What is Currency Trading?

Currency trading presents a world of opportunity independent of the stocks in your portfolio. Central bank meetings, unemployment rates, and other economic data releases can cause currencies to appreciate or depreciate.

Currency trading is a relative game; that is, when you buy one currency, you are inherently selling one or several currencies against it. For example, a more aggressive interest rate policy from the US Federal Reserve compared to that of the Bank of England might cause US dollars to appreciate relative to British pounds.

You can access popular currency crosses like GBP/USD, EUR/USD, and JPY/USD, or you can trade a central US dollar market against a basket of currencies. Futures and forex markets can provide the most straightforward products for trading currencies using either route.

How Does Currency Trading Work?

There are two ways to trade currencies—currency crosses or currency baskets.

Trading a currency cross entails a more specific idea of how one particular currency might move relative to another single currency. These markets are often quoted in exchange rates that you can buy or sell (values taken 4/20/22):

- 1.30 GBP/USD

- 1.09 EUR/USD

- 0.0078 JPY/USD

- 0.80 CAD/USD

For example, if you wanted to speculate on the euro going higher or hedge US dollars in your bank account for an upcoming trip to Italy, you could buy the EUR/USD currency cross at 1.09. This position would profit if the euro appreciated relative to the dollar, say, to 1.10, and it would lose value if the euro fell below 1.09.

