Crude Oil Futures: The Race Against the Clock

Jun 13, 2022

By Frank Kaberna

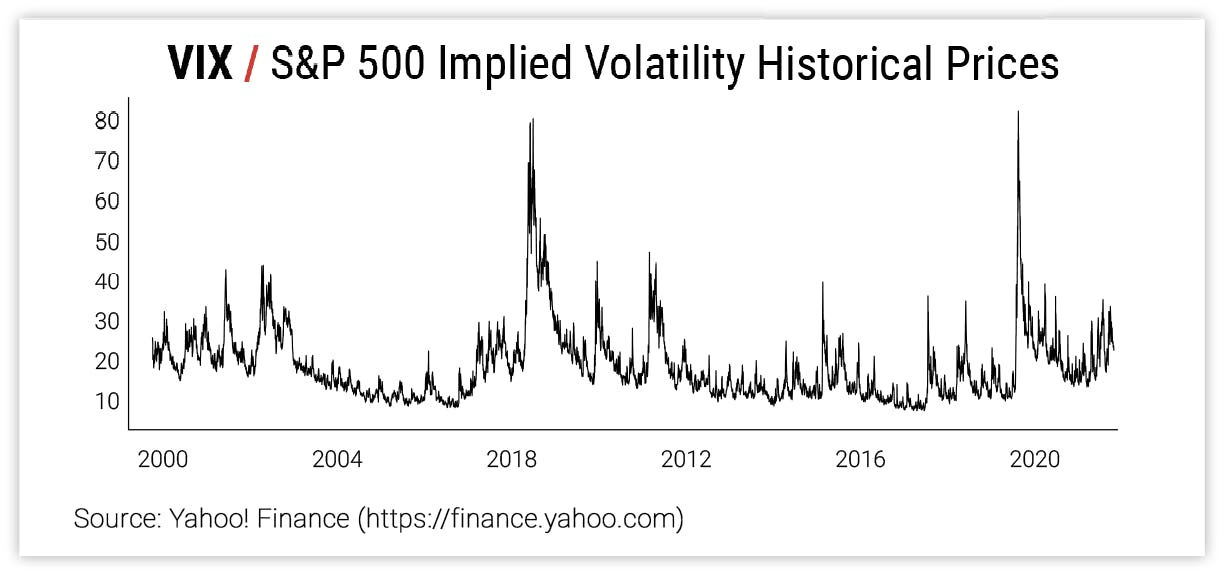

Certain markets are just plain scary, especially when you look at them from the short side. Trading stock volatility can be a prime example of this: the S&P 500 Implied Volatility Index (VIX) could be at 100 - a price it’s never reached - with an almost 100% chance of reverting back down to more normal levels, and the idea of being short such a potentially wild market might keep you from entering the order.

Source: Yahoo! Finance

This fear can be justified by the fact that markets like VIX can go infinitely high, theoretically. Practically, VIX has topped out at 82.7, but the market for S&P 500 IV has also seen periods of doubling, tripling, or even sextupling (VIX went from 12.1 on 1/17/20 to 82.7 on 3/16/22).*

While VIX is currently at moderate measures and you might not be struggling with the internal debate of high probability reward versus potentially catastrophic worst-case scenario, commodity markets like crude oil, natural gas, and soybeans are in such territory.

