How to Set Scalping Levels

Dec 20, 2021

By Frank Kaberna

Standard deviations are as essential to measuring opportunity in markets as batting averages are to gauging talent in baseball - both stats find their way into almost all facets of these respective processes, knowingly or unknowingly.

Stock pickers enter new positions in “beat up” equities subconsciously using standard deviations to inform them on whether that looks like -5%, -10%, or -30%. Buyers and sellers of options monitor volatilities that heavily depend on the standard deviation, and they even place put and call strikes in accordance with the metric. Futures traders compare standard deviations to real-time net changes of a given market to assess the viability of a long or short day trade.

What is a Standard Deviation?

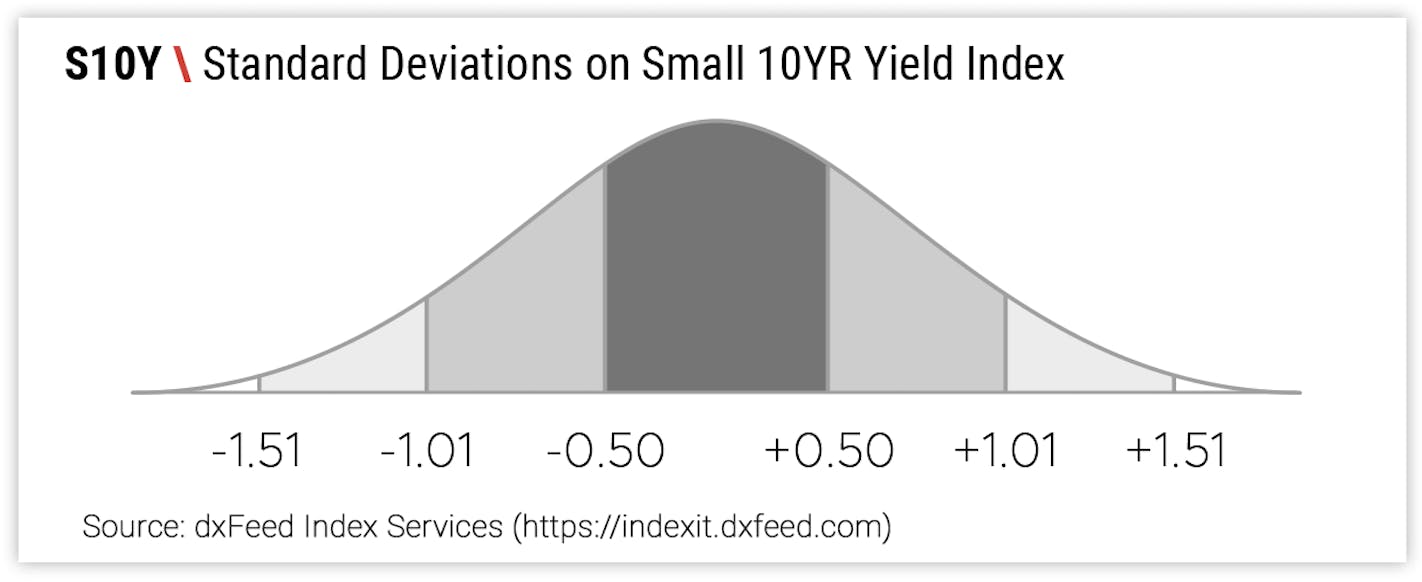

Standard deviations (SDs) summarize a dataset into clean ranges where most of the data points exist. 1, 2, and 3 SDs reflect the boundaries for 68%, 95%, and 99% of the entire set.

Source: dxFeed Index Services

In trading, SDs allow you to quickly see if any of the markets on your watchlist are in the midst of an outlier move, and their tiered manner tells you how much of an outlier it is. Market up or down more than 1 SD? Only happens 32% of the time. 2 SDs? 5% of the time. 3 SDs? <1% of the time.

