Third Time is NOT the Charm

Feb 28, 2022

By Frank Kaberna

When I was at the Chicago Board of Trade, I sat next to a guy named Larry. We were a great pair. Larry had been in the industry for more than a decade bouncing between prop shops and market makers, and he was the type of dude who traded with his gut. I was fresh out of college, and the only thing I could hang my hat on was my ability to analyze historical data to give us a statistical edge.

Larry had these rules founded in what he’d seen over the years that he imparted on to me. Were some of them a little kooky and maybe even paranoid? Sure, but there’s one that I’ve held onto since our dynamic duo broke up: you can’t make the same trade three times in a row.

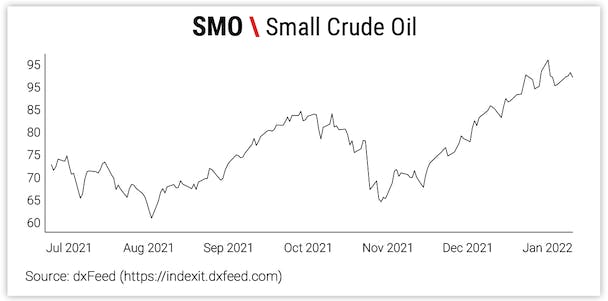

Crude Oil Price Action from Last Week

Amid the recent geopolitical uncertainty, crude oil prices have made a run at multi-year highs. If you bought the nonrenewable energy at any point prior to last week - especially when the price of some futures turned negative on April 21, 2020 - then you’re likely feeling pretty good about that investment.

Source: dxFeed

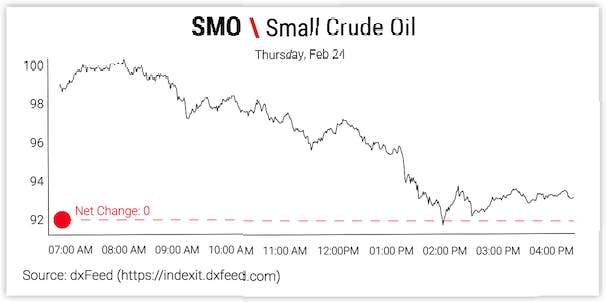

But what’s potentially more interesting is the commodity’s short-term price action around these highs. On Tuesday and Wednesday of last week, Small Crude Oil futures peaked above $93 per barrel before closing more than a full dollar lower allowing traders to profit from selling crude two days in a row. On Thursday, the market made a run for $100.

Managing Losses in an Outlier

If you sold crude oil at the same spot on Thursday as you did Tuesday and Wednesday, then your position could have shown large losses compared to the prior days’ profits as the commodity rallied more than three standard deviations - a move occurring less than 1% of the time.

Source: dxFeed

While the market did come back by the end of the day, the notion of taking almost $1,000 in heat for just $100 or so in profits is unsustainable for most. However, last Thursday was a prime example of how taking losses can both reduce risk and allow for more opportunities. If you sold the $94s only to hit your loss marker at $95, then you could be right back there to sell the $97s a couple hours later. Though it may not seem like much, avoiding $2 ($200 notionally) in movement against you can free up your portfolio for other opportunities and get your crude oil trades back to even or profits faster.

The thing I didn’t tell you about Larry is that he still jumped in and made that third trade every time, but he always had the mechanics to get him through if it became an outlier. Shying away from a trade that seems fishy is maybe not the best practice, but making sure one big move doesn’t wipe away your prior profits is even more important than jumping in.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.