Reasonable Strategies for Shorting Stocks

Aug 16, 2021

By Frank Kaberna

So, you think the stock market is going to crash. You’ve crunched the numbers and measured the charts, and now you’re ready to put your idea into play. The only problem: you don’t know when, and the time between now and the next crash could be costly.

You can buy a put option, but the premium can be expensive especially if the crash doesn’t come for months. You can sell a call option, but you get paid less and less the more the market crashes. You can sell shares short, but that steady exposure can create a prolonged dent in your buying power to the tune of thousands of dollars.

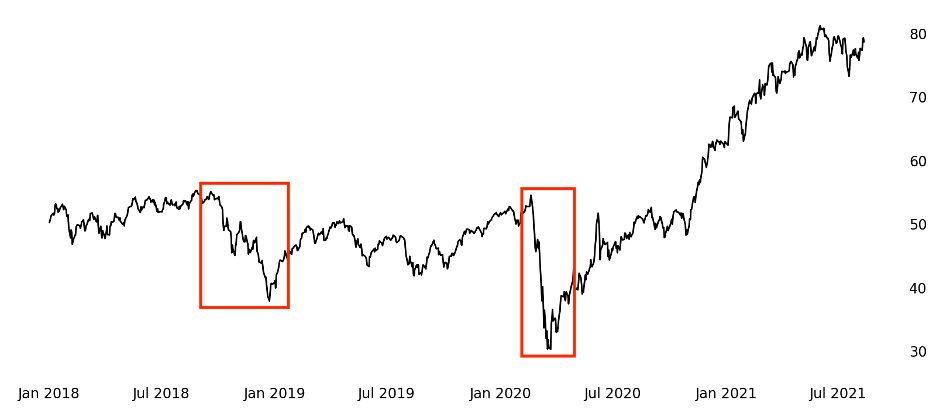

SM75 Index \ Two Crashes in Four Years

Source: dxFeed Index Services

Selling a future might be the best alternative: fixed exposure at an efficient price. However, the upside risk as stocks drift higher is its own kind of premium. How can this be minimized?

The Underhedge with Options

Knowing the actual size of a future is important for many reasons, but it’s especially essential for hedging. All Small futures carry a $100 multiplier, which makes calculating their size relatively simple.

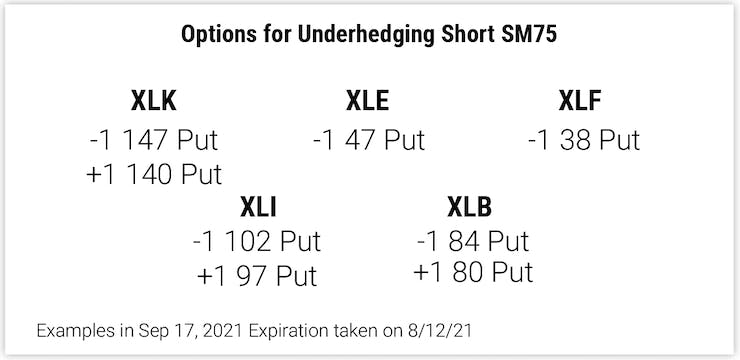

This universal characteristic can make hedging with ETF options quite easy as well. For example, an SM75 price of $78 means a short position holds $7,800 of short stocks, and a short put in a correlated ETF that’s priced lower than $78 would result in an underhedge (ETF options are commonly on 100 shares).

Not only can a short put mitigate short-term upward drift in a short position on stocks that aren’t crashing yet, but it can also work the price you’re short from higher much in the same way covered calls reduce a long position’s cost basis.

SM75 \ Sector Distribution

Source: dxFeed Index Services

Equity index futures that lend near-equal weightings to their sectors as SM75 does can make the process of underhedging a short position a little creative as well. You can pick the sector you’re least confident in falling (or most confident in stabilizing) and sell your put there. But keep in mind that ETFs whose price is higher than the Small future’s will require a spread.

Examples in Sep 17, 2021 Expiration taken on 8/12/21

The guessing game around when the next crash might come can be costly for those betting red. A smaller bet in the opposing direction can pay huge dividends in the meantime.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.