Does Crypto Belong in Your Portfolio?

Sep 13, 2021

By Frank Kaberna

Ethereum - a cryptocurrency with a $400 billion market capitalization that’s second in the space only to Bitcoin* - fell more than 25% from its highs of a week prior at one point last Tuesday, September 7th. Nasdaq futures made new all-time highs the same day.

Source: Yahoo! Finance

It’s become clear that attempting to understand the crypto market by comparing it to popular existing indexes is as lazy as describing an athlete’s talent or musician’s sound in terms of another athlete or musician. It doesn’t get to the root.

How > What

Traders might want to start with movement, and appreciating how cryptocurrencies move might be more helpful than why they move. Asking why in trading can often be moot no matter the market given that it’s probably moved by the time you asked.

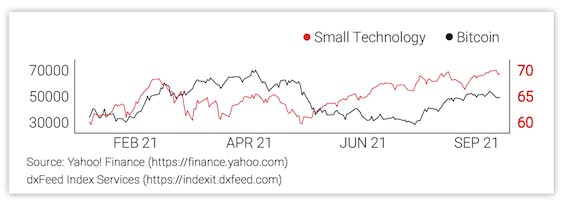

Sources: Yahoo! Finance & dxFeed Index Services

This year alone, Bitcoin has both doubled and halved its value. Pit that kind of volatility against one of its most highly correlated stock sectors in technology and it isn’t even a fight. Not to mention that BTC is moving almost five times as much as STIX on a daily basis (see stats below).

Walk Before You Run

While this excitement has no doubt brought more participants to markets, which can be viewed as a very positive development for other financially active individuals, there is one potentially rough side to all of this:

Many entrants into markets are learning how to invest and trade using the most volatile asset class established in decades.

Of course, you have to cut your teeth somewhere but doing so with a product that has the potential to move thousands of dollars in a flash might not be the best way to kick off a long portfolio life. It’s seldom advisable to try anything new with its most chaotic version (examples include: swimming in deep end, hiking in Himalayas, option trading in naked short VIX calls).

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)

Sources: Yahoo! Finance & dxFeed Index Services

It’s hard to put cryptocurrencies in a box. They move like nothing else currently in the market, and they don’t seem to be going away anytime soon. But until everyday traders get a smaller, more accessible product, they might want to put that box on the shelf.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Ethereum data from coinmarketcap.com as of 9/9/21