What is a Market Crash and How Can You Trade It?

Dec 6, 2021

By Frank Kaberna

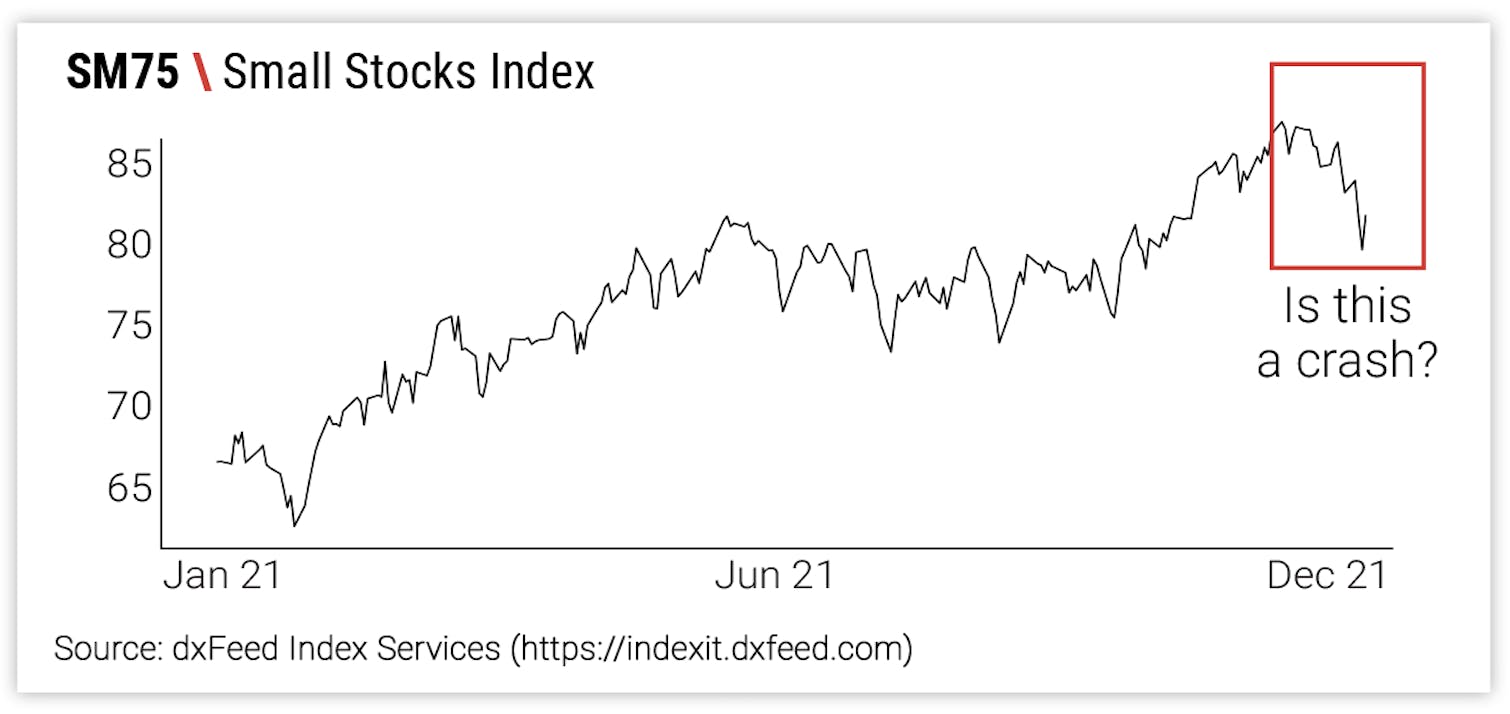

A crash in financial markets can be defined as a large fall in price in a short amount of time, but this definition leaves much to be desired for those looking to trade such an opportunity. What is a large fall from a historical data perspective? How often does this occur? Should you buy or sell?

Source: dxFeed Index Services

Market crashes can also be defined as downside movement outside of what is deemed normal or healthy; and, thankfully, what’s normal can be loosely defined by the standard deviation.

