Technology Stocks: Why are Prices Falling?

May 5, 2022

By David Accomazzo and Clemens Kownatzki

Traders have been rather unkind to technology stocks in 2022. A toxic combination of high valuations, rising interest rates, macro uncertainty, and political pushbacks have conjured up very strong headwinds for the sector.

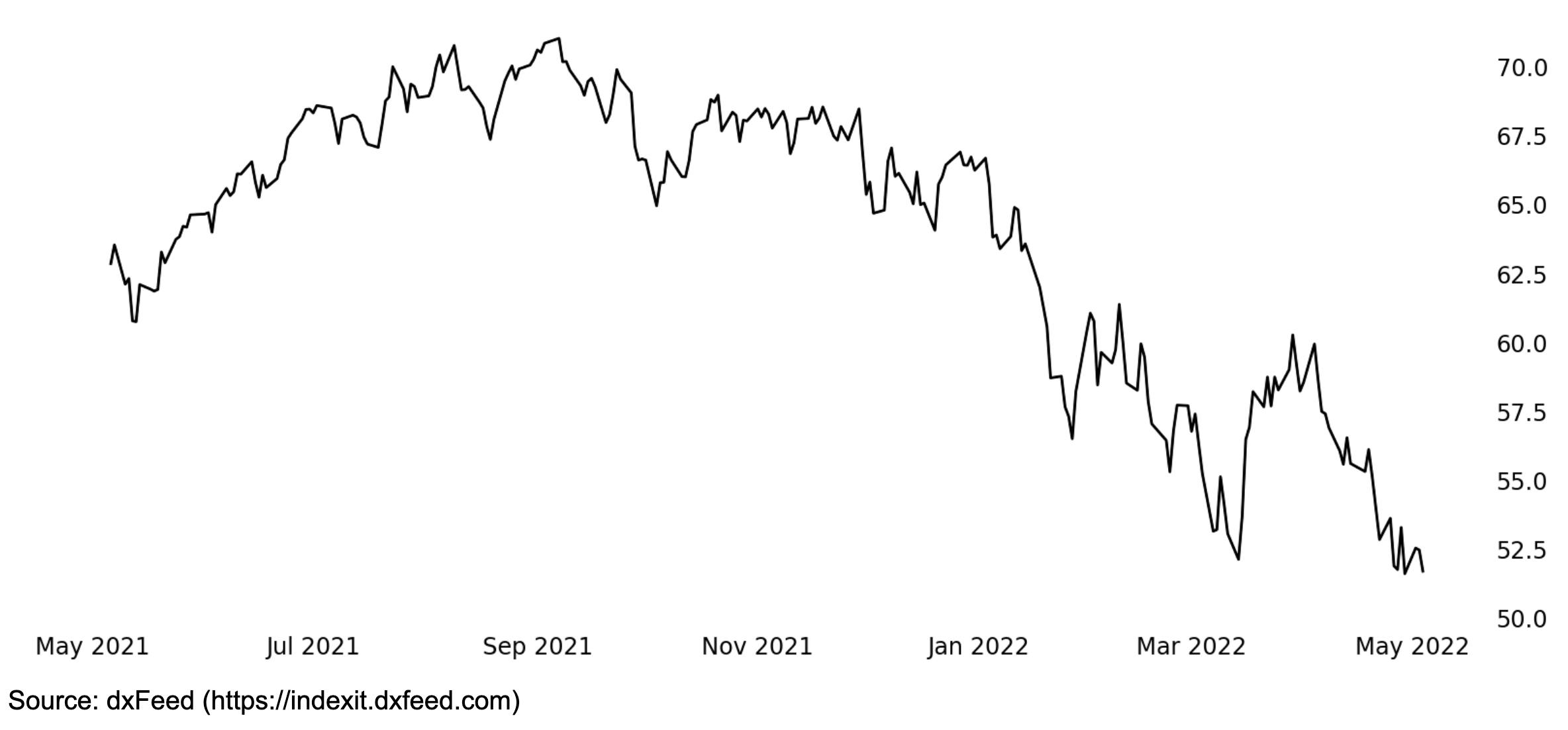

Technology Stock Performance

Tech performance, measured by the NASDAQ Composite Index, shows a YTD correction of just over 20%.* These types of price contractions can be categorized as bear market environments.

NASDAQ Composite Index Price Return Year-to-Date

Source: StockCharts.com

From a trader’s point of view, the real question is whether there is an opportunity. The sector now trades at a 7% discount to its fair market value as calculated by the Morningstar proprietary algorithm, which compares to an 18% premium at the beginning of the year. Sticking with Morningstar’s valuations, a total of 69 tech companies out of a universe of 136 can be considered undervalued.