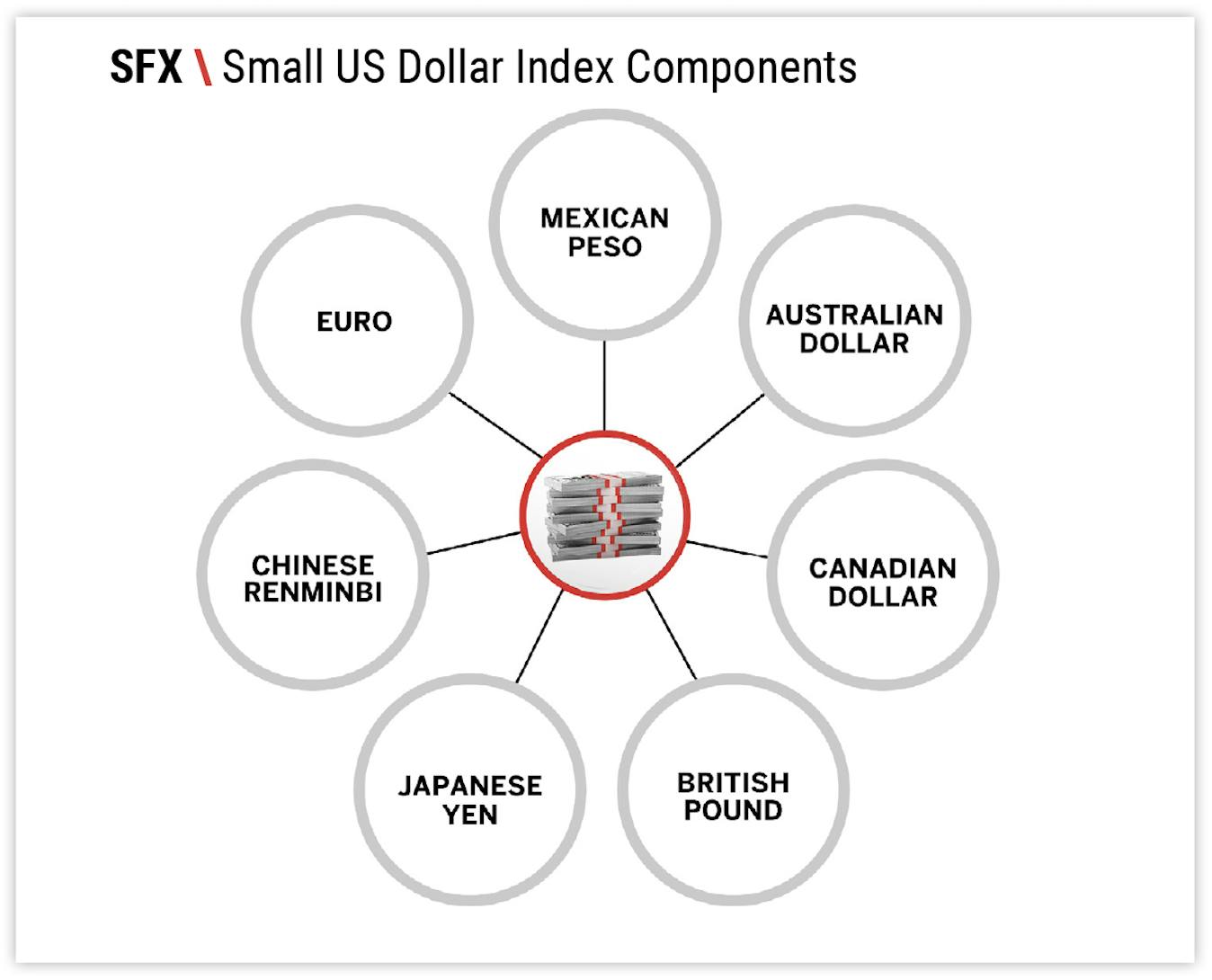

Many people getting started in currency trading will use currency baskets that require a simple idea of where a market like US dollars is headed broadly against a basket of other currencies usually including pounds, euro, yen, and more. This strategy can allow you to mute the risk of specific events occurring in a particular region of the world and purely focus on where the USD is headed.

For example, if you wanted to speculate on the dollar going higher or hedge a future purchase to be made in USD but didn’t know which base currency offered the best opportunity, you could buy the US dollar market against a basket of diversified currencies from across the world.

Small US Dollar (SFX) Components

For a list of the Small US Dollar Index Components and Weights, visit Indexit.dxFeed.com

This position would profit if dollars broadly appreciated against the general foreign exchange market, and it would lose if the USD depreciated for whatever reason likely specific to the US economy.

Types of Currency Trading Markets

Every currency has an exchange rate relative to every other currency, and these prices are the essence of the foreign exchange market at large. But the way that you access them can come in many different shapes and sizes ranging from the spot EUR/USD market to the broad US Dollar exchange-traded fund.

What is the Difference Between Foreign Exchange and Forex Trading? How do They Relate to Trading Currencies?

Foreign exchange, forex, and currency trading essentially reference the same marketplace with just slight nuances:

- Foreign exchange is the large umbrella term often used to describe the entire market—spot and derivatives—for all exchange rates and currencies.

- Currencies directly reference a nation or region’s medium of exchange, such as euro, yen, or dollar. If you are trading currencies, you are likely accessing them using derivatives like futures and options.

- Forex is often used to delineate spot, or cash, exchange rate markets that contain great specificity in both their structure and pricing. If you are trading forex, you are likely doing so on an over-the-counter basis using particular crosses like EUR/USD that can be quoted to many decimal points.

What is the Difference Between the Spot Market and Futures Market?

The spot, or cash, market is an over-the-counter space that entails immediate delivery of large currency quantities. It is usually intended for institutions like banks and funds holding large amounts of currency exposure to speculate and hedge their positions. Spot foreign exchange markets let you access a very wide, sometimes daunting, world of specific exchange rates like EUR/USD and EUR/JPY in a very precise setting that can be more than ten decimal points deep.

The futures market offers uniform quantities of currency exposure ranging from small to large that entail either delivery or settlement back to cash in your account upon expiration. Institutions and everyday people alike can hedge risk or speculate on the future path of currency prices using futures contracts. Foreign exchange futures markets let you trade specific exchange rates like EUR/USD or broad markets like USD versus multiple other currencies in a low-cost, straightforward structure.

How do Currency Futures Compare to Currency ETFs?

Currency exchange-traded funds (ETFs) can offer simple exposure similar to futures, but capital requirements can be much higher for currency ETFs relative to futures. Foreign exchange markets historically boast low volatilities, which futures can make up for with their dynamic, efficient margin system. ETFs, on the other hand, margin most traders at 50–100% no matter the volatility of the underlying market. This can make currency futures much more attractive than ETFs for both everyday and professional traders.

Example Currency Trading Markets

Currency markets can be accessed via futures and ETFs, and some of the most popular products incorporate the US dollar in some way. ETFs such as UUP and FXE can be easier for everyday people to access, but they can cost more in capital requirements per unit of exposure. Futures can cost less than ETFs, but they can be a little more complicated. Some products like SFX futures try to balance the best attributes of ETFs and futures. Here are some examples of currency markets:

- Invesco US Dollar Index Bullish Fund (UUP) - US dollar ETF that holds USD exposure against a basket of other currencies and requires 50-100% in capital to trade.

- Small US Dollar Futures (SFX) - US dollar future that holds USD exposure against a basket of other currencies and requires 1-5% in capital to trade.

- Micro Euro EUR/USD Futures (M6E) - Euro future that holds EUR/USD exposure (so you have to flip your opinion on USD) and requires 1-5% in capital to trade.