Standard Deviations: How Statistics Work in a Crash

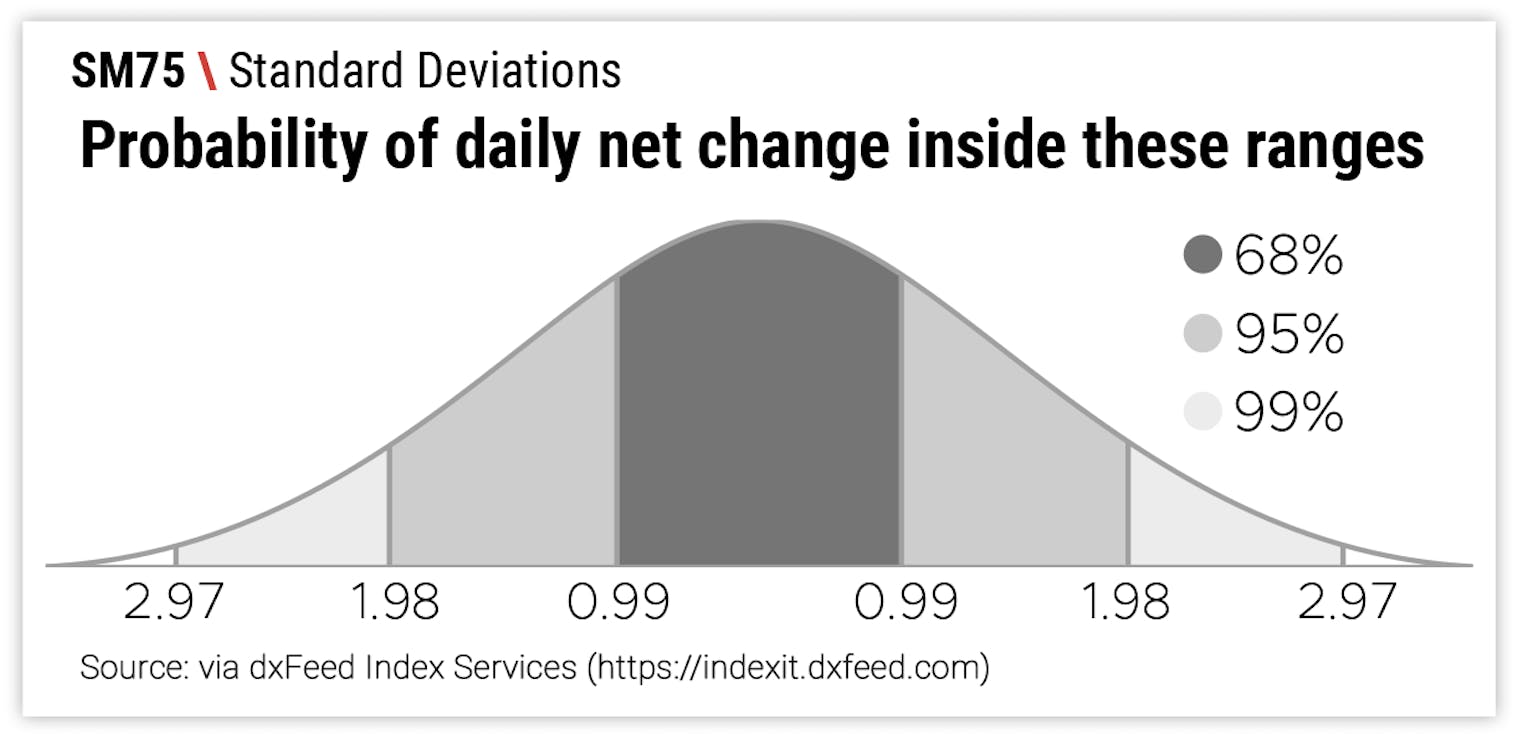

Standard deviations summarize historical price data into simple ranges that the data has stayed inside of with varying levels of confidence. For example, SM75’s 1 standard deviation of +/-0.99 tells you that the market has historically held within that range on a daily basis 68% of the time; and the market has held within +/-1.98 95% of the time and +/-2.97 99% of the time.

So, if the 3 standard deviation range of +/-2.97 reflects that market dropping by -$3 or more less than 1% of the time, then that might be a solid definition of what’s abnormal and thus a crash.

Source: dxFeed Index Services

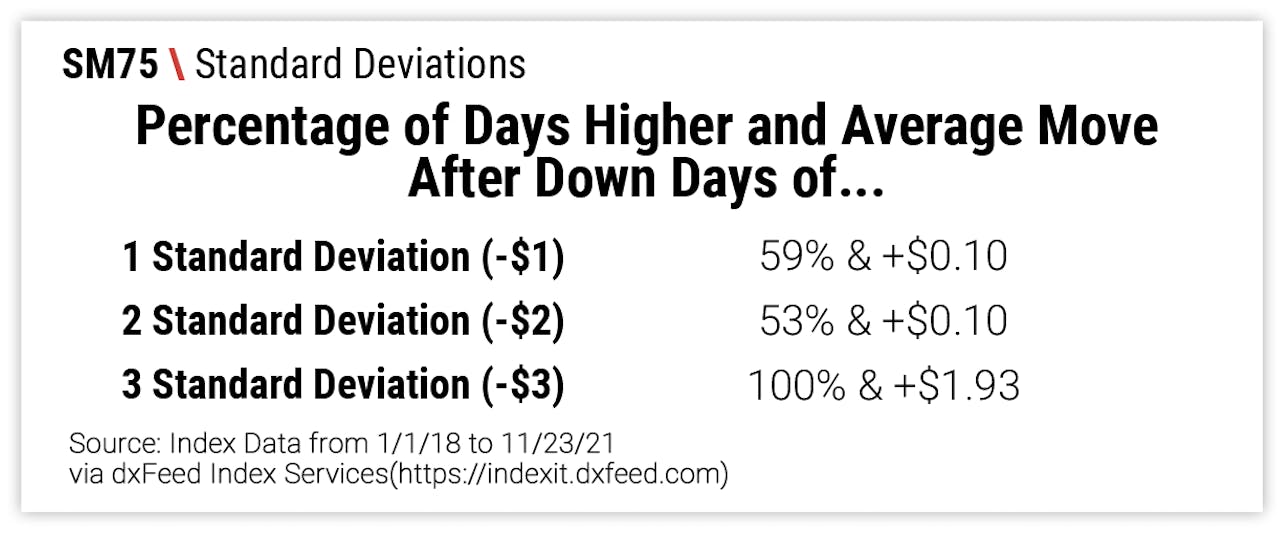

When to Buy a Market Crash

Historically, stocks have tended to rise the day following downside action outside of any standard deviation, but the greatest success has come in buying the crash. That said, this is a rare opportunity that presents itself only a handful of times annually, so any movement nearing 3 standard deviations lower could suffice.

Source: Index Data from 1/1/18 to 11/23/21 via dxFeed Index Services

Crash rhetoric finds its way into news feeds and conversations seemingly more often than crashes actually occur, but taking the time to define and act on them could yield profits in the future.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.