Technology Stock Outlook

There are three major variables to consider. First, the speed and length of this upcycle in rates. Higher rates hurt tech valuations more than the average stock. This occurs because, for the most part, investors are willing to pay higher multiples for growth that is expected to materialize further in the future. As the discount factor of those future earnings increases (the risk-free rate is one major portion of that), their present value inversely diminishes. At this point, you could expect rates to continue seeing upside pressure for the rest of the year. In fact, fixed income derivatives markets are currently pricing in about an 85% probability of Fed Funds rates at 2.75% or higher by the end of this year.† This puts additional pressure on the broad equity market at large.

Next, geopolitical risks can be considered. An escalation of the conflict in Ukraine could also increase the discount factor of future earnings by magnifying the volatility input. This element is arguably very difficult to call. Gaming geopolitical factors such as nuclear war or other major possible outliers can be both difficult and unhelpful in terms of actionable takeaways to promote higher portfolio returns.

A third and final element to consider is investors’ positioning, which seems to provide some positive spin. Investors’ sentiment is weak, and a JP Morgan survey shows that roughly 80% of respondents are already positioned neutral or bearish in their current equity exposure - a possible contrarian indicator.‡ At these levels, there’s little room to the downside compared to the upside, which could provide an asymmetric potential return to risk.

One additional element of support would seem to be increasing mergers and acquisitions (M&A) activity. Besides the flashy bid by Elon Musk for Twitter, there’s been solid interest in other tech acquisitions. For instance, Enphase Energy has just confirmed plans to expand via M&A. Additionally, CISCO's unofficial (and currently inactive) bid for Splunk and general activity by most private equity funds seem to indicate some floor in valuations.

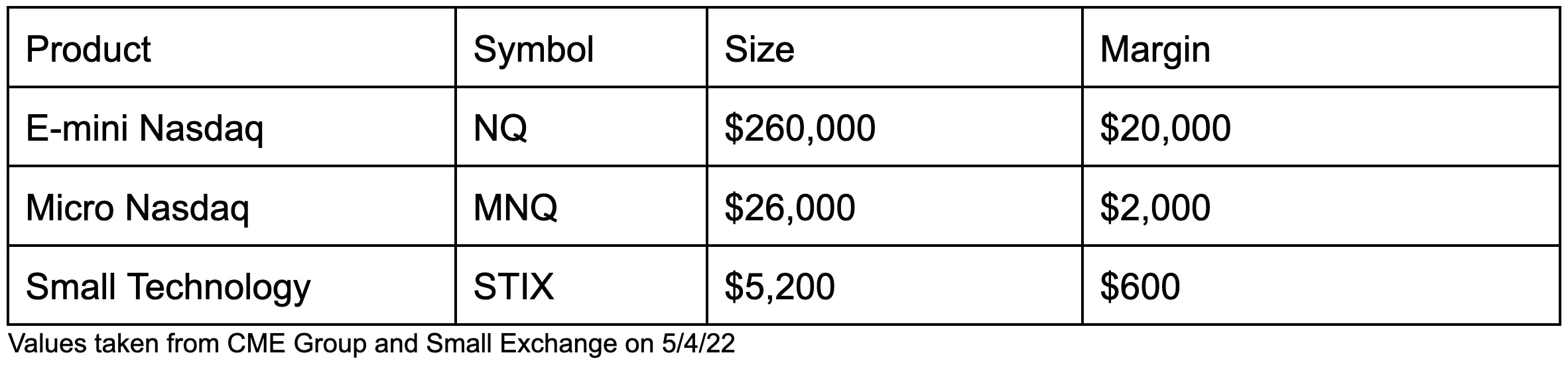

Small Technology (STIX) Futures Price

All these factors can make the case for being more tactical rather than being a passive investor tracking an index. The days of closing your eyes while “buying and holding” the usual Wall Street Darlings could not come back for a while. Yes, there are additional risks out there, but there are also great trading opportunities. And so, on the current risk-reward balance in technology stocks, a quote by Donald Gorman, author of the book Paradox, seems appropriate: “Where's the fun in playing with knives if you can’t draw a little blood?”

Technology Stock Futures

Davide Accomazzo is the Chief Investment Officer at THALASSA CAPITAL and Finance Professor at Pepperdine Graziadio Business School.

Clemens Kownatzki is Associate Dean of Fulltime Programs and Finance Professor at Pepperdine Graziadio Business School.

*Data as of 5/2/22 Source: Yahoo! Finance

†Data as of 5/2/22 Source: CME Group

‡JP Morgan Global Market Strategy 4-25-2022

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.