Doomsday Indicator or Rare Opportunity

May 3, 2021

By Frank Kaberna

Talking heads can share many attributes whether they represent politics, finance, or sports. One mutual trait that’s been particularly relevant lately is overdramatizing events. “That team would NEVER draft that player,” fictional NFL commentator says minutes before said team drafts said player.

The Fed and interest rate analysts currently find themselves in a similar dance. After the US Federal Reserve announced no change in rates last week, many took to social media to hyperbolize and rant about how the Fed will never move rates off 0% and how this will cause an inevitable stock market crash.

The Same Old Song

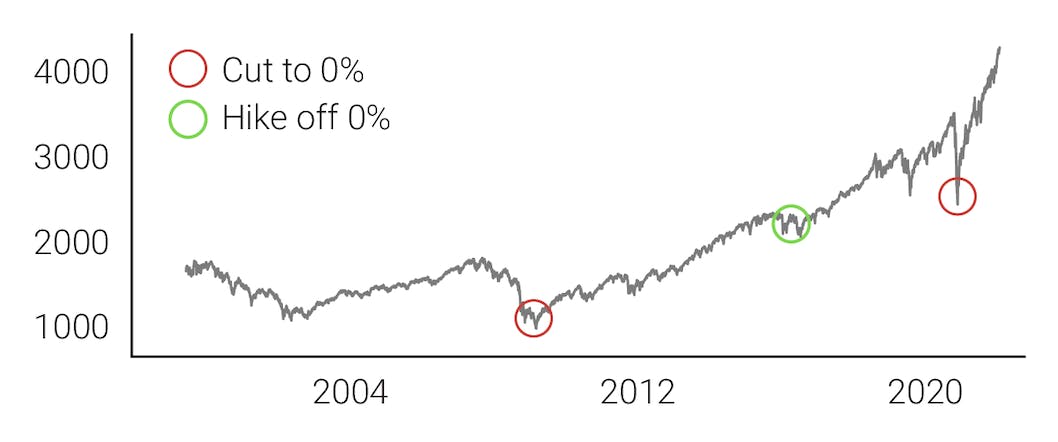

Those who traded in the aftermath of 2008’s crash might be feeling some déjà vu these days relative to the will-they-or-won’t-they mentality with the Fed and hiking rates off 0%. As the equity market put in new high after new high, analysts and opinionated social media users alike projected that the Fed Funds Rate would never come off 0% again. And then the Fed hiked rates several times between 2015 and 2018.*

SPX / S&P 500 Index

Source: dxFeed Index Services

A New Way to Trade

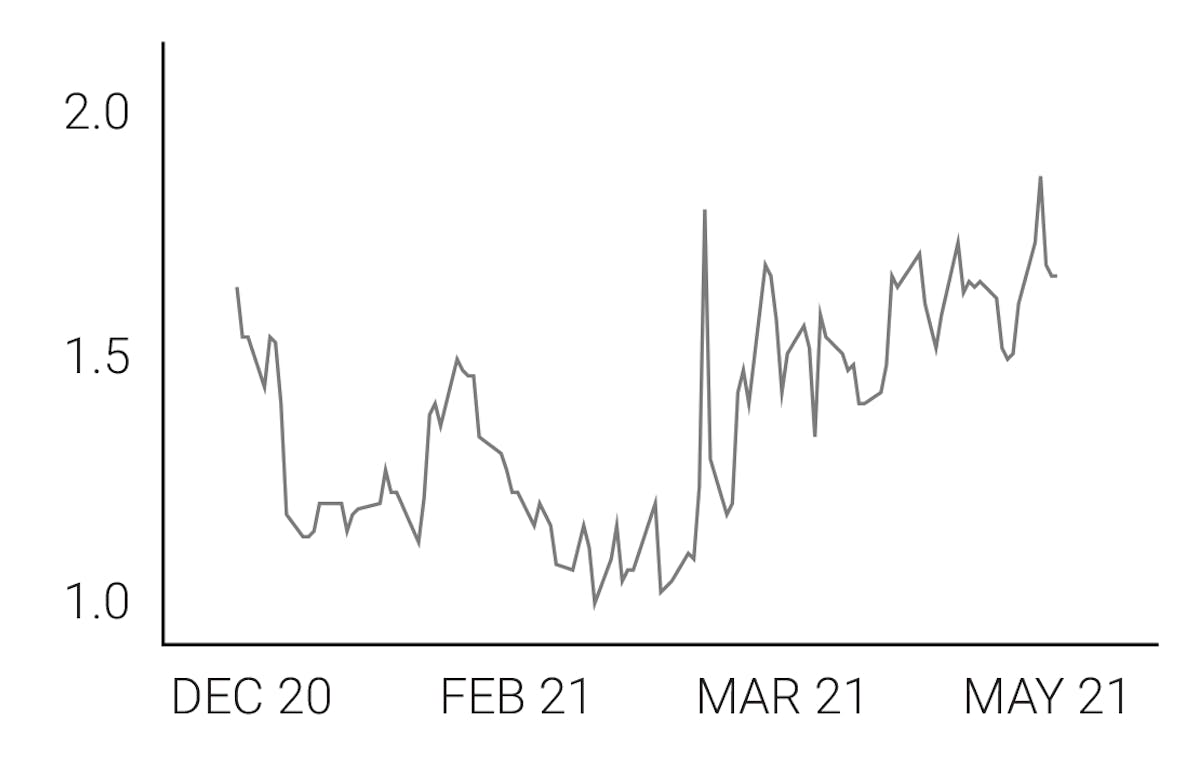

Could rates stay near 0% for months and even years? Of course! Will they stay there forever? Though it’s possible, there is no historical precedent. Ever since the Fed’s inception, cutting rates has at some point been followed by hiking them. Small 2YR Yield futures currently reflect about 0.175% in short-term interest rates. Buying S2Y futures would demonstrate a potential reversion to the historical norm, while selling them contends the opposite.

S2Y / Small 2YR Yield Index

Source: dxFeed Index Services

The Fed’s mission is not to burn down the house, as some talking heads might project, but rather to guide financial markets along in a way that usually has commentators saying, “Oh yeah, this must be the place.”

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Data from https://www.federalreserve.gov/