—at a certain price (known as the strike price) by a certain date (known as the expiration date). Put options offer a similar setup on the potential for a short position. Those who are invested in cryptocurrencies like Bitcoin can sell call options on those cryptocurrencies in return for the premium on that option.

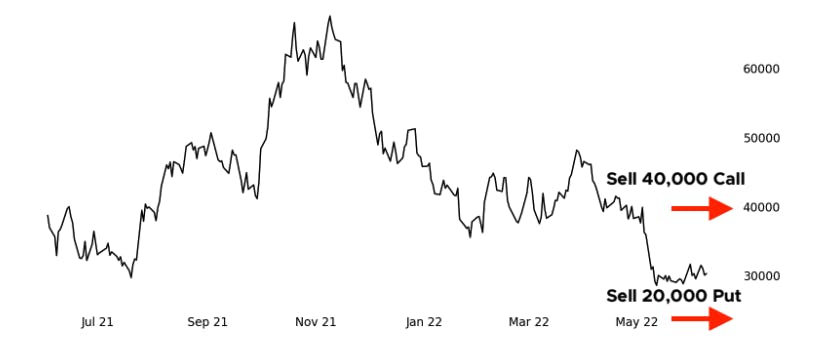

Bitcoin (BTC) Price History with Options Hedge Example

Source: Yahoo! Finance

The covered call is a popular strategy incorporating a short call on a long position in the underlying market that can reduce the cost basis, and thus the risk, of investments while generating short-term income. The closer the call strike is to the underlying market price, the greater premium you can get. However, the more aggressive you get with the strike selection directly translates to higher chances that the market eclipses said strike price and your investment is called away.

For example, say you own 1 BTC at a current market price of 30,000, and you can sell the 30,000 call for 5,000, the 40,000 call for 2,000, or the 50,000 call for 500. The at-the-money, 30,000 call brings in the most premium and reduces risk by the largest amount, but there’s a theoretically 50% chance that BTC is above 30,000 at expiration which would conclude your investment. The other options have smaller premiums but also smaller probabilities of your BTC being in-the-money at expiration and thus called away.

Risk-reducing options strategies for cryptocurrency investors include covered calls, protective puts, collars, and more.

Active traders will often access options without a position in the underlying market to make directional speculations or attempt to profit from fluctuations in volatility. Buying a call option can be a smaller stand-in for buying the underlying market that profits from the market moving higher and has limited downside risk but requires a premium. Put options offer the same characteristics in the opposite direction.

Taking a position in both calls and puts at the same time can create a strategy based on volatility whereby the trader potentially profits from either a lot of movement or a lack thereof.

Bitcoin (BTC) Price History with Options Trade Example

Source: Yahoo! Finance

The strangle is one of the most popular options strategies for trading with a neutral outlook on the underlying market itself. By buying both a call and put option (usually at strike prices equidistant from the underlying market’s price), you can potentially profit from the market moving higher or lower. However, since you pay the premium on both options, the market must surpass one of the strike prices by an extent greater than the cost of the options all by expiration. Many traders will sell the strangle—sell the call and the put—to profit from the market staying inside a certain range for a specific period.

For example, say the price of BTC is 30,000 and you can sell the 20,000 put for 2,000 as well as the 40,000 call for 2,000. Selling both at the same time would enter you into a short strangle position whereby you stood to profit 4,000 if the market closed inside the range of 20,000 to 40,000 at expiration. If you wanted to get more aggressive, you could sell the 30,000 put and call for a larger premium but your probability of success would be lower. If you wanted to get less aggressive, you could sell the 10,000 put and the 50,000 call for a smaller premium but your probability of success would be higher.

As always, consistency is key with almost any trading strategy, so choose what works for you and stick to it. Most trading strategies, like those in crypto derivatives, transcend time and thus can be deployed on a day trade, week trade, or year-long basis.

Trade Cryptocurrency Futures with the Small Exchange

Ready to trade crypto but not sure how to access the Smalls? Read our Derivatives Trading for Beginners guide for step-by-step instructions on how to make your first trade.