Making Probabilities Out of Prices

Aug 2, 2021

By Frank Kaberna

Option traders often write off futures as being uninspired. Devotees of the “more clever” derivative might use their countless strikes across several expirations each with its own set of Greeks to discount futures’ simplicity in the same way the cool kid at your high school harshed on U2 in favor of R.E.M. or Pavement’s complexity and artistry.

Pop culture analogies aside, critics dismissing futures as a 50/50 futile effort fail to see the creativity in searching for and possibly gaining an edge. Historical prices and current projections can come together to shift a theoretical 50% chance to 55% or even 60%, and then it’s just a matter of repetition and mechanics.

Gaining a Long-Term Edge

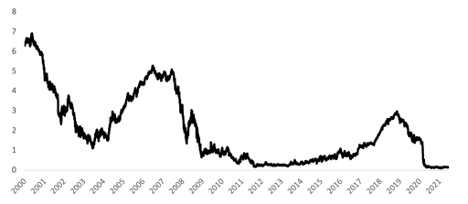

Take 2YR Treasury Yields, for example. Since 2000, they’ve averaged around 2% and been as high as 7%. They currently rest at 0.2%, where they’ve been less than 3% of the time historically.*

2YR US Treasury Yield

Source: US Treasury (treasury.gov)

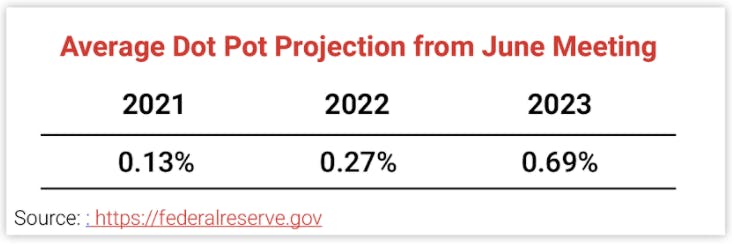

Also, the Fed is projecting hikes to the Fed Funds Rate, which is highly correlated to the 2YR, in the next two years.† This projection combined with the fact that 2YR Treasury Yields have never breached 0% could be enough to push odds of a long-term increase above 50%.

Gaining a Short-Term Edge

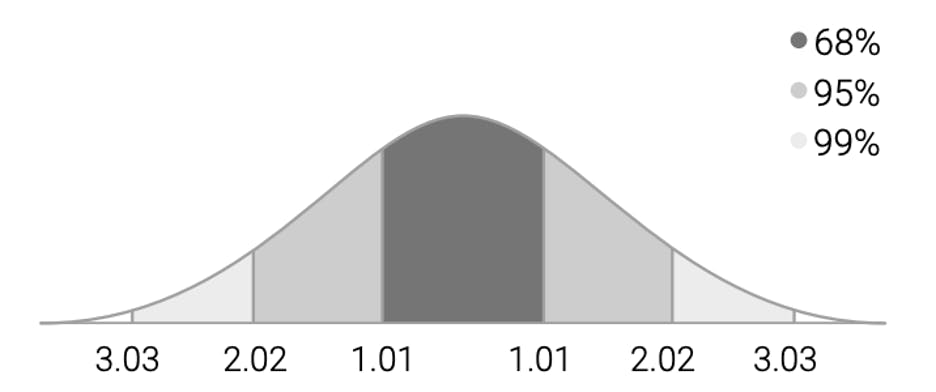

Standard deviations work their way into many futures traders’ repertoire. The calculation presents a range that the market has historically closed within on 68% of prior closes, which creates a theoretical edge for contrarian traders willing to take the other side of outsized intraday moves. 2 and 3 standard deviations can offer even greater edges given their 95% and 99% confidence intervals, respectively.

SM75 \ A Day in the Life

Source: dxFeed Index Services (https://indexit.dxfeed.com)

Simply buying or selling something might look too easy for those used to monitoring delta, gamma, and theta, but there’s plenty of probability and, more importantly, edge in futures markets.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*All stats from treasury.gov 1/1/2000 to 7/29/21

†https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20210616.pdf