- Micro Australian Dollar AUD/USD Futures (M6A) - Australian dollar future that holds AUD/USD exposure (so you have to flip your opinion on USD) and requires 1-5% in capital to trade.

- Micro British Pound GBP/USD Futures (M6B) - British pound future that holds GBP/USD exposure (so you have to flip your opinion on USD) and requires 1-5% in capital to trade.

- Micro Canadian Dollar CAD/USD Futures (MCD) - Canadian dollar future that holds CAD/USD exposure (so you have to flip your opinion on USD) and requires 1-5% in capital to trade.

How to Trade Currencies

Foreign exchange markets have little to no correlation to equity markets making currency trades great for portfolio diversification. Many people speculate on the future value of exchange rates or hedge currency exposure by trading currency futures.

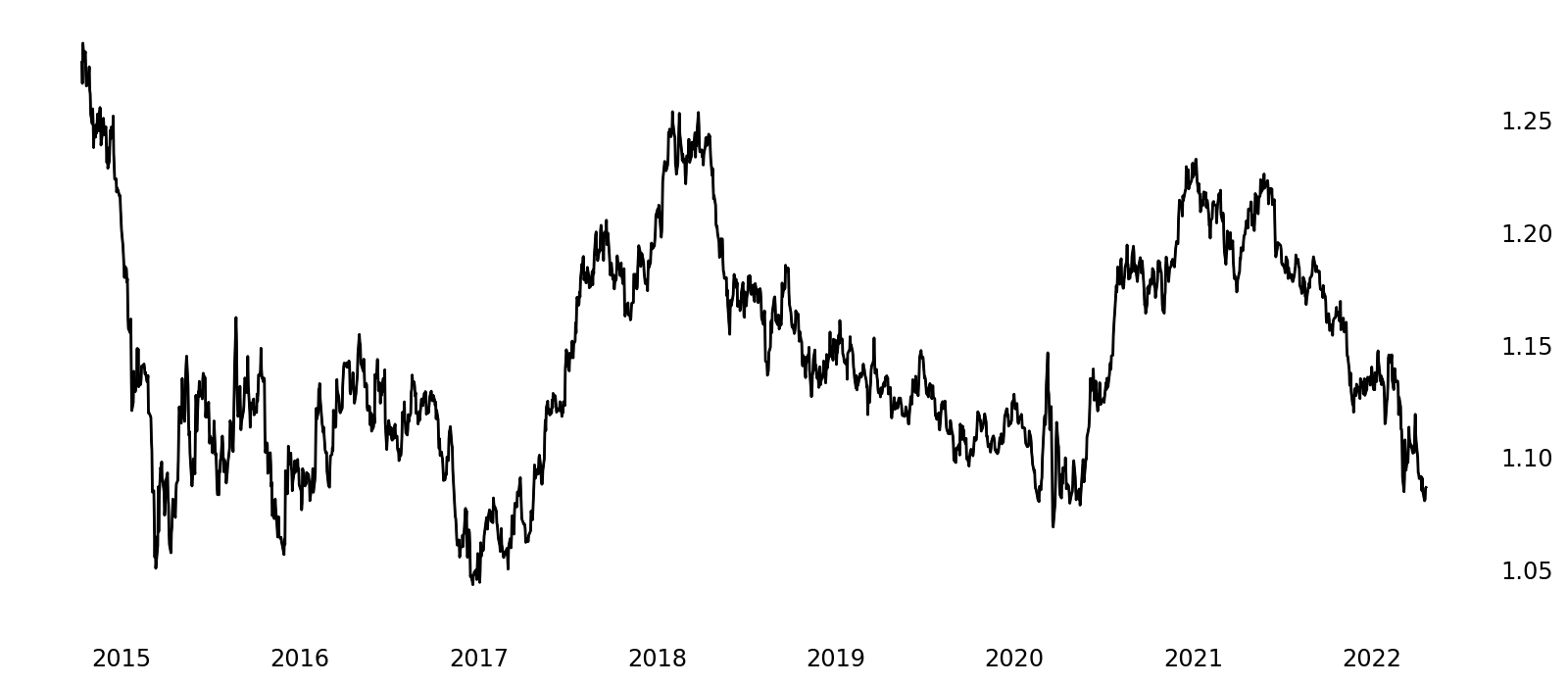

Though exchange rates can fluctuate widely and trend for extended periods, they tend to hold a long-term range. Many traders use this mean-reverting attribute to either get on a trend toward historical highs and lows or take the other direction on a market that’s already at an extreme. For example, EUR/USD has had a volatile few years, but it has spent the majority of its time between 1.05 and 1.25.

