How Risky is Shorting a Market with Futures?

Feb 7, 2022

By Frank Kaberna

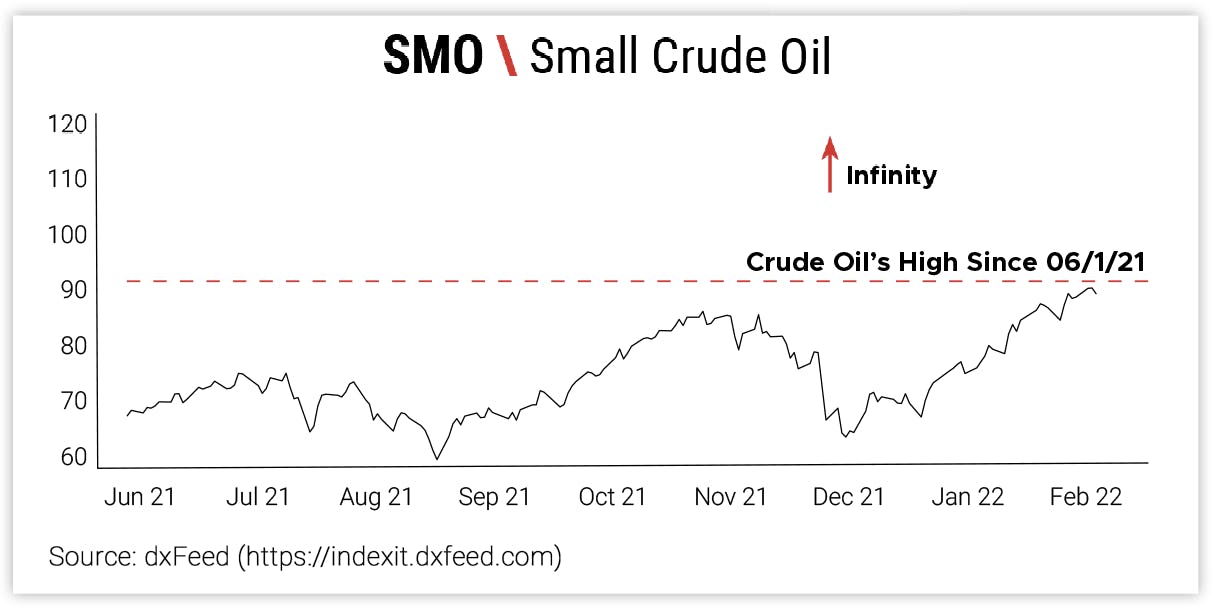

One of the most frightening sights in trading is the infinity symbol that appears next to the potential loss on a position that is short the underlying market. Selling futures, calls, and even shares of stock short can give you both the ability to profit from a market moving lower and the theoretical chance of losing multiples of your money if the market’s price approaches infinity.

Source: dxFeed

But prices rarely reflect a sideways eight. Actually, no market has reached infinity yet, so it might not be realistic to view this as your loss potential when getting short. Everything from crude oil to crypto has topped out at a real number even while reaching for their highest heights. So, what’s a realistic measure of risk in shorting a market?

Futures Margin as a Measure of Risk

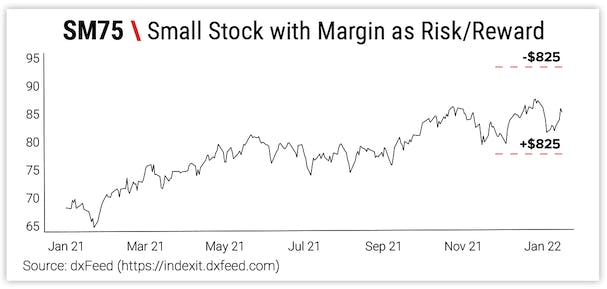

Taking a short futures contract for example, since futures can offer one of the most direct, cost-effective ways to sell a market, you’re likely to see a real dollar amount in the margin column next to your theoretically infinite potential loss. This value is not only the capital required to put on and hold the trade, but it can be viewed as an approximation of your risk over the lifetime of the contract if you were to choose to hold it to expiration. Most margin systems in the derivatives market take into account historical data and volatility when spitting this number out, and they do so to ensure your account can withstand the turbulence of such a position on its way to expiration.

To further this example, say you sold a Small Stocks (SM75®) February 22 futures contract that required an initial margin of $825. This can translate into an expected potential change in P/L of +/-$825 between now and expiration - the third Friday of the month or February 18, 2022.*

Source: dxFeed

Is Margin an Accurate Measure of Risk?

The largest 30-day loss for a short SM75 position in the last year was $885 in the month spanning 9/20/21 to 10/20/21. The standard deviation of monthly changes in this market reflects turbulence of +/-$300 for a short position more than 68% of the time. This is all to say that a short position lasting 30 calendar days witnessed a P/L inside of the initial margin amount most of the time.

Attempting to profit from downside in a market isn’t the most natural feeling, but shorting a future can often yield similar movement in your account to buying one even though its theoretical risk incorporates that intimidating infinity symbol. Give yourself the ability to profit from both directions.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.