Management Mechanics for Day Trades

Feb 22, 2022

By Frank Kaberna

There’s a satisfaction to day trading that can’t be found in any other strategies. The finality of knowing whether you’ve won or lost by the end of the day creates a very clean experience whereby no to be continued’s are left hanging at the end of each trading episode and no sleep is lost hoping that tomorrow will bring profits to a position.

That said, management mechanics are essential if you wish to bring this strategically diversified angle to your portfolio. Let’s assume you’re a contrarian taking the other side of large moves outside of the normal, or 1 standard deviation, range, though the logistics laid down here can quite easily be applied to trades that follow trends.

How to Manage a Losing Day Trade

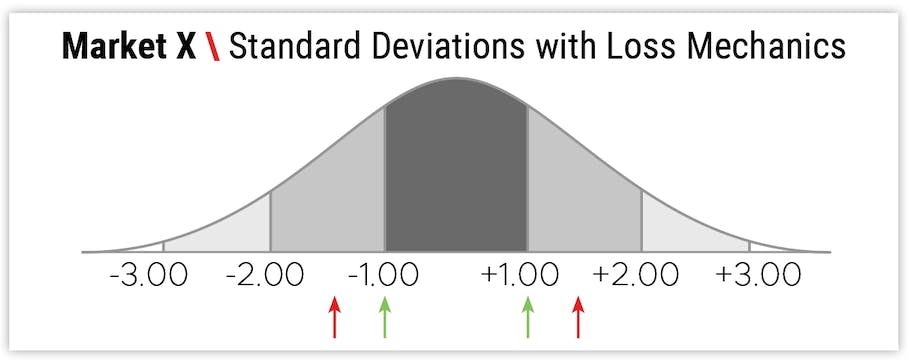

The key to managing almost any strategy is to set realistic expectations and then execute on them. Thus, if you are using, say, a standard deviation metric to inform your entrance into a market, then the same measure can apply to your exit.

If you buy a market that’s down 1 standard deviation or sell a market that’s up that amount, then it would be realistic to expect that market to move about half that value by close. By contrast, expecting a market to reach a semi-rare 1 standard deviation level and then exhibit an even rarer move by close is not very realistic. Many traders will simply manage for a loss and move on if the market has moved against them for half of the initial entry level.

How to Manage a Winning Day Trade

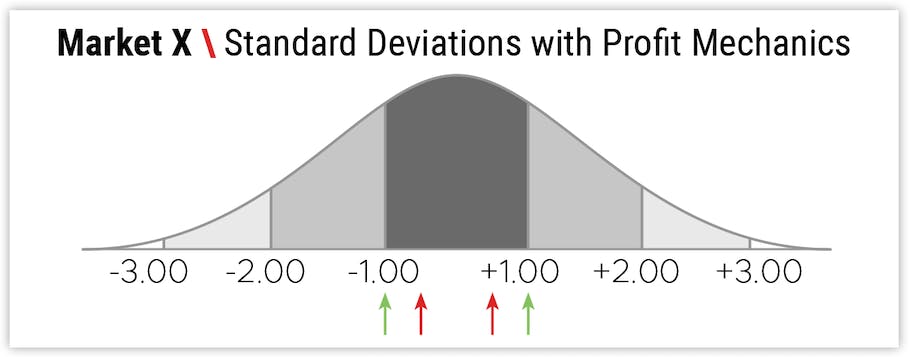

The same set of expectations can work for managing winning day trades - close the position at a daily P/L showing profits of half the net change that you entered at.

Too often, traders turn winners into losers by expecting too much from their position by the day’s close. If the market normally stays inside a net change of +/-1.00, then is it realistic to expect 2.00, 3.00, or more intraday?

How to Scratch a Day Trade

Finally, if the market does not reach either of the management markers you’ve determined as a function of realistic expectations, then it is likely hovering around your entry price as trading hours wane. This situation can often lead to a trade scratch - closing a position for a small profit or loss amounting to a rounding error from your initial account value. Many traders will scratch positions that haven’t hit predetermined markers in the last hour of trading.

The ability to test processes you think will beat the theoretical 50/50 with results that could present themselves in seconds can be intriguing to any do-it-yourself investor, but ensure the legitimacy of your experiments with controls that keep day trades from becoming anything else.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.