Hedging Risk in Futures

Sep 20, 2021

By Frank Kaberna

When you go to buy something in the market an innate sense of fear can kick in just long enough to delay your purchase by a few seconds: What if the market moves lower? What if it moves lower by A LOT?? What if the market GOES TO $0?!?

Though markets outside of penny stocks actually reach $0 with great rarity, the risk is real and should be treated as such. So, how can you mitigate it?

Managing Risk with Product Awareness

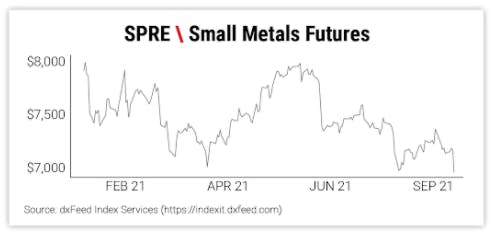

The first, most obvious way to reduce risk in your long strategies is by reducing the number of dollars that stand between your entry price and $0. Take, for example, last week’s crash in metals.

Source: dxFeed Index Services

Simply starting with a smaller product can help take the edge off when stressing your next big buy. Futures are the most direct way for retail traders to access commodities like metals, and there are Gold futures, Micro Gold futures, and Small Metals futures.

Source: Data as of 9/16/2021 CME Group & Small Exchange

Hedging Futures with Options

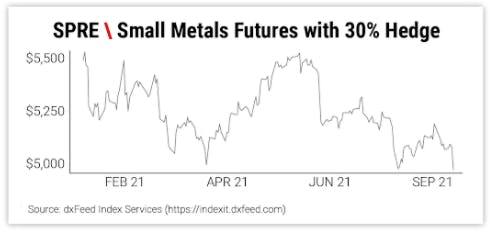

Source: dxFeed Index Services

The math relating SPRE futures to GLD options ([Small Price/ETF Price]*Delta Hedge) translates to about 13 deltas in short GLD calls, which can easily be done via a credit spread.

Last-minute fear must be overcome to jump on long opportunities that arise amid a crash. While that feeling may always be there, your reluctance can be quelled by the right product and hedge.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.