Trade Size: Are You Taking Too Much Risk?

Mar 21, 2022

By Frank Kaberna

The question of trade size and risk is answered too often after the fact: After a losing trade, you had too much size. After a profitable trade, you didn’t have enough. What if you could take the “should have had less” and “could have had more” emotions out of trade size?

Futures Margin: The Key to Assessing Risk

The margin system behind most futures essentially inputs product size and volatility metrics to then spit out a capital requirement that is viewed as being equivalent to the amount of risk in the lifetime of the trade (from order execution to expiration). This can make futures margin your go-to measure for whether or not you’re comfortable with placing and holding a certain trade.

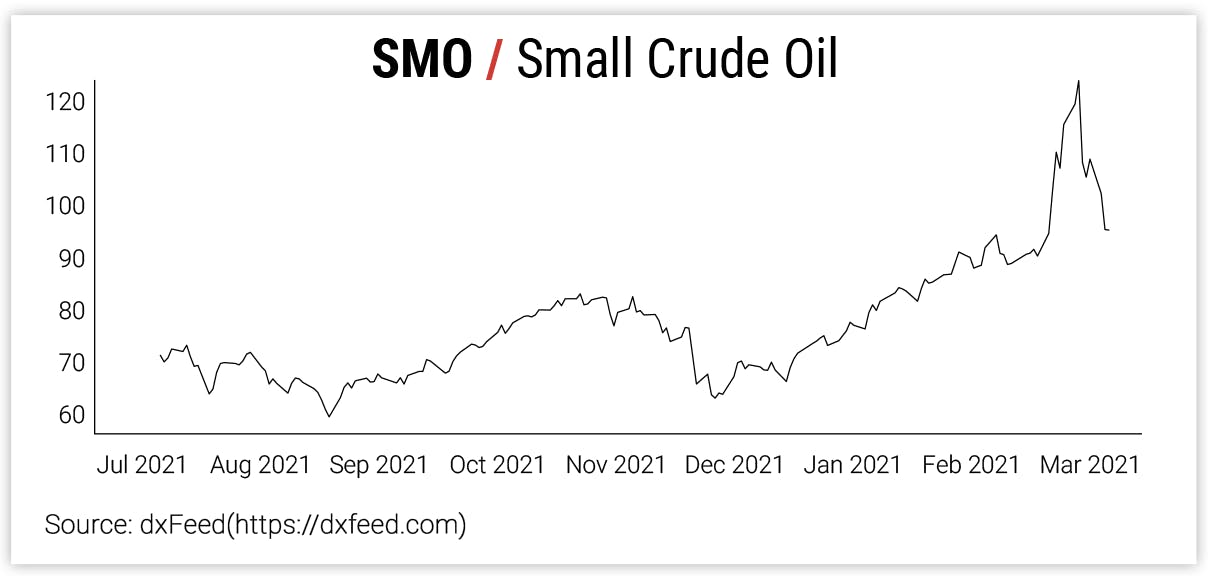

Source: dxFeed

Not comfortable with +/-$2,000 in a position’s P/L over the course of a month? Then trading Small Crude Oil may not be for you at the moment.* Back of the envelope math popular among day traders implies that futures can move about 1/5th their margin on a daily basis. This shortcut can not only help in deciding whether or not to day trade a certain market but also let you approximate some trade sizing mechanics based on the derived value.

Futures Trade Size Mechanics

Going off the example above in SMO (margin: $2,000; daily risk: $400), let’s say you’d be comfortable with 1 contract for either long-term investment or short-term day trading purposes. Accordingly, positions in other small markets should attempt to replicate that risk/reward profile:

Want more or less risk? Simply apply your particular percentage increase or decrease to the values already established. Creating equivalent risk/reward metrics across your positions using concrete measures like margin can help to reduce the liability of your portfolio to good or bad days in one specific asset class. That is, it’s not very diversified to allow your P/L to swing mostly as a function of the biggest product you trade.

The best part about sizing this way? You can set up the mechanics beforehand and leave nothing to your emotions on any given day. All you have to ensure is that the odds are in your favor.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*All margins are approximations taken 3/16/22