How to Trade Forex Markets with Currency Futures

Mar 29, 2022

By Sage Anderson

The U.S. dollar is synonymous with American culture, but the influence of the "greenback" extends well beyond the shores of North America.

That's because the U.S. dollar serves as the world's primary reserve currency.

In its role as a reserve currency, the dollar is held by the central banks of sovereign nations—vast pools of U.S. currency that are constantly being cycled through the global economy via cross-border transactions and investments.

Of course, a currency with that much influence in the global economy is closely followed, meaning that hundreds of millions—if not billions—of people around the world are tracking the ongoing value of the dollar.

Moreover, many of those stakeholders are active in the foreign exchange (FX or forex) markets, whether it be to hedge exposure to the dollar, or to speculate on the future value of the dollar.

Tracking Foreign Exchange (FX) Markets with Exchange Rates

Normally, when talking about the value of something, it's quoted in terms of the dollar (or another currency). For example, a gallon of milk might be valued at $5, a barrel of crude oil might be valued at $90, and an ounce of gold might be valued at $2,000. But valuing currencies themselves is unique, because they need to be quoted in terms of something else—usually another currency. For example, one could say that a single U.S. dollar is equal to 20 Mexican pesos, or that one dollar is worth 1.27 Canadian dollars.

These conversions are known as "exchange rates," and they are important because they not only form the basis for understanding the dollar's value relative to other currencies, but they also represent benchmark lexicon in international FX markets.

Exchange rates are typically quoted using the format "ABC/DEF," and are interpreted to mean that the first currency listed is a single unit, while the exchange rate itself represents the amount of the second currency that is required to purchase a single unit of the first currency.

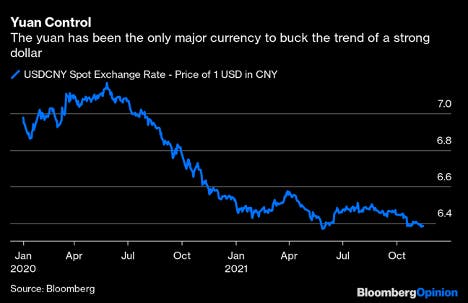

For example, the current USD/CNY exchange rate is approximately 6.35, which means it takes roughly 6.35 Chinese yuan to purchase a single dollar. The USD/CNY exchange rate has gathered increased attention recently because the dollar has steadily depreciated against the yuan during the COVID-19 pandemic.

Prior to the onset of the COVID-19 pandemic, the USD/CNY exchange rate was closer to 7—meaning one US dollar could be exchanged for roughly 7 RMB.

However, starting in May of 2020, the dollar started to steadily depreciate against the CNY, dropping to its current level of around 6.35.

The aforementioned examples help illustrate the importance of exchange rates for investors and traders in the FX markets. But keep in mind that the relationship of a single foreign currency pair may not be indicative of the entire FX narrative and that’s why investors and traders involved in currency markets often track individual currency pairs (like the dollar versus the yuan), as well as the dollar's ongoing value against a basket of foreign currencies.

The U.S. Dollar Index (DX-Y.NYB)—also known as the “DXY”—is one of the most-followed gauges of the dollar’s ongoing value, in basket terms.

The DXY measures the value of the U.S. dollar relative to a group of currencies that essentially constitute the country’s closest trading partners—the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

Interestingly, the DXY rallied significantly in 2021 against that basket of currencies, which was in stark contrast to the dollar’s decline against the Chinese yuan. That situation—gaining against a broad basket of currencies, and declining against a single currency—illustrates the importance of tracking currencies in both individual pairs (dollar vs. yuan) and currency baskets like the DXY.

The Small US Dollar Index

To invest in or trade currencies like the U.S. dollar, market participants typically use three different products. The most common are the spot market, the futures market, and the forwards market.

The spot market for foreign exchange essentially represents the underlying market for FX futures and forwards. Taking a $100 bill and exchanging it for euros at a train station in Paris would be an example of a spot market transaction. The FX spot market is massive, and exceeds every other financial market on earth in daily volume.

On any given day, governments, companies, and individuals exchange anywhere between $3-$5 trillion in foreign currency on the spot market. Traditionally, this market is referred to as the "forex market,” or the "foreign exchange market," and it is conducted completely over-the-counter (OTC) through brokers—there aren’t centralized exchanges for these spot market transactions.

