How to Trade Options on Futures

May 16, 2022

By Sage Anderson

Stock investors seeking a little more alpha can branch out into options, and the same audience might look to add futures to the mix for a low-cost speculative and risk management tool that can bring greater activity to their portfolio. An investor might have sold a covered call option on a concentrated stock position to produce additional income during a sideways trend in the markets; and they might have opened a bullish or bearish futures position on anything from stocks and bonds to currencies and commodities to take advantage of potentially lower capital requirements. But is it possible to combine the flexibility of options with the higher potential returns of futures? Fortunately, such products already exist - futures options, or options on futures.

The Difference Between Stock Options and Options on Futures

The primary difference between options on futures and traditional equity options is the underlying with which they are associated. As the name implies, options on futures derive their value from an underlying futures contract. Options on futures change in price similarly to stock options (i.e. when the futures contract move higher in price, calls tend to move higher and puts tend to move lower all to varying degrees as a function of their delta), but that the underlying market is a futures contract with specifications including multipliers and expirations relative to the uniform tick values of stock and ETF underlying markets.

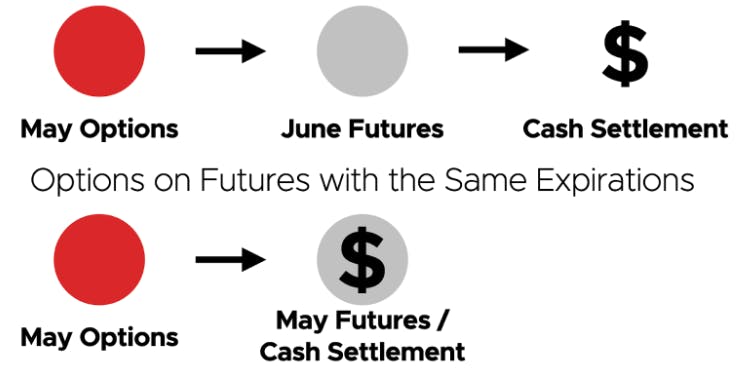

Options contracts can have expirations that differ from the expiration of their underlying futures contract, and there will often be multiple options expirations settling to each futures expiration. As such, traders should be aware of the expiration of the futures contract as well as the exact expiration of the options on futures contract to ensure exposure is aligned with their ideas.

Furthermore, the options contract will often settle to the underlying futures contract if expirations do not align, and traders can end up with a full futures position if they hold an in-the-money option to expiration. Since futures contracts also settle to cash, holding an in-the-money options contract to an expiration that does align with the underlying futures expiration can simply result in cash settlement of the position.

Options on Futures with Differing Expirations

For example, say a trader owns one May E-mini S&P 500 (ES) futures call option that’s in the money and there’s no associated futures contract that expires in the same month. Upon expiration, the option would settle into a long June ES future.

Another dynamic to be aware of when trading options on futures is the contract multiplier. When trading equity options, a single option contract represents 100 shares of the underlying stock market. In the world of futures options, the contract multiplier varies depending on the multiplier of the underlying futures contract.

Using ES again as an example, the contract multiplier is $50. If one owns a call option on ES, and ES increases by 1.00, then the trader would make $50 in profit (as opposed to the $100 profit one would have made with an equity option).

Small Exchange futures and options both include the $100 multiplier that can make trading them look and feel the same as 100 shares of stock or stock options; and that multiplier holds for equity index markets as well as commodities, currencies, interest rates, and more.

Finally, options on futures use a similar margin system to the futures themselves that can result in greatly reduced capital requirements, or buying powers, compared to stock options. This contrast can be especially stark for low volatility markets like forex - stock options products like Euro ETF (FXE) can require close to 25% while futures options products like Euro futures (6E) can require as little as 2%.

Stock Options | Options on Futures |

|---|---|

Settles to 100 Shares | Most settle to 1 futures contracts |

100 Multiplier | Variable Multiplier |

Monthly Expiration cycle on 3rd Friday | Variable Monthly Expiration |

Margin based on stock price | Margin based on product size and volatility |

Though there are some slight nuances between stock options and options on futures, they tend to operate similarly from a strategic standpoint. For example, both calls and puts may be traded on stock options and options on futures, and, mechanically, they act the same - long calls theoretically benefit when the associated underlying rises while long puts theoretically benefit when the associated underlying declines, and vice versa for short positions.

Trade Strategies for Options on Futures

Many of the same options strategies utilized in the traditional equity options universe - long calls, short puts, straddles, strangles, iron condors - can also be utilized in options on futures universe. That said, calendar and diagonal spreads are typically not utilized for options on futures.

Traders looking to use options strategies that are either directional or volatility-based can simply use deltas to transfer their stock options strategies to options on futures. Selling 16 delta strangles in the S&P 500 ETF (SPY) options? You could try it out in the similarly sized Micro S&P 500 futures (MES) options. Sizing up at-the-money straddles in US Dollar ETF (UUP)? You could do the same in Small US Dollar futures (SFX) options for a larger credit and lower buying power requirement.

Of course, liquidity plays an important role when trading options on futures, just as it does when trading equity options. In either case, liquidity in the options should be robust, ensuring that it’s as seamless to enter a position as it is to exit that position. Many traders will monitor bid-ask spreads in options strikes looking for one to five ticks wide for solid liquidity.

Historically, one of the main barriers to trading options on futures was the high notional values associated with such positions, much as it was for futures themselves. However, with the introduction of new futures products geared toward retail market participants, these capital barriers have largely been removed. One such outlet for investors and traders to access “right-sized” futures exposure as well as associated futures options exposure is the Small Exchange®.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.