Probabilistic Modeling for Trending Markets

Apr 18, 2022

By Frank Kaberna

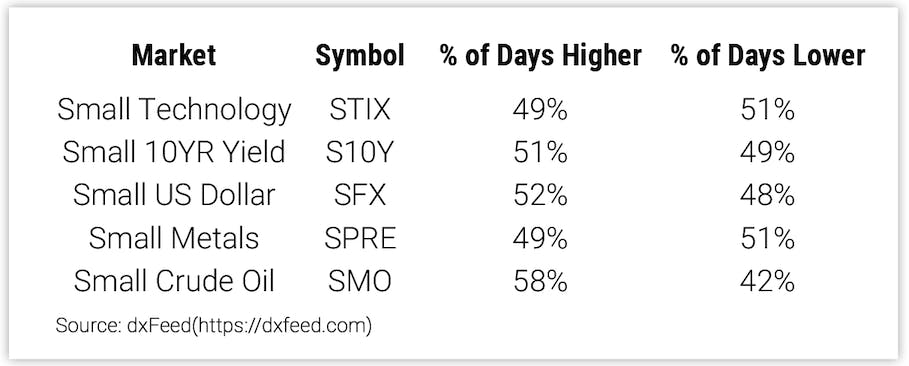

Many mathematicians start with the same, single assumption when they commence any probabilistic modeling: the probability of a market moving higher or lower on any given day is 50%. Though this may seem oversimplified, it is actually quite true to practice if you look at the performance of a few Small Exchange markets in the last year:

Source: dxFeed

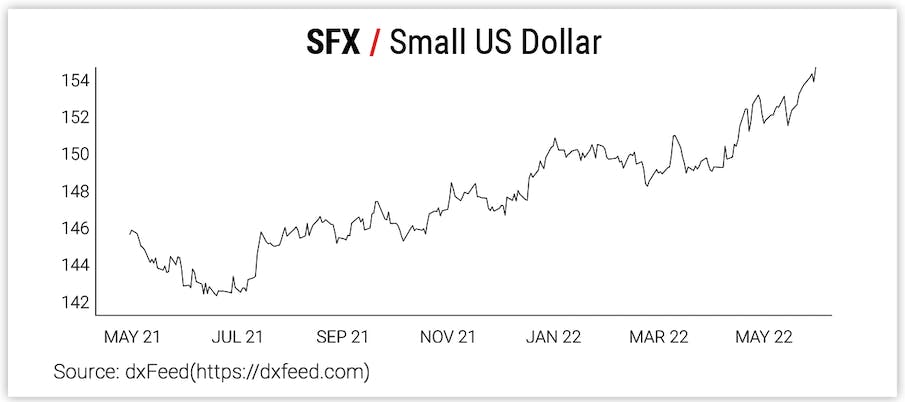

The uniformity of these statistics may seem unbelievable especially when you consider markets like Small US Dollar are pushing new highs since Summer 2020. It goes to show that even the most trending markets have reversals; that is, nothing can go straight up in price.

Source: dxFeed

Probabilistic Modeling: Do Market Trends Reverse?

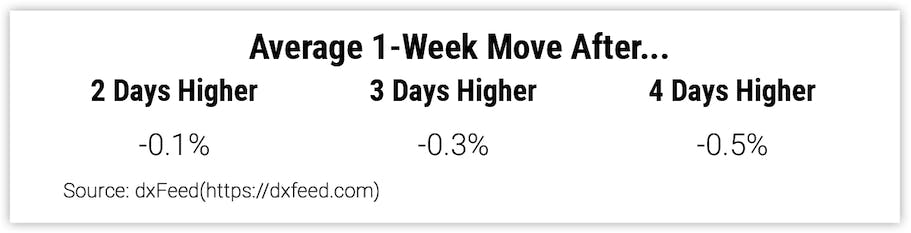

In theory, a market can move in any direction for any amount of time. In practice, markets tend to lose steam after spending multiple days traveling in the same direction. Take the last year of action in Small US Dollar, for example:

Source: dxFeed

While the memorylessness property may dictate that a market’s historical price action has no bearing on the current day’s movement, it’s hard to argue with the data - markets could have a greater tendency to reverse course after multiple days in the same direction.

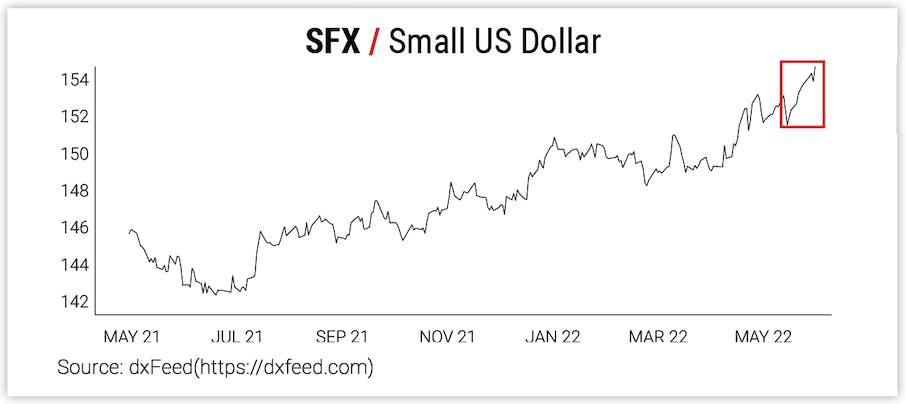

How to Trade Market Trends

Many traders will ride a trending market in the same direction using a short-term time frame, and this strategy would have worked quite well in the Small US Dollar market that moved higher nine days in a row leading into last Wednesday, April 13th.

Source: dxFeed

Traders willing to hold positions for more than a few hours could find greater success in the contrarian angle - going against the trend. And, if you use small enough products like the Small US Dollar or Micro Euro futures, then you can better withstand those trends if you don’t catch the top or bottom. Even better, you can sell out-the-money options against these trends for less initial risk and a higher probability of profit.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.