Don't Turn Yourself Around

Jan 11, 2021

By Frank Kaberna

Last week’s activity has many traders asking questions: How should markets react to certain real-world events? Is there any correlation between the state of the collective consciousness and the performance of financial instruments? Where do we go from here?

A good plan of action for your trades and investments in times like these could simply be to stay calm. Though exercises such as politics may demand a more passionate approach, activity in your portfolio should maybe not evolve as rapidly as your Twitter news feed.

This isn’t to say that active traders should avoid short-term opportunities, but rather that the more consistent strategy may be to refrain from uprooting long-term investment and trade both sides of a passing moment. Take, for example, the recent activity in interest rates.

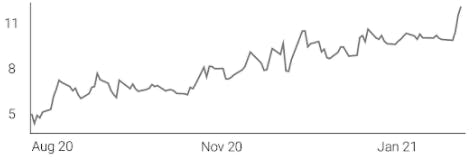

Rates in the Short Term (Small Treasury Yield \ S10Y)

Source: dxFeed Index Services

The 10YR Treasury rate, via S10Y futures, has doubled in the last five months as it tears through 1.00%, or $10.00 in S10Y. Contrarians interested in selling into this rally may find that adding the context of the last few years could cloud their judgment.

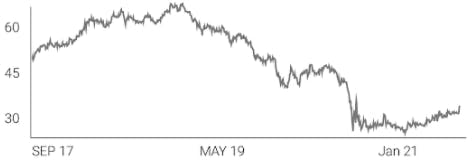

Rates in the Long Term (Small Treasury Yield \ S10Y)

Source: dxFeed Index Services

The average 10YR Treasury yield over the last three years is 2.00%, $20.00 in S10Y. This fact might lead those looking for mean reversion to find value in the upside. So what do you do with a market that could have potential for profits from both the long and short side? Well, you can buy AND sell it.

It’s possible to be both bullish and bearish as long as trades are separated into varying timeframes and products permit flexibility. S10Y futures let you trade rates for a margin cost of just $180.* This can allow for a long-term position of a few units with interspersed short-term trades of a single unit.

If your mechanics are sound and your portfolio is organized, you can have ephemeral strategies side-by-side with more persistent opinions all without getting turned around.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Value taken on 1/7/21, per contract, based on OCC initial margin rates