Source: dxFeed

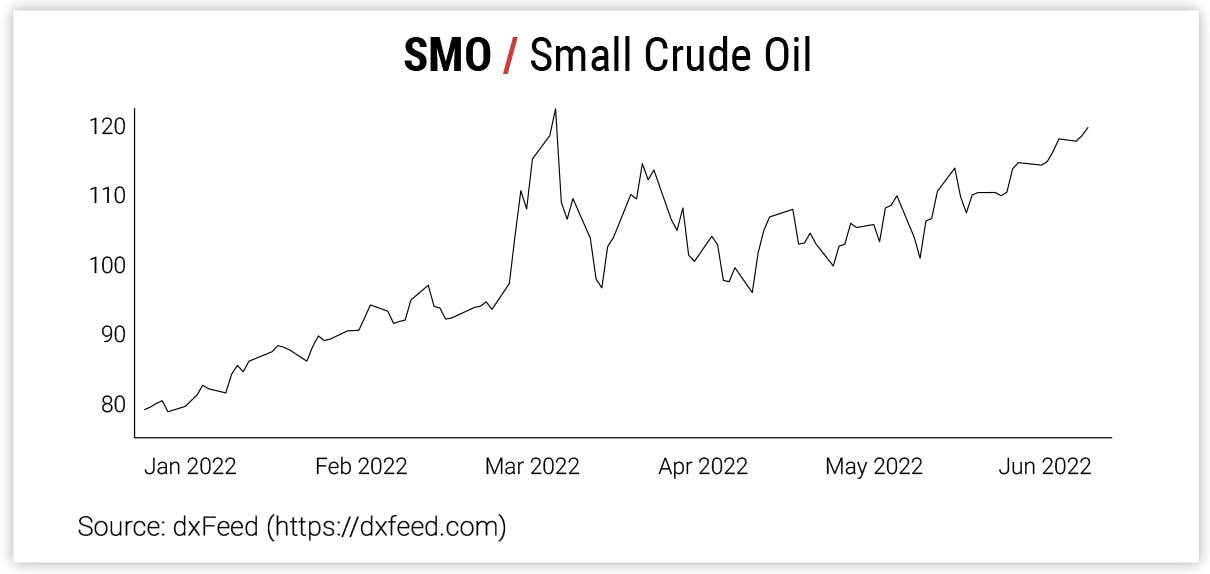

Crude oil, for example, is trading at prices above 120 unseen since 2008, and the commodity has only traded in this rarefied air 0.8% of the time (66 total trading days) since 1990.* Knowing that crude’s average price is somewhere in the mid-double digits (depending on how far back your data set goes) might make contrarians want to sell, but how can you reduce the amount of risk taken in the interim if your timing is off?