Unlike the spot market, the futures and forwards markets do not deal in actual currencies. Rather, they deal in contracts that represent claims to certain types of currency—at a specific price per unit, with a fixed date of settlement.

The forwards market also operates OTC, which means the two parties involved in the transaction set their own terms.

Considering that the spot and forwards FX markets both operate OTC, that means the only market that offers foreign currency exposure on a regulated exchange is the FX futures market—an important distinction.

FX futures contracts possess specific parameters—the number of units being traded, delivery/settlement dates, and minimum price increments—none of which can be customized. That standardization helps ensure consistency in the futures market, making it easier to understand and use.

Moreover, the futures exchange acts as a counterpart for traders, providing clearance and settlement. That dynamic provides security and confidence for participants in futures transactions.

Like most products in the financial markets, FX futures are used by investors and traders for hedging and speculative purposes.

For example, a trader might take on a simple long position in one currency, or deploy a pairs trade involving multiple currencies in another position.

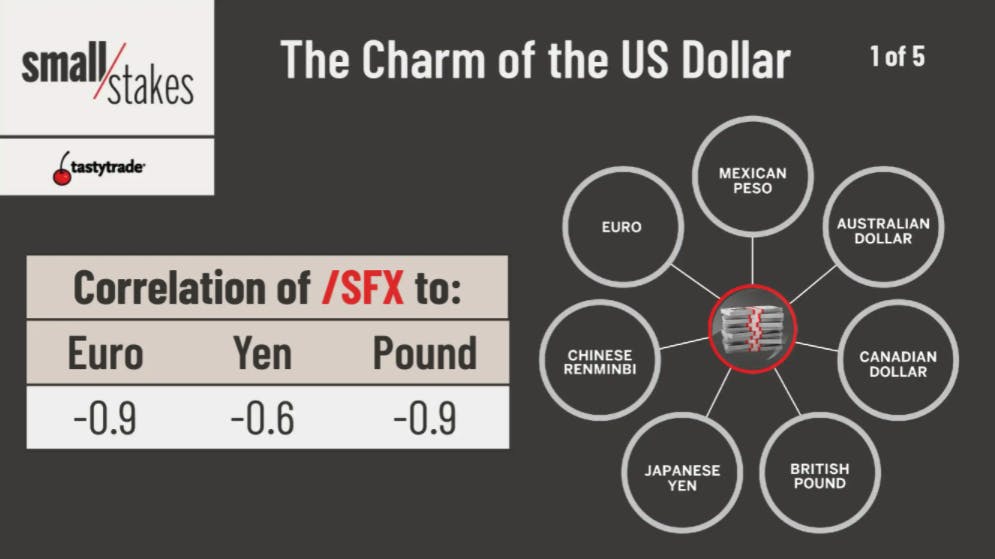

Beyond individual currencies and currency pairs, investors and traders can also take positions in currency baskets. For example, Small US Dollar Index (SFX) futures offered by the Small Exchange provide exposure to a diversified basket of currencies, including the euro, Chinese yuan, Japanese yen, British pound, Canadian dollar, Australian dollar, and Mexican peso. Unlike the DXY, the Small US Dollar Index offers exposure to the yuan, which has become a key part of FX markets due to the rising influence of the Chinese economy.

The SFX also offers capital efficiency relative to other choices in the marketplace.

For example, when trading a currency ETF such as the Invesco CurrencyShares Euro Currency Trust (FXE), the average investor needs to set aside 50% to 100% of the trade’s total value in cash. SFX on the other hand only requires 1% to 2% of the product’s value.

Similar to the rest of the Smalls, SFX prices move in increments of 0.01, with each tick representing a dollar. Trading hours in the Smalls are weekdays from 7am to 4pm central time, with a universal expiration on the third Friday of every month, when all Smalls settle to cash*.

Investors and traders looking for a simple and capital-efficient way of trading the foreign exchange markets may therefore find the Small Dollar Index (SFX) compelling.

During periods of heightened market volatility, the U.S. dollar often thrives as a “safe haven”—at least it did in March of 2020 when COVID-19 was first sweeping across the globe.

For more on the “Smalls,” and their niche in the broader financial markets, readers can also tune into the Small Stakes series on tastytrade financial network.

*Except SMO. Visit the SMO market page for details.

Sign up for more articles like this with our free weekly market commentary.