Neutral Trading Strategies for an Inactive Market

Jun 6, 2022

By Frank Kaberna

What do you do when the dust settles, the smoke clears, and you’re left with middling markets? After quite a volatile May, June has seen the stock market bounce back (albeit slightly) and the US dollar cool off.

Many traders hunt price extremes when looking for value in the market, but this strategy can leave you waiting on the sideline for extended periods. Pairs trades, or spread trades, as well as neutral options strategies can create opportunity out of a sideways, seemingly stagnant market.

How to Create a Pairs Trade

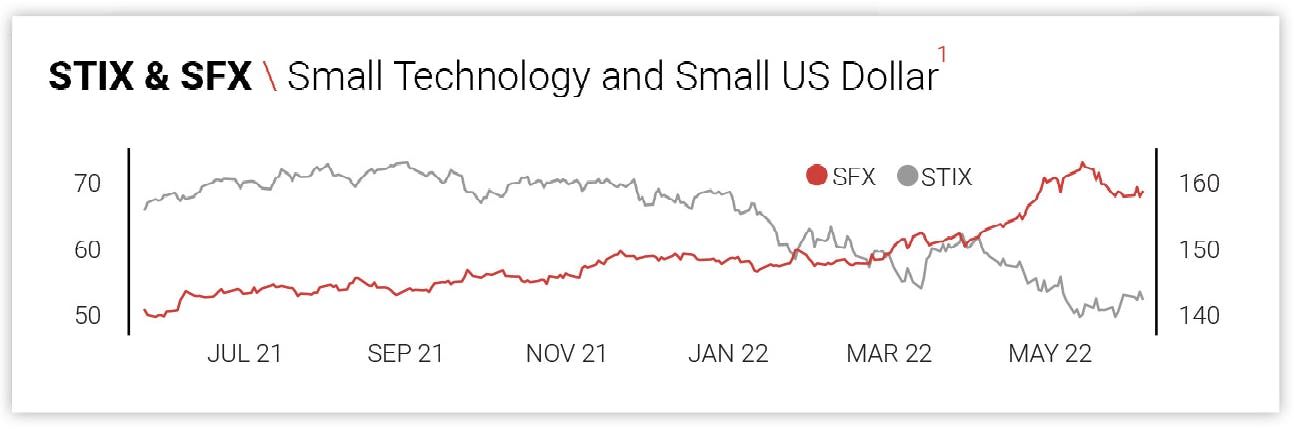

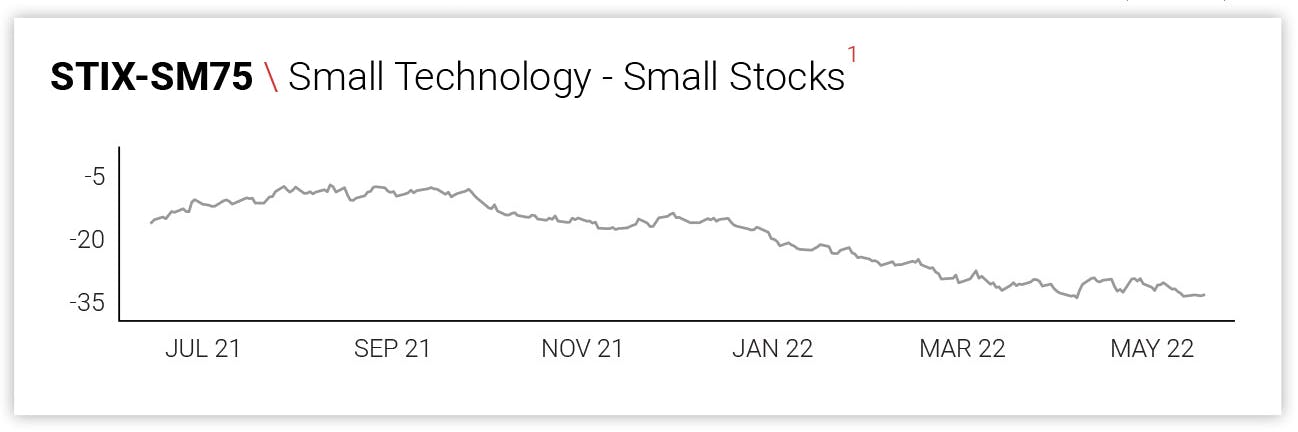

One of the most common ways to view pairs trade, or spread trade, opportunity is through the lens of convergence and divergence. You can look at two highly correlated products like stock futures or interest rate futures, measure how much they’ve converged or diverged, and then choose to go with or against such price action.

