Should You Trade Bond Price or Yield?

Jan 24, 2022

By Frank Kaberna

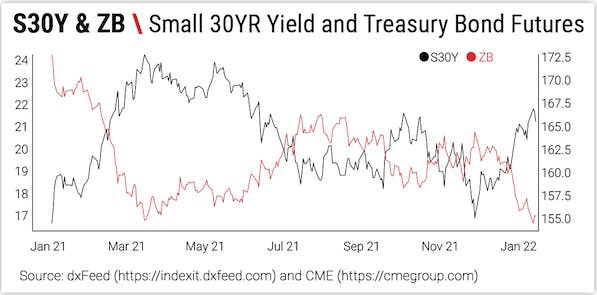

For decades, people formed opinions about the Fed and US interest rates in percentage yields only to then flip their assumptions trading traditional products like Treasury Bond futures and the TLT ETF presented in a price. The emergence of yield-based products from the Small Exchange® and CME, however, have now afforded you the choice between the two when you go to execute on your interest rate idea.

Before comparing them, it’s worth noting that one is not “better” than the other. Yield is a direct reflection of a given note or bond’s price. This is similar to how implied volatility, and the derivatives on top of it, comes from a given market’s options while simply posing the same opportunity as the options themselves but in a different light.

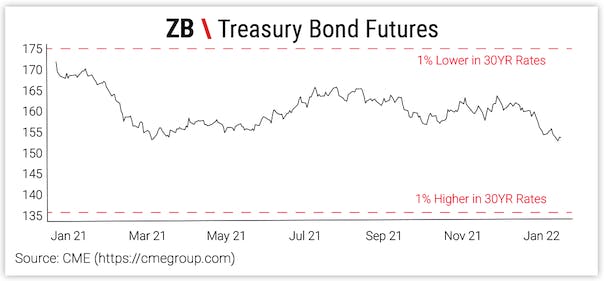

What to Expect Trading Bond Price

Traditional bond futures tick in 32nds of a point, and each point is worth $1,000. If you’re bullish interest rates you can sell ZB, and vice versa for rate bears, since bond prices move inversely from their yields. Trading bond price can mean daily moves exceeding $1,000, and a 1% change in 30YR rates could correlate to more than $15,000 per ZB contract.

Source: CME

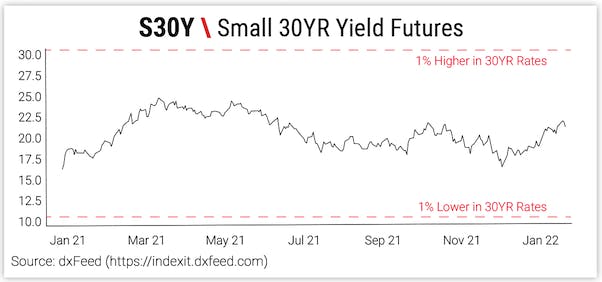

What to Expect Trading Bond Yield

New bond futures that trade in yield move in 10ths of a basis point, or 0.001%, and each tick equates $1. You can buy S30Y futures if you think rates are moving higher, and sell them if you think rates will decline. Daily 30YR yield movement of 5 basis points corresponds to just $50 per Small Yield futures contract, and rise or fall by 1% would mean exactly $1,000.

Source: dxFeed

No one knows the future path of rates, but the journey will be reflected in price and yield. And now you have access to both.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.