Mean Reversion: When Can You Sell High and Buy Low?

Feb 14, 2022

By Frank Kaberna

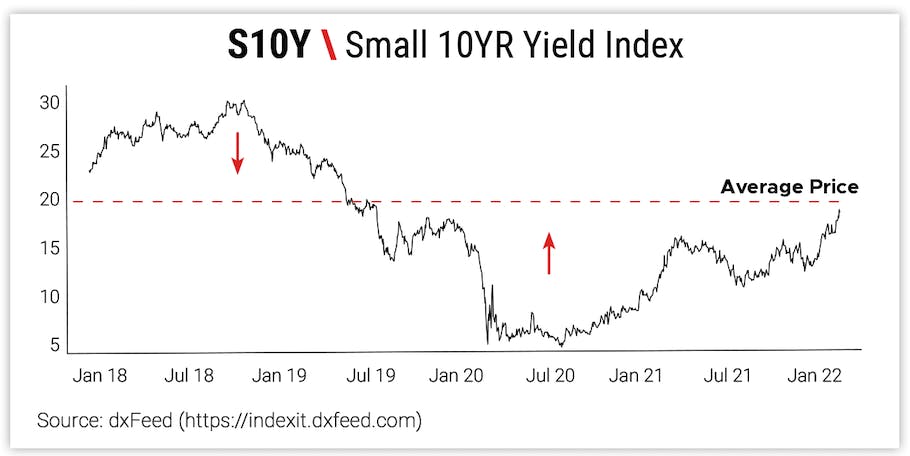

The old motto, “sell high, buy low,” has become a punchline over the years as the growing number of everyday people entering the market find trading not so simple. However, a handful of markets do show mean reversion qualities; that is, asset classes such as interest rates and commodities have a historical average price that they oscillate around.

Source: dxFeed

Is there something to the idea of buying a market far below its “normal” price range? Or selling when it’s at historical highs? What does “mean reversion” trading look like in short, medium, and long term?

Mean Reversion in the Short Term

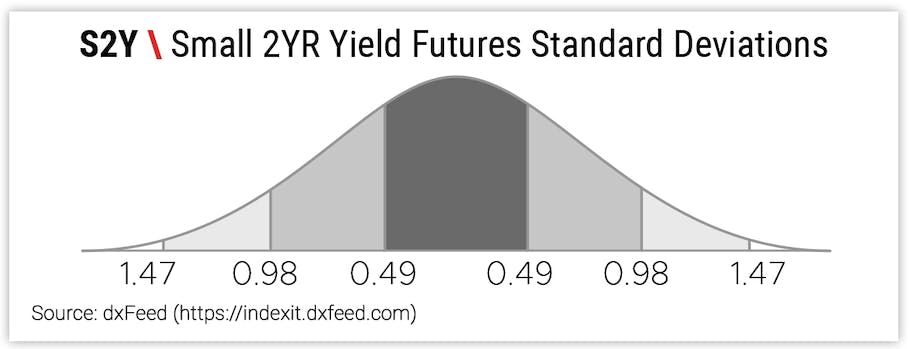

Applying mean reversion to day trading has become increasingly popular, as the strategy has made its way from the algorithms of professional traders to the platforms of everyday people. You can set a net change of 0.00 as your “mean” in a given market and then buy or sell it if it has fallen out of or risen above its normal range - standard deviation.

Source: dxFeed

While it’s most likely unrealistic to expect markets to close every trading day at a net change of 0.00 as you sell every tick higher or buy every tick lower, waiting for a market to move beyond what historical data deems “normal” and going against such a move can put the edge in your favor.

Mean Reversion in the Long Term

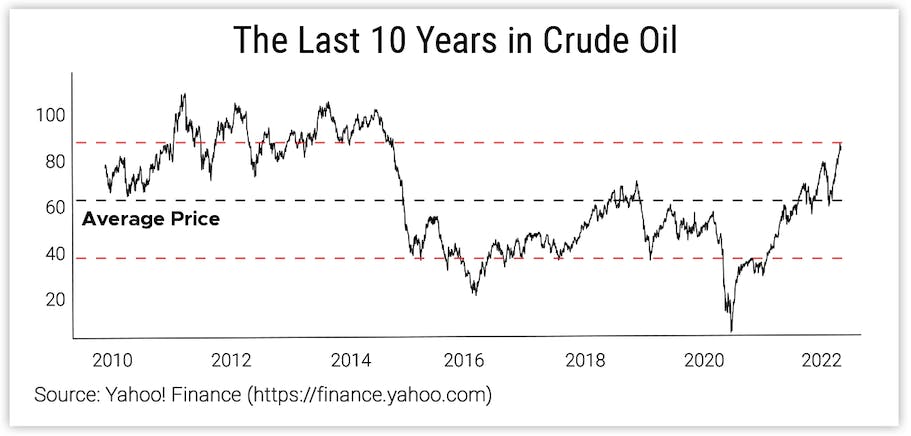

Then there’s the case for creating core portfolio positions out of taking the other side of markets far from their average prices of the past. Keep in mind, however, that this strategy often excludes equity markets that have seen long-term upside drift.

Source: Yahoo! Finance

Take crude oil, for example. This commodity has seen highs above 100 and lows in the teens over the last decade, but it often normalizes to a price in the 50s, 60s, or 70s. Buying below $40 per barrel and selling above $90 per barrel has yielded profits in the past, but staying small or using options to manage risk can be essential given the unknowns of how far the market might move outside its range or how long it might spend there.

Trading might not be as simple as the old adages it’s boiled down to, but there’s been plenty of success in applying mean reversion to markets both intraday and interyear. In 2022, you have so many markets at your disposal that it’s likely at least one is showing an extreme in each setting.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.