How High Can Stocks Go?

Feb 8, 2021

By Frank Kaberna

Infinity. Stocks can theoretically go infinitely high. Anyone who’s looked at selling calls or shorting stocks might know this fact given the ominous -∞ that sits next to their maximum loss potential. Hmm...well then how can AAPL be worth more than any other company in the world at a relatively small price of around $130? AMZN is above $3,000. Berkshire Hathaway A shares are above $350,000!

Companies can split their stock (AAPL has witnessed five splits); stock splits increase accessibility to the everyday trader while reducing similarities between the stock price and Icarus, both reaching for some unachievable, unwieldy goal.

The Days Between (Stock Crashes)

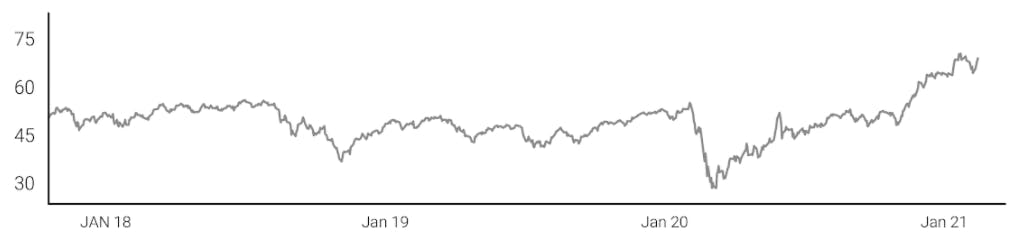

The stock market* has officially “crashed” four times in the last forty years: 1987, 2000, 2007, and 2020. From crash to crash, stocks have put in new highs ranging from 2.5% to 355% relative to the most recent new high prior to crash. Small Stocks 75 (SM75) is already up 24% from the all-time high it posted just before 2020’s fall.

Practicalizing Infinity

“Infinity” for SM75 rests somewhere between 55 and 250, given the historical context above. How can the everyday trader rein in this still-wide margin of error when selling into a new stock high? Decreasing size can be a great place to start. Simply transferring shorts to Small Exchange futures or ETF options from large, traditional futures can go far to increase the durability of your positions.

Stocks always manage to fly too close to the sun at some point...it’s just a matter of being around when they come back to earth.

Waiting for a Crash (Small Stocks \ SM75)

Source: dxFeed Index Services

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*All stocks prices as of 2/3/21