EUR/USD Exchange Rate History

Source: Yahoo! Finance

Currency trading can be very effective for those needing to hedge parts of their business that are dependent on a foreign currency or even those looking to take some conversion risk out of an upcoming vacation. For example, if your base currency is USD and you are doing business with or traveling to the Eurozone and England, you can lock in the current high prices in US dollars by selling USD futures.

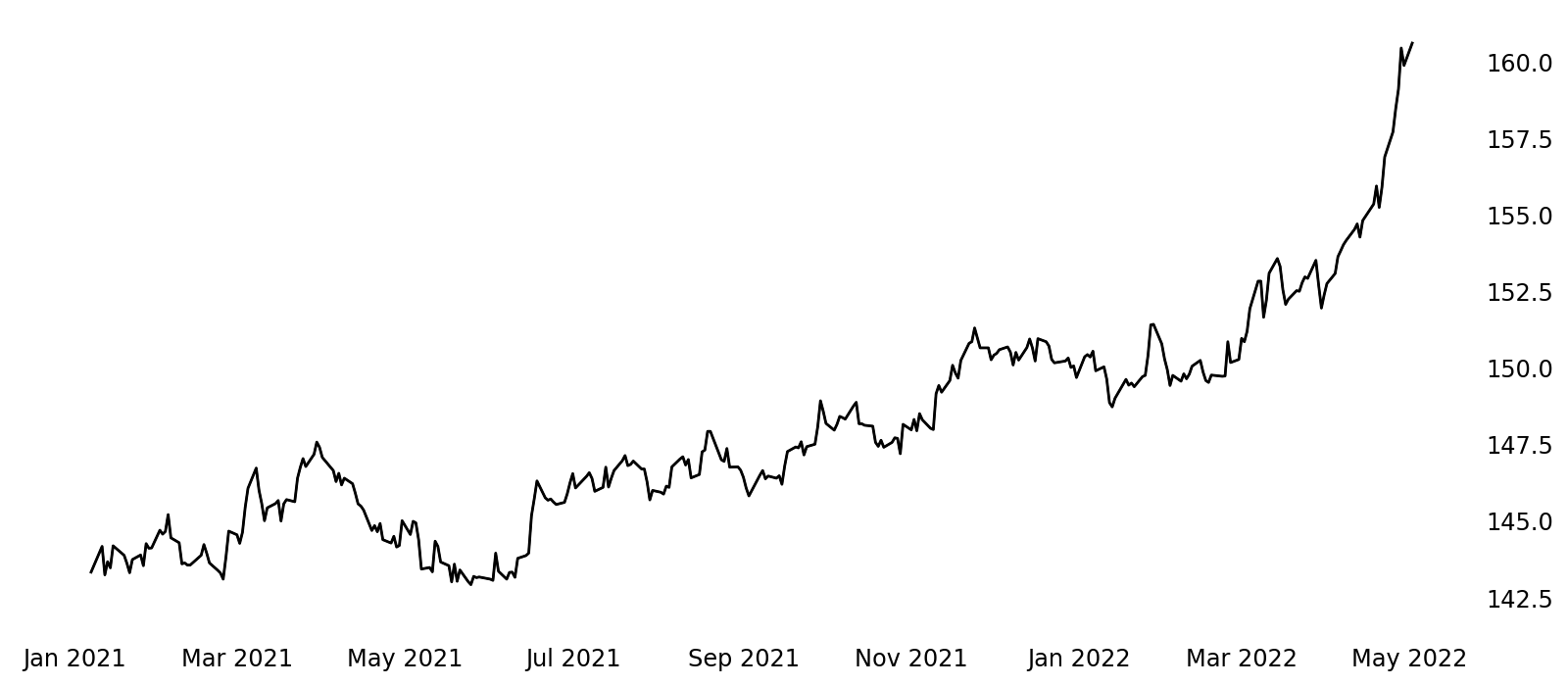

SFX \ Small US Dollar Price History

Source: dxFeed

Currency futures can offer the shortest path from idea to execution in this asset class given their relatively small size and straightforward nature. Think US dollars will move higher? You can buy Small US Dollar (SFX) futures. Wanna lock in the current EUR/USD exchange rate for your upcoming trip to Europe? You can sell Small US Dollar (SFX) futures.

US Dollar Futures Trade Example

Small US Dollar (SFX) futures yield profit and loss in direct correlation to movement in the US dollar currency. If you buy one Small US Dollar (SFX) futures contract and the USD appreciates relative to the euro, yen, or other currencies, then you should profit, theoretically.

