How High Will Crude Oil Prices Go?

Mar 14, 2022

By Frank Kaberna

When commodity prices take off in the short term people tend to fear long-term changes to their everyday lives, especially when it comes to one with such large implications downstream as crude oil does. Sure, more drivers are going electric with every passing day, but the overwhelming majority of the population is still reliant on crude oil’s byproducts for not only car travel using gasoline but also air travel that’s dependent on jet fuel.

So how out of hand can the price tag at the pump or on your next trip get? And what can you do about high crude oil prices?

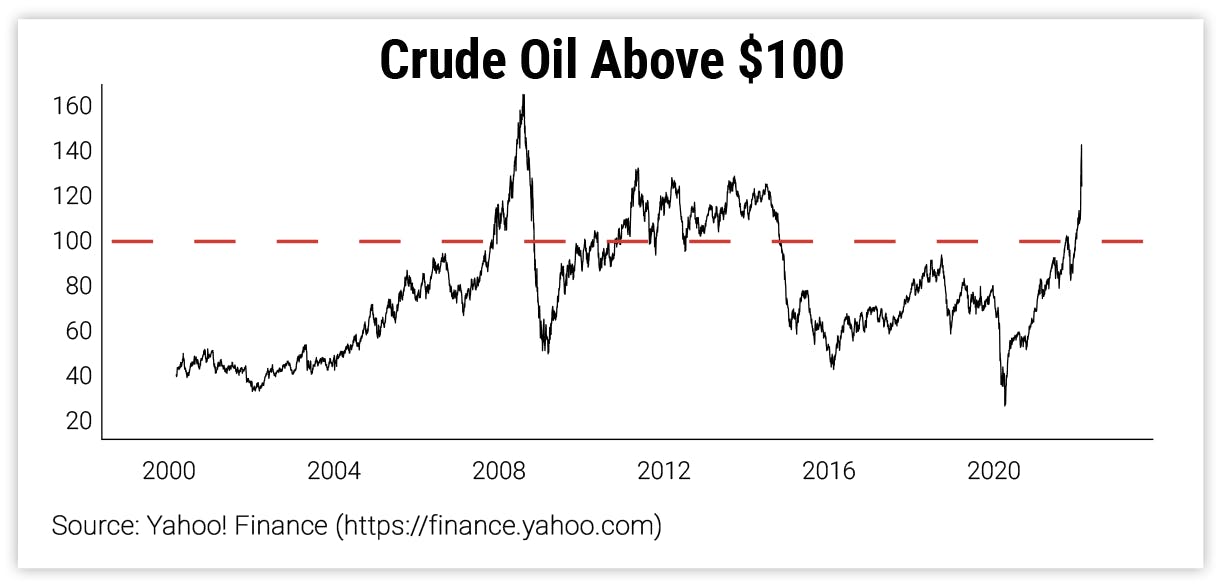

Historical Crude Oil Prices

Going back to 2000, the highest crude oil price was $145 per barrel, which means last week’s price action and its effects are not far off from historical highs. In the same time frame, crude closed above $100 just 8% of the time and spent just 20 days above the watermark before reversing below it, on average.

Source: Yahoo! Finance

This is all to say that crude oil above $100 is a rare sight, historically speaking, and making brash, long-term decisions based on such an outlier might not be the most prudent.

How to Short Crude Oil

Aside from trading in your gas-powered car for an electric one or simply trying not to use the commodity’s byproducts for the next few weeks, you can use futures to sell high crude oil prices.

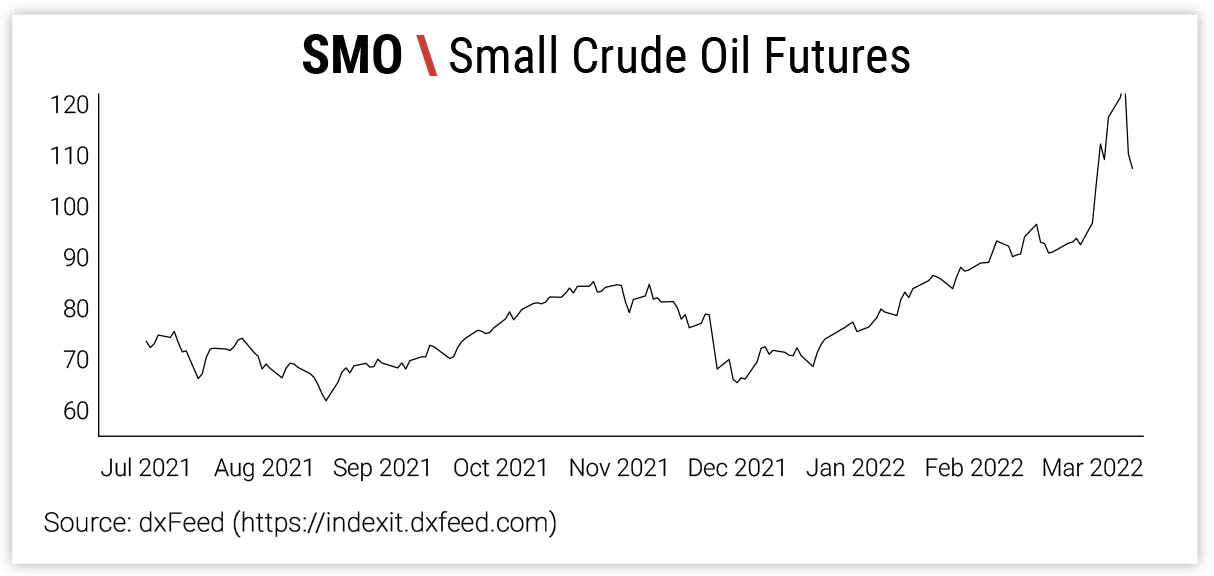

Source: dxFeed

You can use Small Crude Oil futures to speculate on where prices for the energy might be headed at 1/10th the size of the traditional CL futures. Think crude prices will fall from their recent highs? You can sell SMO and profit $100 with every $1 decline in the commodity. Think crude prices will continue to rise?You can buy SMO and profit $100 with every $1 rise in the commodity.

There’s often talk of a new normal being set when markets hit extremes, but, more often than not, the old normal remains dominant. Only time will tell with crude oil prices, and you can access them in a direct, relatively small fashion.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.