When Will the Steepening Stop?

Mar 1, 2021

By Frank Kaberna

While “The Steepening” may sound like a Hollywood-produced thriller wherein an animated monster made of tea leaves terrorizes some unassuming small town, it’s in fact the increase in the spread between short-term and long-term interest rates.

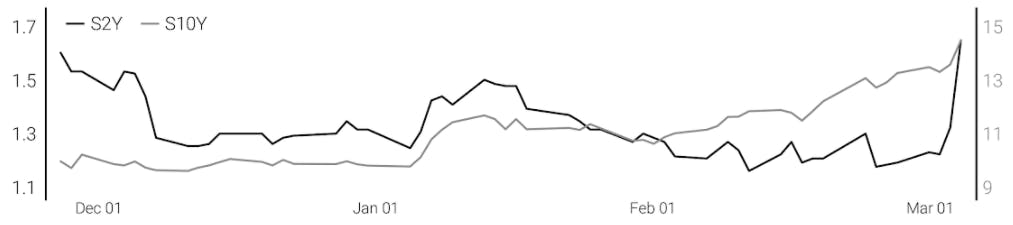

This form of steepening, however, can be a beast in its own right: the gap between 2YR and 10YR US Treasury rates has gone from below 0.80% at the start of December to above 1.3% last week (its highest value since 2015).*

The Case for the 2YR

Most of the steepening seen in the yield curve has come from the fresh legs of the 10YR getting as far as 1.4% as the 2YR still sits near 0%. A case could be made for the 2YR finally waking up and taking part in some of the upside that the rest of the curve has witnessed in the last few months (Small 2YR Yield (S2Y) futures let traders directly access short-term rates).

The Case for the Flattener

Traders can also play the difference between 2YRs and 10YRs by way of the spread. This interest rate-neutral trade puts two parts of the yield curve together to speculate on their difference growing and contracting. Some flattening could be in order after this historic run of steepening.

The everyday trader can choose to view this blockbuster event through the lens of bullish/bearish interest rate trades or steepening/flattening yield curve spreads.

The Heat is On (Small 2YR vs Small 10YR)

Source: dxFeed Index Services

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Treasury yields (https:/treasury.gov) and index values (https://indexit.dxfeed.com/) taken on 2/25/21