Forex Trading: How to Get Started

Nov 22, 2021

By Frank Kaberna

The foreign exchange market can be as vast as that of equities. With more than 150 currencies in circulation, there are enough single names to fill almost two Nasdaq indexes worth of components.

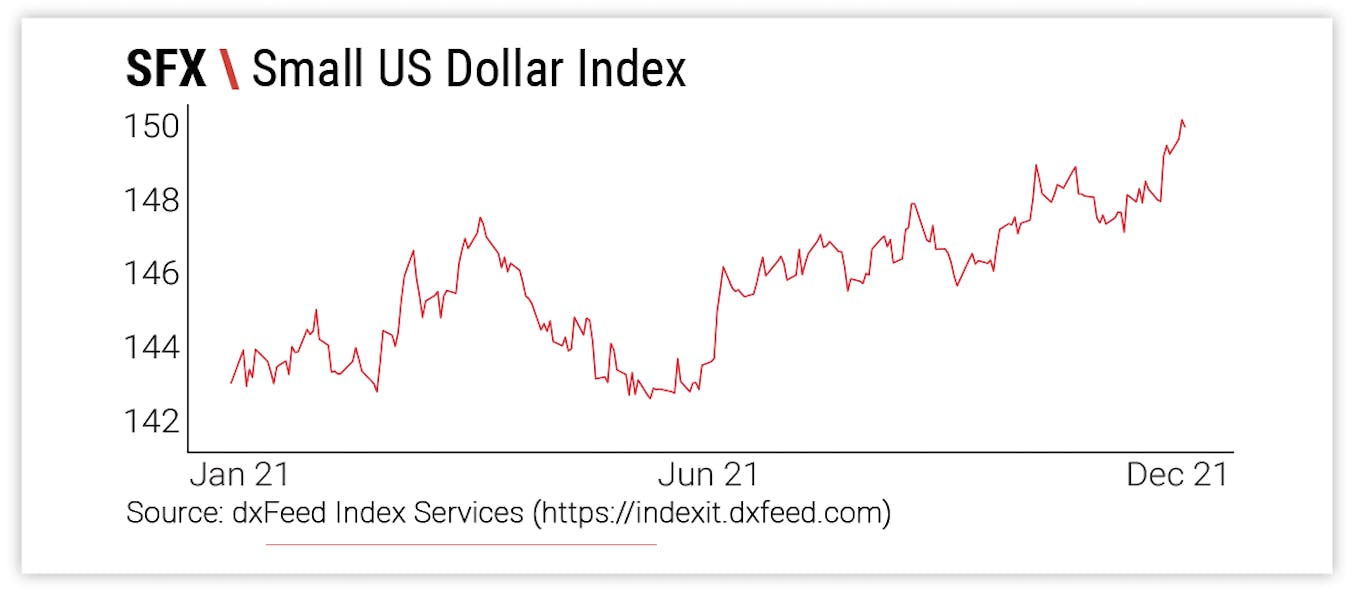

However, the best place to start can be a diversified basket, similar to the world of stocks. In the same way that many get their feet wet in equities with some version of the S&P 500 (ETF, E-mini futures, Micro E-mini futures, etc.), the US dollar offers a solid, central location for your first forex trade.

