Is It Time to Hedge Your Stocks?

Jun 1, 2021

By Frank Kaberna

A thought many people have after things don’t go their way: I should have hedged! The key to hedging, unfortunately, is doing so when things ARE going your way. To use a sports analogy, bettors on the side of the Atlanta Falcons in the 2017 Super Bowl preferably would have hedged when they were up 28-3 and their opponent’s, the New England Patriots, odds to win were 11-1.

By the time Tom Brady won the overtime coin flip, you could buy the Falcons at lower prices than before the game started. This would be akin to your stock investment growing by 1,000% and falling back to below where you go in.

Is Now a Good Time to Hedge?

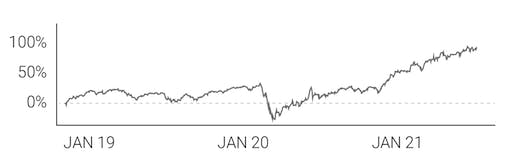

Most stocks have moved higher by many percentage points in the last handful of years. For example, the Small Stocks 75 Index is up almost 100% since the start of 2019. Since 1990, the S&P 500 has witnessed an average annual appreciation of just 9.5%. Though equities tend to drift higher, their recent meandering has been stronger and more focused to the upside than usual.

Small Stocks \ SM75

Source: dxFeed Index Services (https://indexit.dxfeed.com)

How Do I Hedge Stocks?

Futures are often considered a prime candidate for hedging given their lower cost and ease of use. The most straightforward way to hedge a portfolio of stocks is to simply liquidate part of it, but selling your equity positions can come with complications depending on where they reside; also, you have to decide which stocks to sell and at which prices. Equity index futures such as SM75® offer broad hedging exposure to technology, financial, energy, industrial, and material stocks in about an $8,000 chunk that costs just $627.*

Futures’ flexibility allows you to hedge for as little as a few hours when you think stocks might see some downside. The only decisions you have to make after settling on a hedging vehicle are when to do it and how much of your portfolio you’d like to account for. The “when” comes down to when you perceive fear in the market. The “how much” can simply be viewed as a percentage of your investment.

Hedging a $50,000 Account with SM75

Source: dxFeed Index Services (https://indexit.dxfeed.com)

Thanks to new products like Small futures, investors can reduce stock exposure in an easy, customizable fashion at a perceived market top. Being able to call that top is another thing entirely, but it might be a sign when the odds swing heavily in your favor.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.