Foreign Exchange: A Market by Christopher Nolan*

Jan 25, 2021

By Frank Kaberna

Entering the foreign exchange market is like watching a Christopher Nolan movie for the first time. What’s the timeline here? How does this development affect the other plot lines? Is Leonardo Dicaprio’s character even alive? It can be difficult to make heads or tails of these two universes’ innerworkings actually affect each other.

Starting with the US dollar can help to reduce complexity for many new traders, especially when looking at Small US Dollar (SFX) futures that are diversified against seven foreign currencies (including euro, Chinese renminbi, Japanese yen, and more). One character. One narrative.

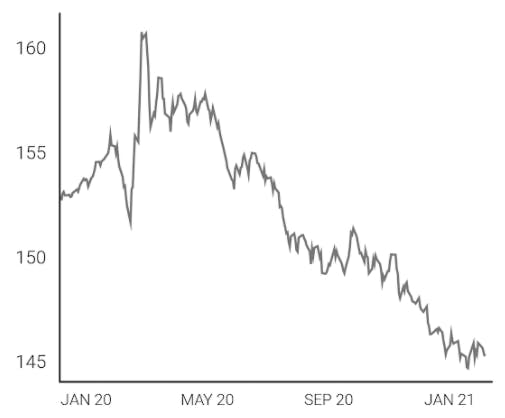

No Dream Within A Dream (Small US Dollar \ SFX)

Source: dxFeed Index Services

The reviews are in for the US dollar: bearish. USD has been panned by almost every currency in the world as it sits at lows unseen since 2018. Picking up a long position in SFX poses potential opportunity if the market were to bounce off this downside extreme, nottomention the hedge it could pose for those holding commodities such as gold, oil, or corn that are priced in US dollars.

Without adding too many levels to your trade, the fact that cheaper dollars often translate to more expensive assets means that buying those cheap dollars can hedge against the potential for asset prices to fall.

If hedging isn’t your speed, new pairs trading opportunities could await the trader that’s willing to add a few more characters to the cast.

Foreign exchange might look daunting at first blush, but you can quickly turn it into a choose-your-own-adventure movie thanks to simple products like Small US Dollar (SFX) futures.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Christopher Nolan did not write, direct, or produce foreign exchange markets.