Do You Even Pairs Trade?

Mar 30, 2021

By Frank Kaberna

As March draws to a close, equity indices from the Small Exchange are within a few percentage points of unchanged on the month. That said, the last four weeks of stock movement have been anything but sideways for the active trader utilizing pairs opportunities.

Extreme Sector Rotation

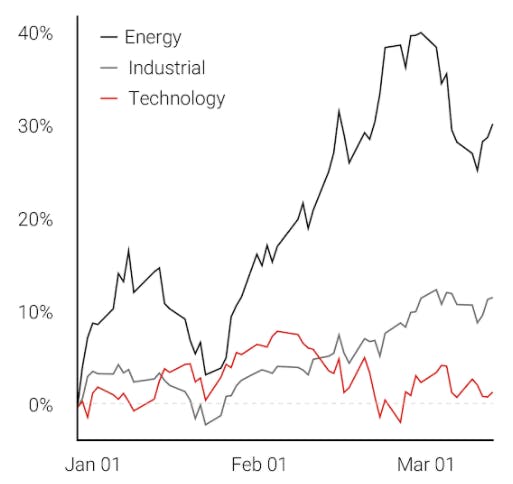

As of last Friday, the industrial sector outperformed technology stocks by nearly 10% in the month of March; and just two weeks in, energy was trading almost 10% on top of tech before coming back to a more normal difference of 4% month-to-date.*

The Year in Sector Rotation (Energy vs Industrial vs Technology)

Source: dxFeed Index Services

Convergence vs Divergence

Active traders can potentially profit from a flat stock market’s battling inner workings via the pairs trade. Small Stocks (SM75) futures bundle industrial, energy, material, financial, and technology stocks together into a single contract, while Small Technology (STIX) futures exclusively hold tech stocks. The two products have captured much of the sector rotating action of the last month and beyond.

A sideways equity index isn’t a good enough reason for inactivity; there’s always something to do in this greatly diverse stock market.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*All statistics computed as of 3/26/21 using XLK, XLE, XLI