Extra! Extra! Headline Moves Market!

Feb 16, 2021

By Frank Kaberna

Last week, Federal Reserve Chairman Jerome Powell said he would not “even think about” lifting interest rates off their current 0-0.25% level as the US economy continues to work through the pandemic.*

But, like, what does that even mean for markets and the everyday trader?

The Short-Term Reaction

Treasuries, which are some of the most commonly traded interest rate products in the US, saw their yields fall in the immediate wake of Powell’s speech. But it’s important to distinguish the Fed funds rate - a very short-term yield benchmark controlled by the Fed - from the yields traded in Treasury bills, notes, and bonds that are traded in the market.

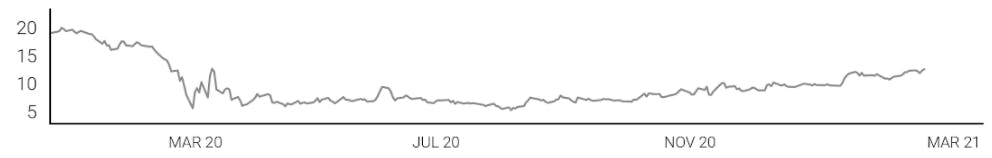

While Small Treasury Yield (S10Y) futures fell as traders attempted to bring 10YR rates closer to the 0% reflected in that of the Fed funds, the market bounced back in the days following to make new highs on the year.

The Long-Term Opportunity

People often read headlines and respond with knee-jerk trades that might not make sense in the long term. At the end of the day, the Fed does not control Treasury yields, its influence is very slight especially as you add duration to the product, and the guy basically said he wasn’t going to change anything. So...why did S10Y fall?

Sensational headlines and quotes will always create short-term volatility in markets, but some of the best opportunities can be found in analyzing whether those words actually mean anything for markets in the long term.

More interesting still is the fact that 10YR rates are actually lower than average given a Fed funds rate of 0-0.25%!** Who knows where S10Y futures are headed next? The only thing that’s certain: markets will move where they want regardless of some one-off headline.

Does the Fed Really Matter? (Small Treasury Yield \ S10Y)

Source: dxFeed Index Services

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Fed’s Powell Signals Easy Money Policies to Remain in Place for a While from Wall Street Journal (https://wsj.com)

**Data from 1990 to present (https:/treasury.gov)