Trade | Movements | Profit/Loss |

|---|---|---|

Sell 1 SFX Future | SFX from 155 to 154 | +$100 |

Buy 1 SFX Future | SFX from 155 to 157.50 | +$250 |

Buy 1 SFX Future | SFX from 155 to 153 | -$200 |

*These are example trades using theoretical values

How do Changes in Exchange Rates Affect Currency Trading?

Exchange rates have a direct effect on currency trading. If an exchange rate for currency A relative to currency B falls, then the value of currency A depreciates and that of currency B appreciates, theoretically. Exchange rates and currency trading are part of the same market, which is to say that movement in one part simultaneously moves the other. This relationship is not necessarily a cause and effect dynamic as the trading of currencies directly translates to current exchange rates you might be quoted at a bank.

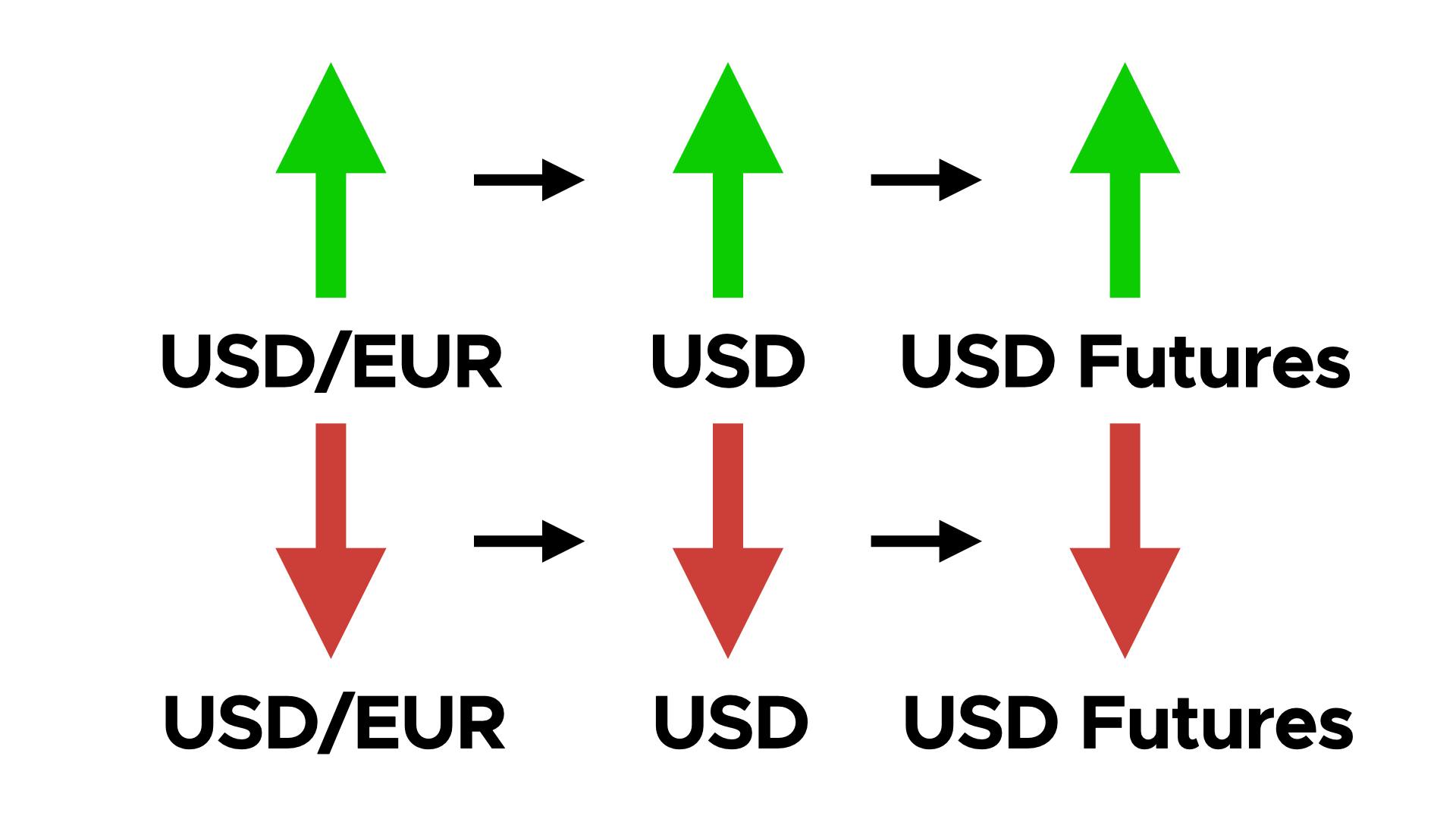

How Exchange Rates Affect Currency Futures

Exchange rate changes have a direct effect on currency futures:

- Higher exchange rates can mean a higher currency value and higher currency futures prices

- Lower exchange rates can mean a lower currency value and lower currency futures prices

How do Changes in Interest Rates Affect Currency Trading?

