Will Pot Stocks Ever Go Up?

Aug 30, 2021

By Frank Kaberna

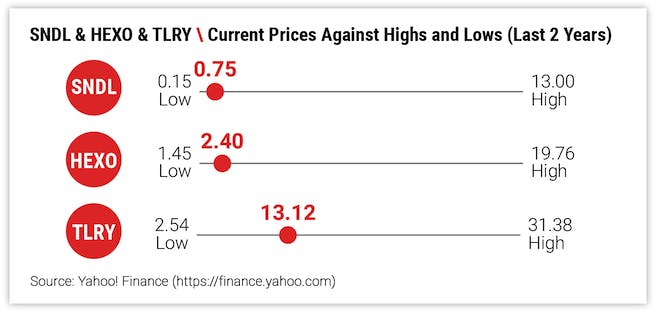

Pot is maybe the least cool it’s ever been. Prices for Small Cannabis futures are down 14% since their launch in June, and pot stocks like SNDL, HEXO, and TLRY are down more than 50% from this year’s highs back in February.*

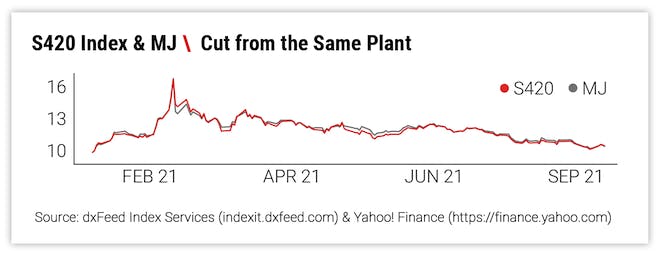

Many are starting to write off the formerly burgeoning stock sector completely as it reaches territory travelled just 25% of the time in the last three years.** But could there be growth potential for those willing to hold pot stocks through their current rough patch?

How Low Can Pot Go?

The potential downside in stocks, and thus stock futures as well, is usually $0, but a more realistic view might be where pot stocks bottomed out prior to their day in the sun. Since Small Cannabis futures have only been around for a few months, this picture can be painted with historical prices in a few of the index’s top components.

Has it been worse? Yes. However, the pessimistic sentiment surrounding cannabis and the likelihood of its products to gain further legality has brought the companies dealing in the space quite close to pre-potmania prices.

Relieve the Potential Pain with Options

If you think pot prices will rebound immediately, then buying the futures outright could pose the greatest profit potential; but those thinking it might take a while can bide their time with options.

Alternative Harvest ETF MJ poses a high correlation and similar size to Small Cannabis, while S420 poses a relatively reduced cost to buy the pot stocks themselves. Traders can go to the October options expiration in MJ to sell calls against their S420 longs in the interest of reducing cost basis and defending against short-term risk.

Pot might not be cool again for a little bit, but it could offer greater potential than markets like Ethereum and AMD that are part of the current zeitgeist.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Data as of 8/26/21

**Price of MJ in lowest 25th percentile of prices since inception (2/9/18)