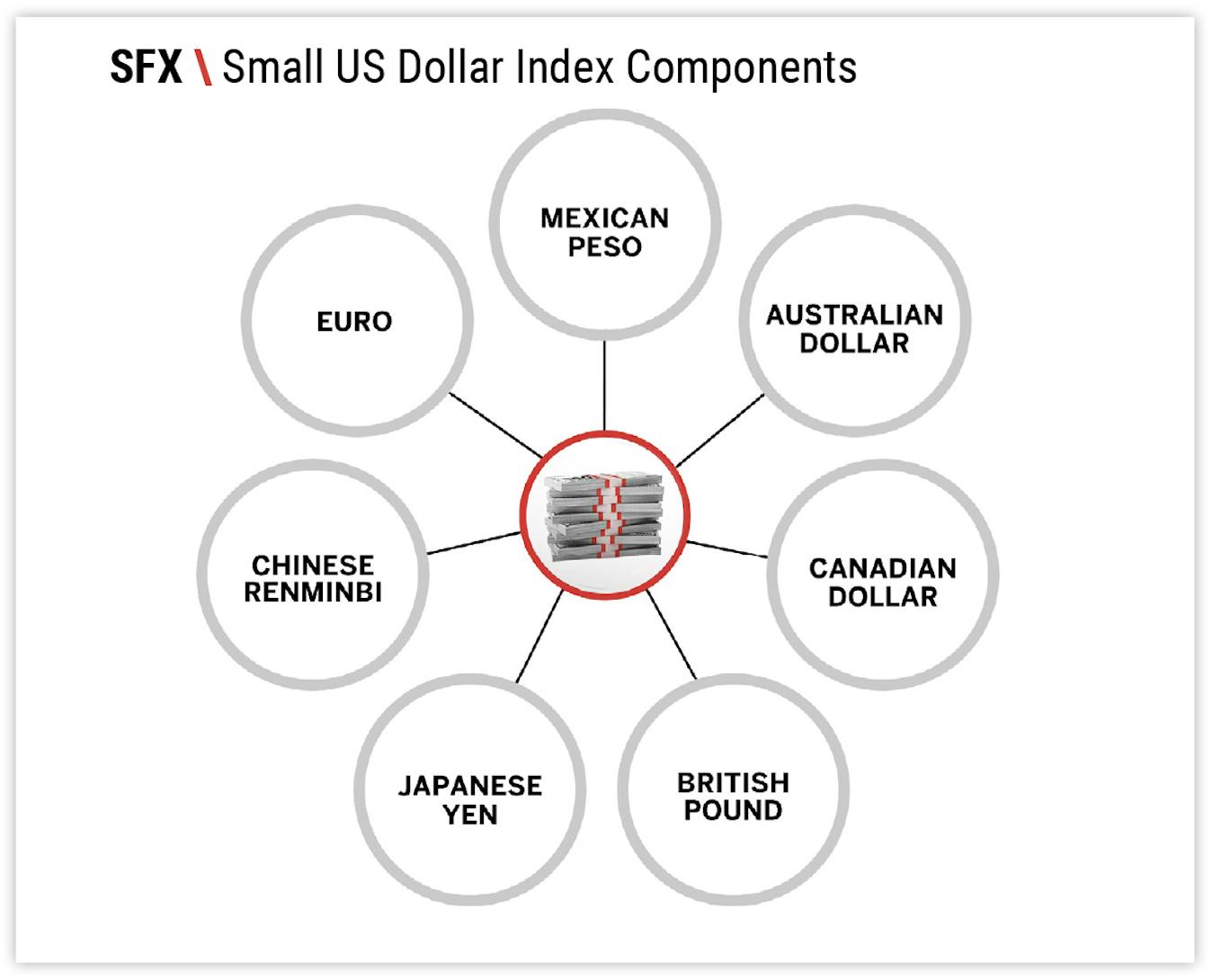

Most USD products, like Small US Dollar futures, represent the dollar relative to a basket of foreign currencies to give it a well-rounded measure without too much reliance on one region.

How Do You Trade a Currency?

Short answer: just like any other market! Though there is some nuance to currencies, they rise and fall based on a multitude of factors the same as stocks, commodities, and cryptos. That said, price extreme traders and technical analysts can feel comfortable applying their usual mechanics to another market exhibiting daily price action.

Source: dxFeed Index Services

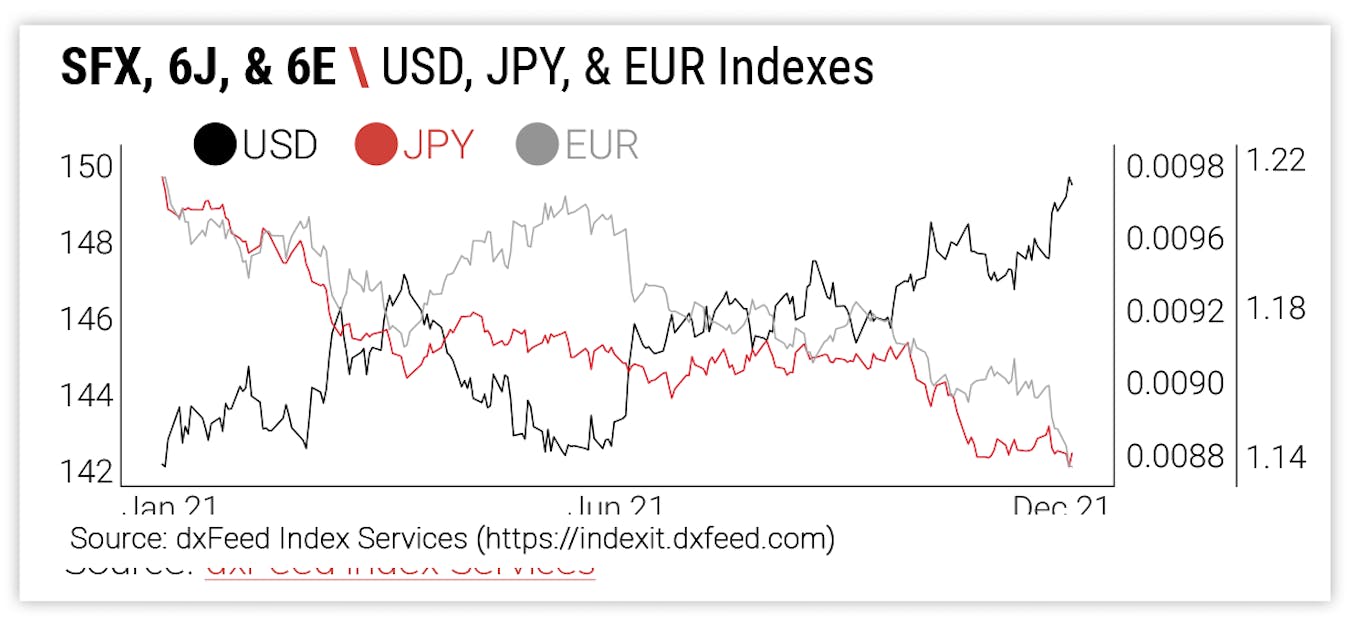

What drives forex markets, though, is specific to the asset class. US dollar appreciation usually comes from higher interest rates and stronger economic data in the US relative to the Eurozone, Japan, Great Britain, and otherwise; and vice versa.

When You Buy USD, You Sell Foreign Currencies

Since traditional currencies are priced in terms of another currency, buying US dollars directly reflects a short position in one or a mix of Japanese yen, euro, British pound, etc.

Source: dxFeed Index Services

With US dollars at their highs for the year, you might be looking at a short position to play the potential for mean reversion, especially if your base currency is USD and you’d like to hedge some of that exposure. Selling a Small US Dollar future converts USD to yen, euro, pound, renminbi, and more in one trade.

Forex often seems like an exclusive asset class that requires a background in the field, but you can get started and grow your currency trading skills just like stocks.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.