Interest rates have more of an indirect effect on currency trading. If interest rates rise in the United States, for example, then the knee-jerk reaction would be for US dollars to also rise. However, the effect of interest rates on currencies is more relative given the fact that currencies are priced against other currencies whose regions are also moving around interest rates. So if interest rates rise in the US but they rise by an even greater extent in Europe, then the value of US dollars might fall relative to the euro or pound.

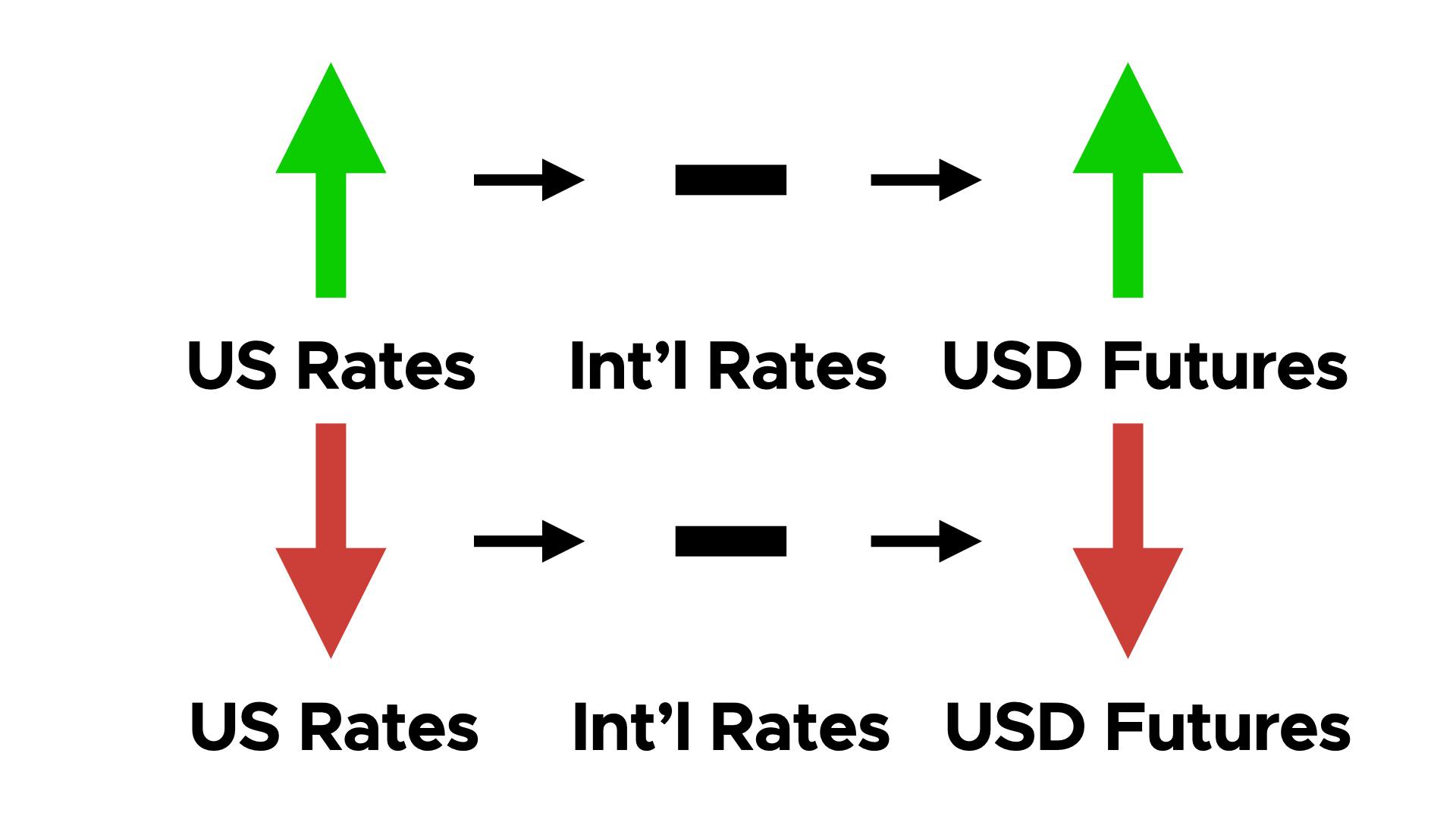

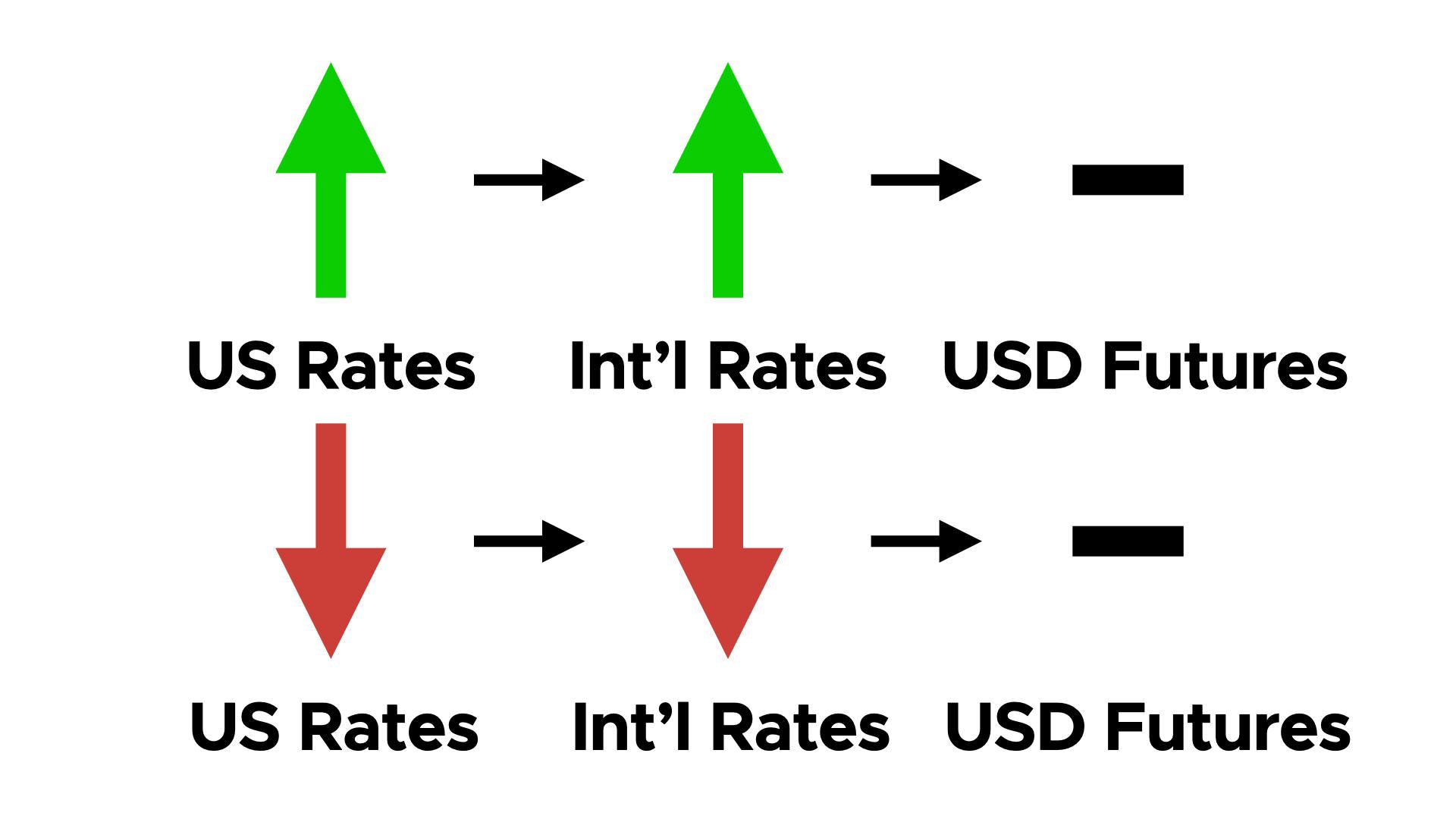

Interest rate changes have an indirect effect on currency futures:

- Higher interest rates in region A and unchanged or lower interest rates in region B can mean higher currency futures prices for region A

- Higher interest rates in region A and higher interest rates in region B can mean lower currency futures prices for region A

- Lower interest rates in region A and unchanged or higher interest rates in region B can mean lower currency futures prices for region A

