Are Stocks Climbing Too Fast?

Jul 6, 2021

By Frank Kaberna

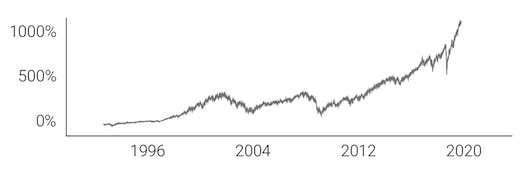

The S&P 500 took 27 years to increase by $2,000 (going from $300 in 1990 to $2,300 in 2017). Just last week, the equity index notched another $2,000 in less than an eighth the time.* This exponential rise has been cause for uneasiness and questions among investors.

SPX \ S&P 500 Percentage Return

Is this velocity sustainable? Are stocks due for a crash? Was last week’s all-time high in the CBOE’s SKEW Index a tell that downside action is soon to come? Ultimately, the market and those participating in its trade will have the final say as to whether or not equities descend, but that doesn’t mean you can’t prepare.

When Should You Hedge?

Unfortunately, investors’ appetite for risk is usually prone to recency bias. Animal spirits can often push people to add more risk after their positions have appreciated and lessen it only after they’ve seen a fall.

Ideally, you’d put on a hedge just as the tides are about to turn, but this is pretty unrealistic. As the stock market ascends, many investors manage risk by slowly taking some exposure off the table over time. For example, you could hedge 5% of your portfolio after every 10% increase.

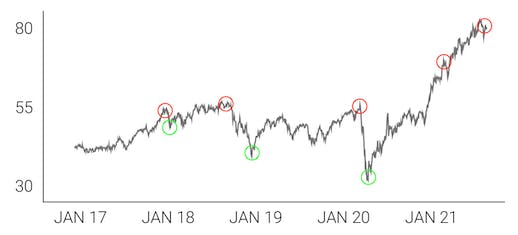

SM75 \ Small Stocks 75 with Hedges

Source: dxFeed Index Services (https://indexit.dxfeed.com)

How Should You Hedge?

At the end of the day, no hedging strategy is perfect, and it’s your call to act in a way that’s both comfortable and effective. An $80,000 stock investment using short Small Stocks 75 futures (about $8,000 in size†) could be effectively hedged 10% per contract whenever the investor perceives risk. And futures allow for those managing risk to put on and take off hedges in almost any time frame without having to uproot the investment.

There seems to be a reason for media outlets to call for a stock market crash every week. While those predictions rarely come to fruition, history does dictate that turbulence will set in at some point. It’s better to be prepared beforehand.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*S&P 500 Index values between 1990 to present

*Value taken on 7/1/21