How the Fed Affects Interest Rates

Jun 21, 2022

By Frank Kaberna

Last week, the Federal Open Market Committee held their fourth meeting of the year where they hiked the Federal Funds Rate - a benchmark for short-term interest rates in the US - by 0.75% (75 bps); this was the largest hike by the Fed in more than 20 years.* So why did it send interest rates lower?

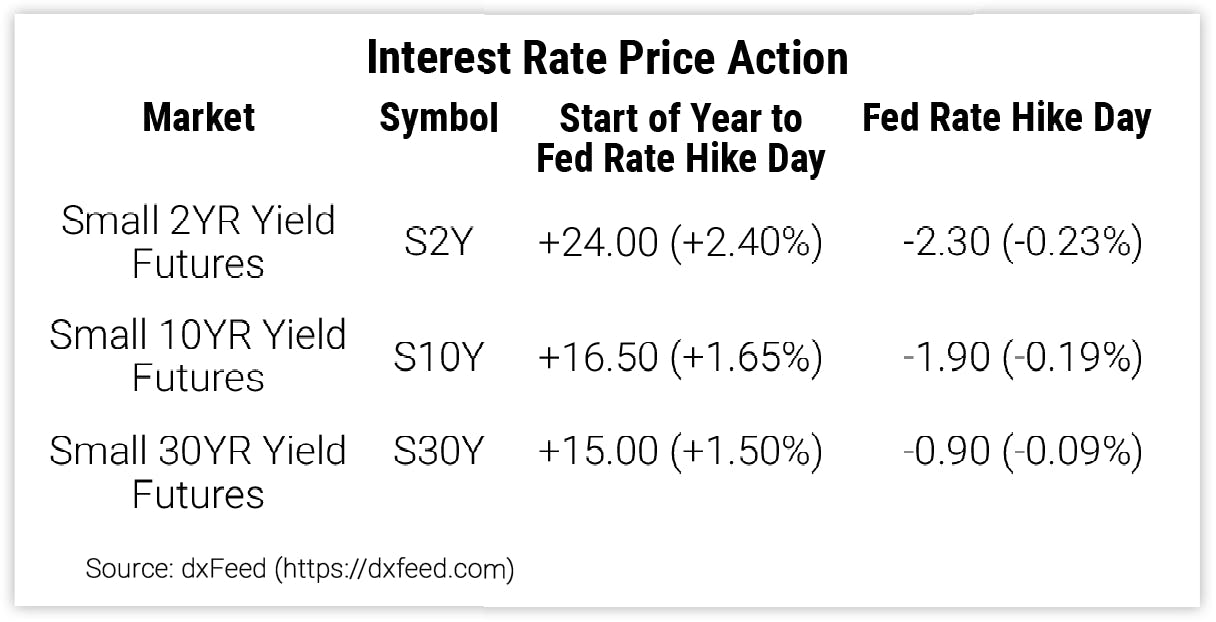

While the Fed only directly affects the Fed Funds Rate, changes made to that interest rate can affect popular interest rate trading markets like US Treasuries. However, on June 15, 2022 - the day the Fed hiked rates by 0.75% - Small 2YR US Treasury Yield (S2Y) futures fell by the equivalent of -0.23% in 2YR US Treasury interest rates, which are often highly correlated with Fed Funds Rates.

