Getting Over Trader's Block

Apr 19, 2021

By Frank Kaberna

At the time of writing (9am CT 4/15), all Small Exchange futures are well within their weekly range as forecasted by volatility. Most markets are safely between year-to-date extremes, and the VIX index is at its lowest level since news of the pandemic initially felled equities back in February 2020.

With all of that said, last week was one of the year’s best for active futures traders.

Relationships Over Individuality

If you’ve been exclusively looking at the outright markets, then you’ve most likely been met with sideways, frustrating trades. However, amid that sideways action, relationships among the outrights continue to twist and turn. Trading the difference between two markets has in some cases yielded more opportunity than the individual markets themselves.

How to Trade a Relationship

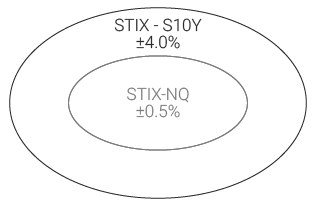

The relationship between two correlated markets can be viewed as a rubber band. Their difference expands and contracts with some regularity relative to how strong the band is. Very highly correlated relationships, like Small Technology to Nasdaq, only deviate slightly, while the weaker ones, like Small Technology to Small 10YR Yield, witness greater divergences.

One way you could access these relationship trades would be by buying the underperformer and selling the outperformer, if you think the rubber band will hold. But the band does break every once in a while, so realistic expectations and firm mechanics could prove helpful.

Finding inspiration in low volatility can seem tough, but seemingly sideways markets can lead to some of the best opportunities for active traders.

Small Technology \ Relationship Standard Deviations

Source: dxFeed Index Services

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.