Welcome to the Future of Interest Rates

Dec 7, 2020

By Frank Kaberna

In 2020, people rarely go to their platforms with the intention of trading interest rates. It’s usually Tesla, Bitcoin, [insert marijuana company] in some order, especially for the growing millennial class of market participants. So why is the Small Exchange bringing you a brand-new interest rate product?

Well, to start, Small Treasury Yield (S10Y) is not your father’s bond product. For decades now, traders’ exposure to interest rates has been confined to allocating some small percentage of retirement funds to some bond fund for some reason like diversification. Further engagement as seen in stocks has long been impeded by confusing construction and large size.

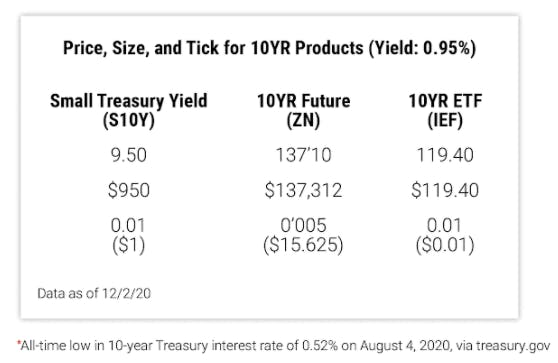

S10Y directly tracks the yield of the 10YR US Treasury – one of the most widely accepted benchmarks for interest rates. Alternative futures and ETFs use a tangential price, established for large institutions, that holds little relevance to the individual trader.

Small Treasury Yield futures also curb size relative to traditional futures for easier access. S10Y is currently priced at 9.50, which translates to a size of $950 and margins that range from $100 to $300 depending on your broker.

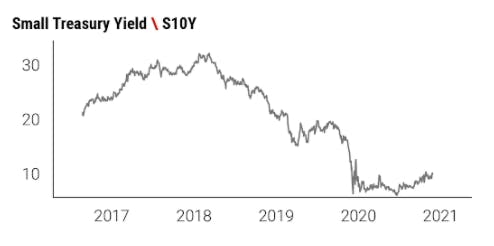

Those that say rates aren’t as compelling as crypto or tech stocks might be interested to know that the 10YR yield is around its lowest levels since the US Treasury started tracking the benchmark* as the global economy digests negative interest rates in places like Japan. Many market professionals view rates as the lifeblood of the financial system, and their activity could influence equities, currencies, and every asset class down the line.

Your ideas on whether interest rates will bounce back to normal or descend to negative have never been more relevant, and now you can take those ideas to execution with ease.

Source: dxFeed Index Services

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.