Crude Oil Futures Trading Example

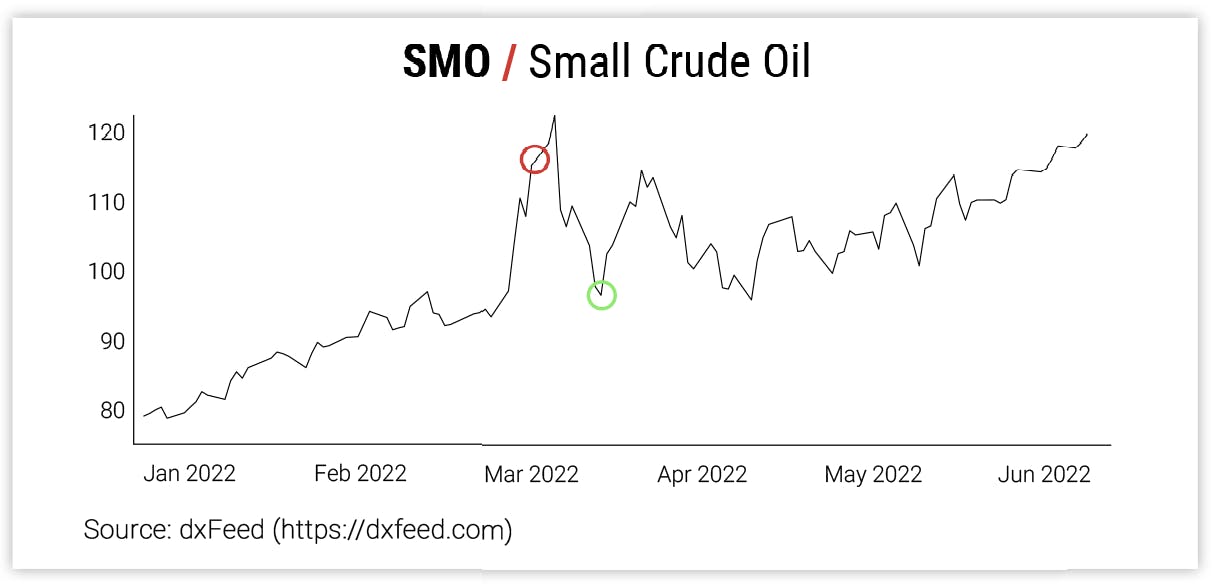

One of the worst experiences a trader can undergo is getting too early to a trade, managing for a loss at the predetermined stop-loss, and finding that the market moves to profits shortly thereafter. For example, say you sold Small Crude Oil (SMO®) futures at 115 on 3/4/22 with a loss marker of -$1,000; you would have witnessed about -$600 in losses before more than +$1,500 in profits using SMO futures versus -$6,000 and +$15,000, respectively, using CL futures.

Source: dxFeed

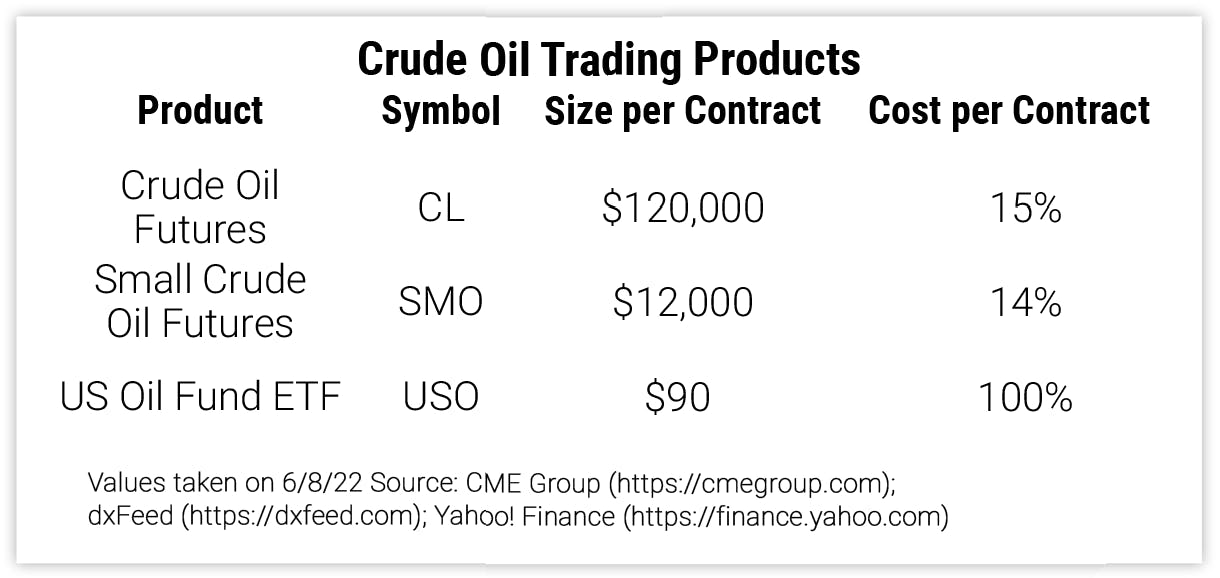

How to Make Crude Oil Smaller

Simply choosing a smaller product can help reduce risk and increase your duration in a trade. Mean reversion is a strong principle, but it doesn’t necessarily abide by your timeline. You can get even smaller than Small Crude Oil futures with USO shares, but commodity ETFs can be prone to drag and other side effects as well as cost much more per unit of exposure driving down returns.

Sources: CME Group, dxFeed and Yahoo! Finance

Rewards can look like layups. Risks can look devastating. Managing expectations with the right-sized product can give you the best of both worlds while making that race against the clock more of a saunter.

Get Weekly Commentary on Small Markets!

Sign up to start receiving free analysis on everything from stocks and bonds to commodities and foreign exchange.

*Source: Yahoo! Finance (https://finance.yahoo.com)