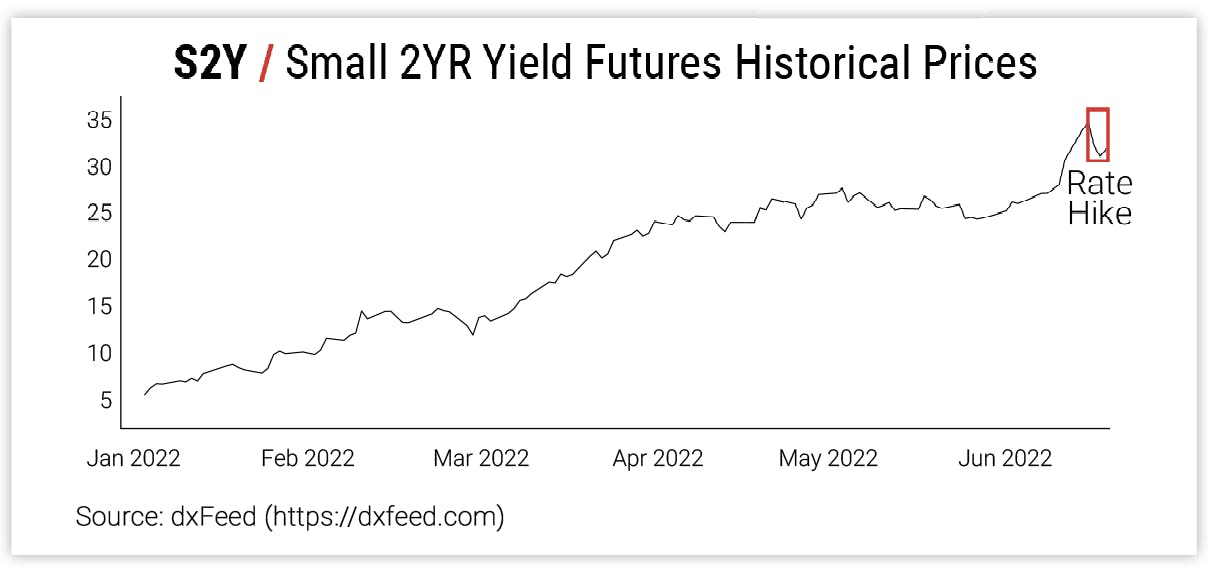

If the Fed is one of the most influential voices in interest rate pricing, then how can interest rate markets move lower on the actual day that the Fed hiked rates? Futures and options have a time component that requires traders to think steps ahead, and you can see by the price action in S2Y futures leading up to the actual event that this hike had been priced in for a while.

Interest Rate Futures: How They Work

On days when the Fed isn’t hiking or cutting rates, interest rate futures largely move based on where traders think rates are headed. You can think of the day-to-day interest rate price action as efficiently getting closer and closer to what the Fed will do in the future, and this process is informed by employment data, inflation data, the state of the stock market, and more. For example, Small 2YR Yield futures rose the equivalent of +2.40% from January 1, 2022, to the Fed Rate Hike Day of last Wednesday, while the Fed has only hiked rates 1.50% in the same time. The difference is owing to future rate hikes already priced into the market.

What to Expect from the Fed

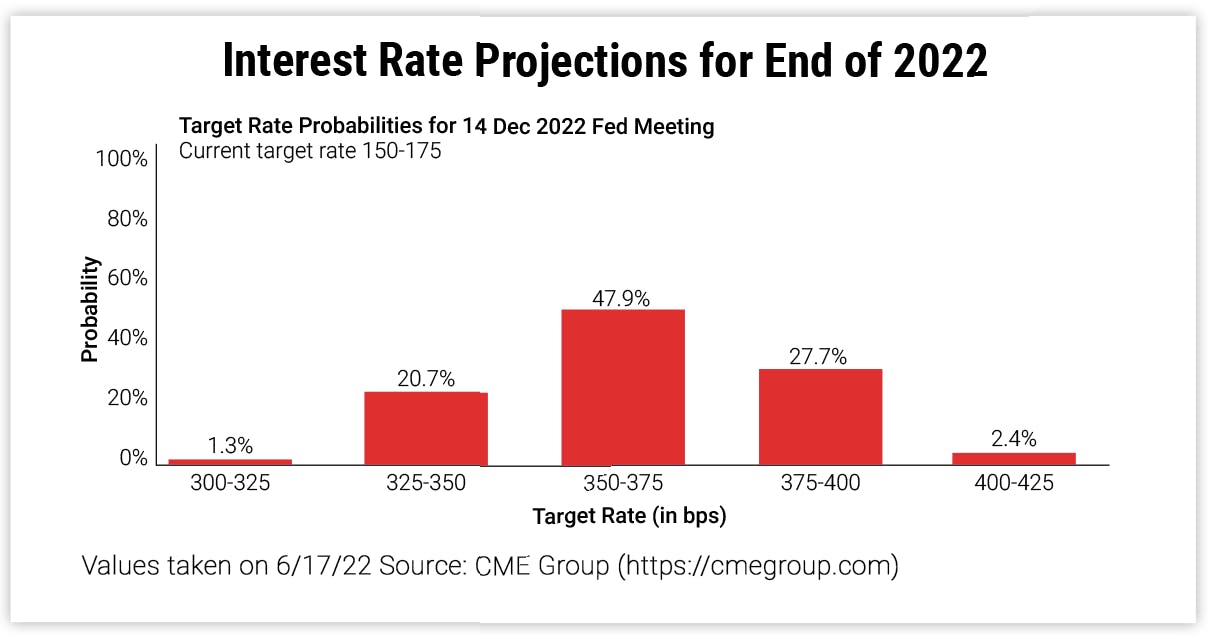

The move lower in rates coming out of the Fed meeting owed to Fed Chair Powell’s talking down of large rate hikes in the future. Though projections still state that the Fed will continue to move Fed Funds Rates higher, those projections came down slightly after Powell’s press conference.

Derivatives trading can seem daunting at times given that you have to be positioning yourself for what’s next, but the question in rates seems pretty straightforward: do you buy into the mania of much higher interest rates being required to quell inflation (buy S2Y), or do you think the inflation madness has peaked and rates will revert (sell S2Y)?

Get Weekly Commentary on Small Markets!

Sign up to start receiving free analysis on everything from stocks and bonds to commodities and foreign exchange.

*Source: The Federal Reserve (https://federalreserve.gov)