Entering Orders with Standard Deviations

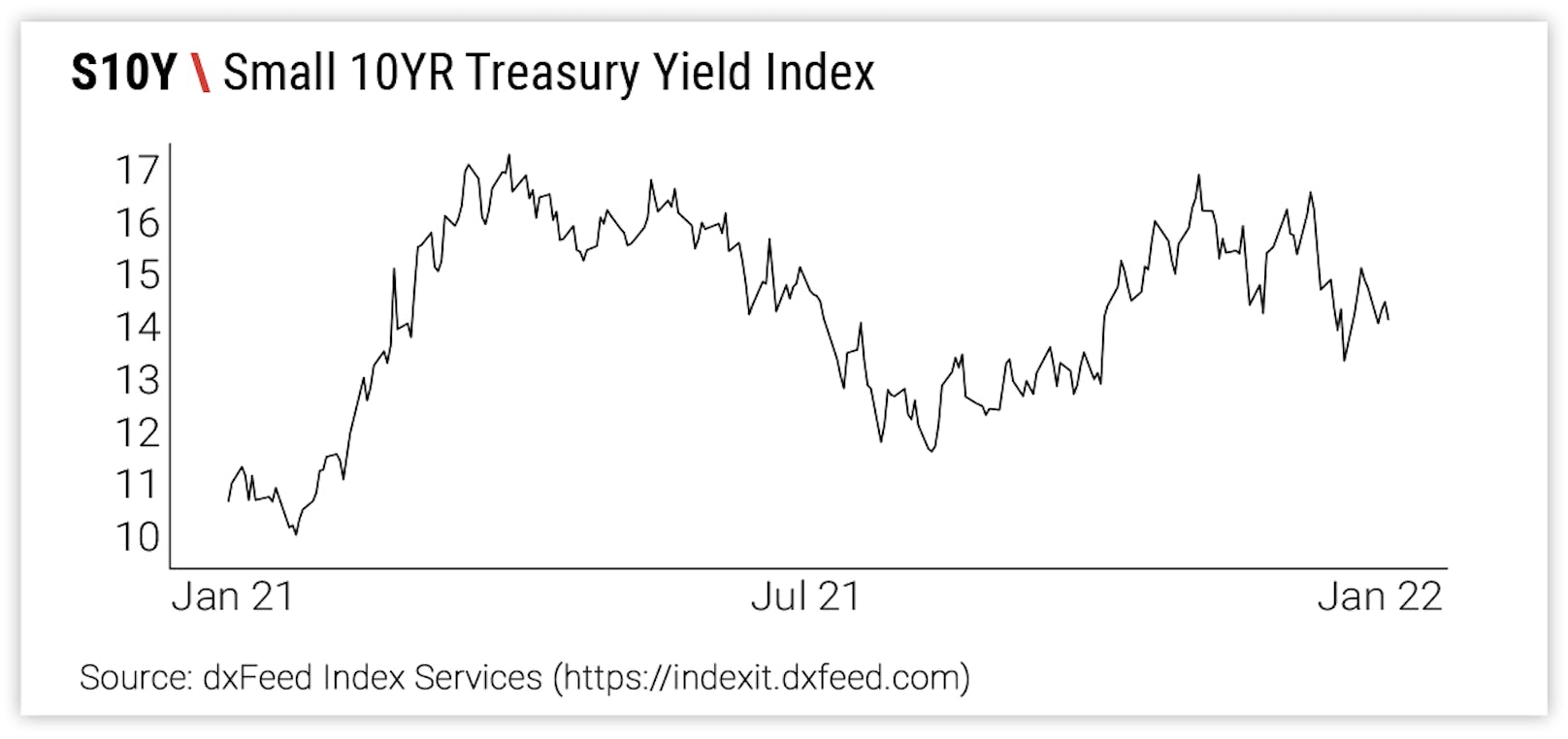

While SDs can be a solid companion for combing through your watchlist in the time-sensitive search for trades, many will enter orders around these markers even when the market isn’t close.

Source: dxFeed Index Services

This is often done prior to an event like last week’s Fed Meeting in the hopes that the entire ecosystem of stocks, bonds, and commodities will be momentarily pushed out of whack as algorithms and institutions digest the news.

Does the market always come back? Of course not, and some of the best traders have mechanics for closing lowing positions at the ready before they even enter. But most would probably rather strike out using advanced statistics than a gut feeling.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.