For example, stock futures Small Technology (STIX) and Small Stocks (SM75) have gone from trading around the same price a year ago to the former trading at a $35 discount. If you think the trend will continue, you can sell the underperformer (STIX) while buying the outperformer (SM75). Think the two markets will converge? You can buy STIX and sell SM75.

A similar story is being told in the yield curve as US interest rates of varying duration flatten to historical lows. Traditionally, longer-term rates trade higher than shorter-term ones. Recently, however, the difference between 10YR and 30YR rates has come down to nearly 0% after trading at around a 0.7% premium of the latter over the former. This can be seen and traded in S10Y and S30Y futures. Think they’ll converge further and potentially invert the yield curve? You can sell S30Y and buy S10Y. Those thinking the curve will return to normal can do the opposite.

How to Create a Neutral Options Trade

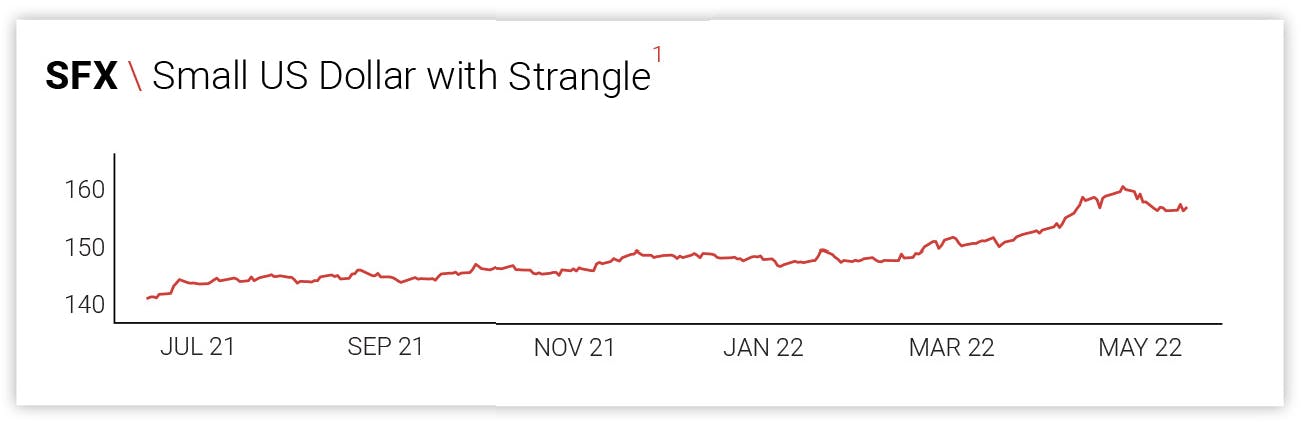

Options derivatives can give you another opportunity to profit from a market remaining range bound. The short strangle includes a short call and put option and is a strategy rewarding the inactive market thanks to its neutral outlook.

As USD cools off from its bull run, a short SFX strangle (for example, -1 156 put and -1 161 call) could show potential if the forex market continues to coil. While the strategy can be expensive using stock or ETF options, a short strangle in SFX options is currently requiring between $100 and $200 in capital.*

Pairs trades and neutral options strategies alike can profit from markets trading in a range, and, if the summer continues to trend in this sideways direction, such opportunities could be booming.

Get Weekly Commentary on Small Markets!

Sign up to start receiving free analysis on everything from stocks and bonds to commodities and foreign exchange.

1. Source: dxFeed Index Services

2. Values taken on 6/3/22 (July 15, 2022 Expiration)