- Lower interest rates in region A and lower interest rates in region B can mean higher currency futures prices for region A

How to Express Your Opinion with Currency Futures Trades

If you think... | Then you can... |

|---|---|

US dollar will appreciate relative to other currencies, | Buy Small US Dollar (SFX) futures. |

US dollar will depreciate relative to other currencies, | Sell Small US Dollar (SFX) futures. |

Currency Futures Trading Strategies

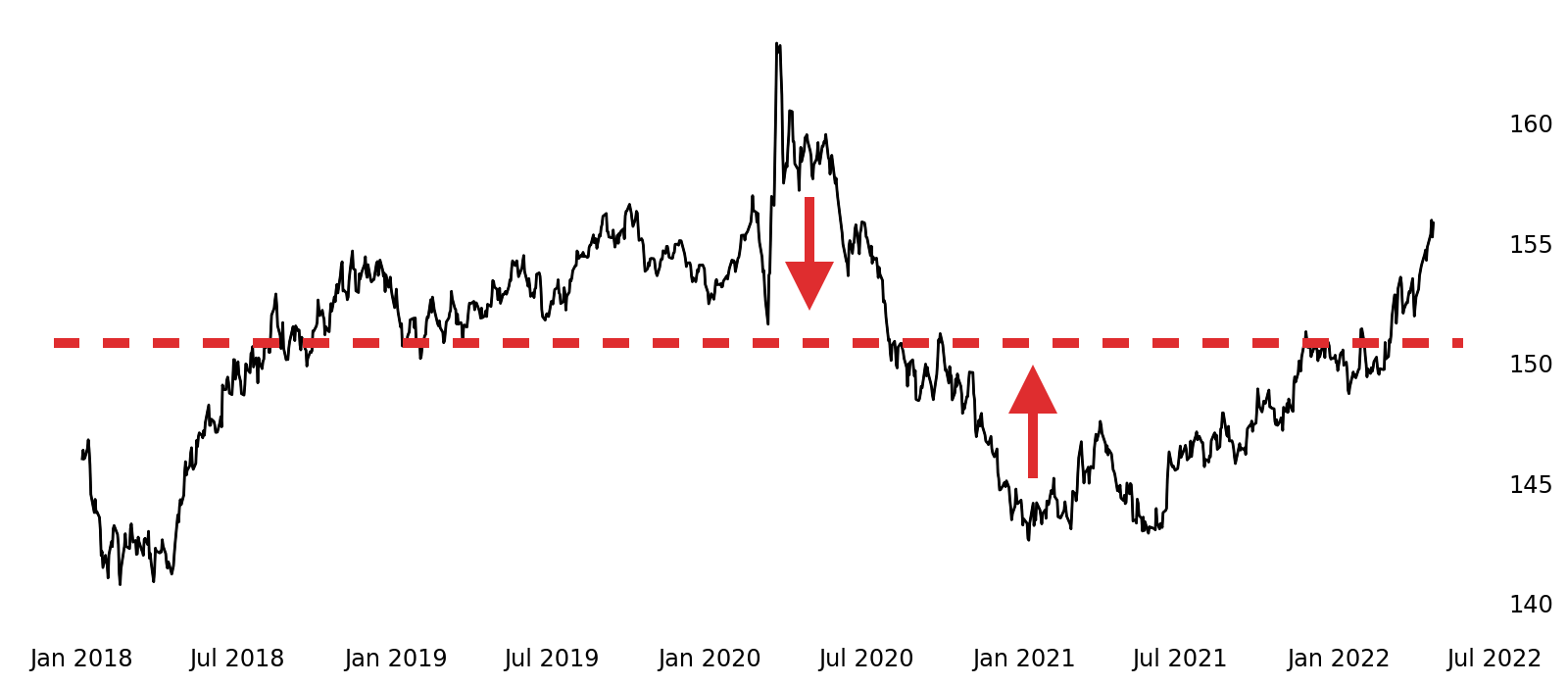

Mean reversion is one of the most common strategies in currency trading. It contends that currencies have a long-term mean (or average) level, and they tend to move higher or lower than this mean while always returning to it at some point.

SFX \ Small US Dollar Historic Movement Demonstrates Mean Reversion

Source: dxFeed

Trading currencies with mean reversion would contend that the trader buys currencies when they are below their average and sells them when they are above their average.

Trade Currency Futures with the Small Exchange

Ready to trade currency but not sure how to access the Smalls? Read our Derivatives Trading for Beginners guide for step-by-step instructions on how to make your first trade.