Yield Curve Flattening and Steepening Explained

Nov 1, 2021

By Frank Kaberna

The yield curve has long boasted singular opportunity distinct from stocks, but, until recently, it’s been guarded by definitions and formulas only “pros” would understand. Interest rates have evolved as an asset class to now include smaller, simpler products priced in yield and designed for everyday people.

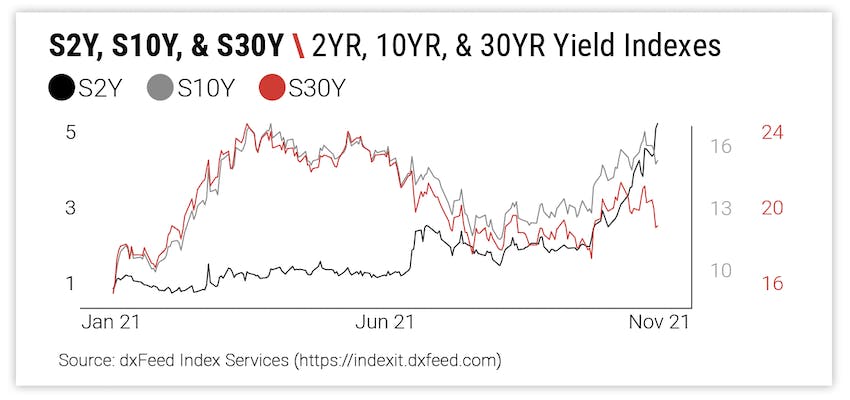

Source: dxFeed Index Services

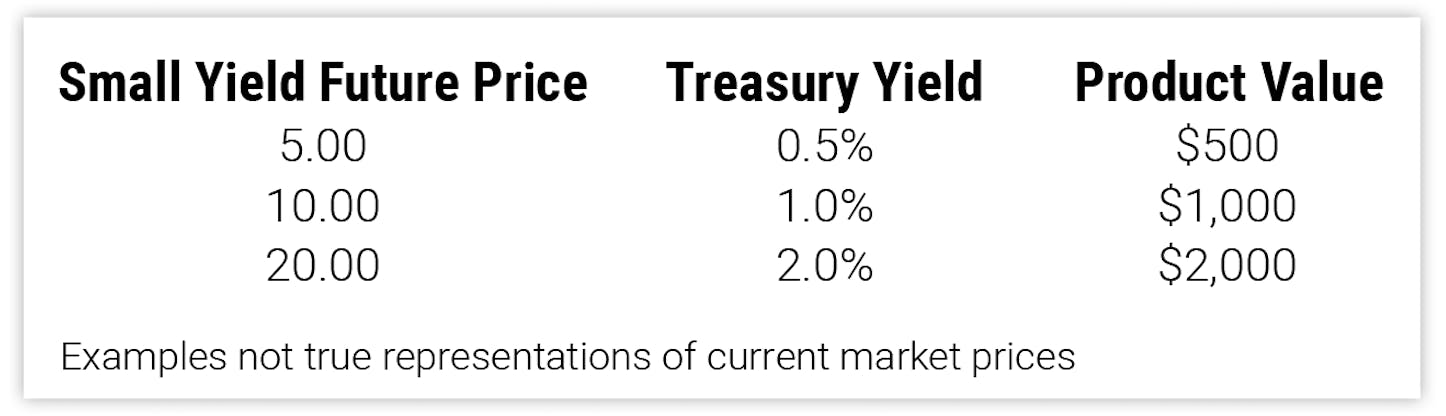

Think 10YR rates are headed higher? You could buy S10Y futures. Think 2YRs could edge lower? You could sell S2Y futures. And each product is a representation of the actual Treasury yield:

Flattening and Steepening Explained

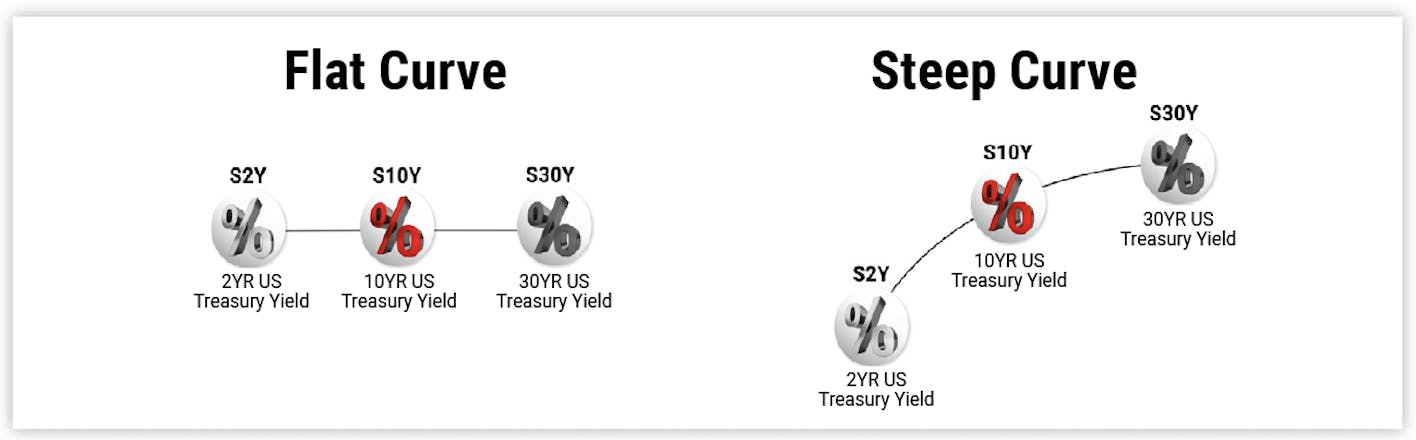

Once you’ve conquered outright interest rate direction, it’s time to check out the spreads. In the same way bullish and bearish measure outright direction, steepening and flattening dictate movement in the yield curve or interest rate spreads.

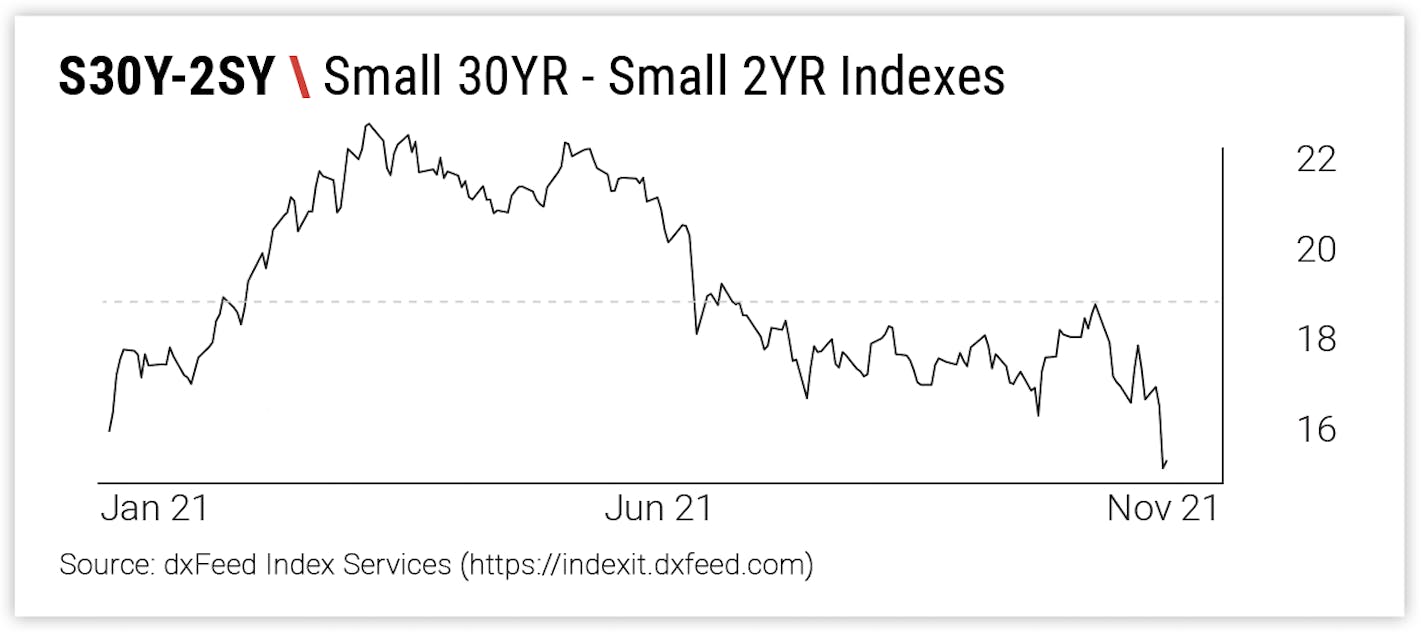

If the yield curve is flattening, as it has been in the last few weeks, then the difference between rates at the long end (30YRs) and those at the short end (2YRs) is getting smaller; and vice versa for steepening, which we saw at the start of 2021.

Yield Curve: How to Trade It

Most view spread trading across the yield curve as a mean reversion play - put on a steepener after you’ve seen a bunch of flattening and look for flattening after large levels of steepening.

Source: dxFeed Index Services

Given the historic level of flattening the curve has just seen,* traders looking for mean reversion can place a steepening trade; this strategy incorporates short positions on short-term yields and long positions on long-term yields (for example, -1 S2Y +1 S30Y).

The yield curve no longer needs to be an asset class that you kind of understand. Thanks to new products that are both simpler and smaller, visualizing and trying out the yield curve is easier than ever.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Data from Yahoo! Finance and dxFeed Index Services as of 10/21/21