How to Make Crude Oil Smaller

Oct 18, 2021

By Frank Kaberna

After presenting a trader friend with the potential edge in selling crude oil’s recent quinquennial highs, he responded, “Cool, but how high can it go?”

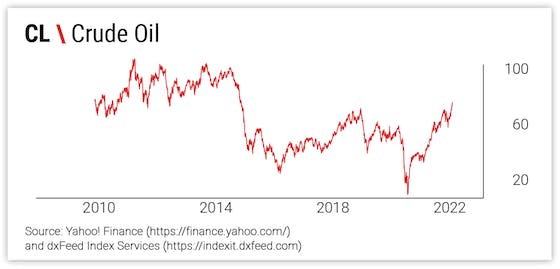

This question can plague many attempting to act on what the data tells them, and it’s especially justified for volatile commodity markets like oil and natural gas. Thankfully, crude oil has been around for a while, and there’s enough data to both display an opportunity and measure the risk around it.

Crude Oil: Trading the Reversal

Knowing that a market has historically reversed course from its highs can be great news for contrarians looking to sell expensive crude oil, and an average move lower of -$2.50 in the month following said high can pose a big fat edge.

Source: Yahoo! Finance as of 10/13/21

Extending Duration in Crude Oil

The challenge becomes withstanding the P/L volatility that can come along with a short crude oil position, not to mention the market’s ability to reach $100 a few times in the last decade.

Source:dxFeed Index Services & Yahoo! Finance

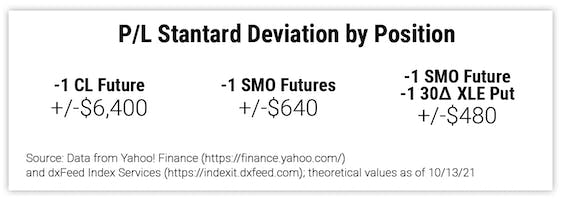

The first step to extending duration is often to simply reduce size. Small Crude Oil (SMO) futures cut the size of traditional crude futures (CL) contracts tenfold. Next, offsetting part of the short position with a long deltas via a short put can help even further. Options on the highly correlated, similarly sized Energy Sector ETF (XLE) offer a solid spot to do so.

Source:dxFeed Index Services & Yahoo! Finance theoretical values as of 10/13/2021

Crude oil has a volatile reputation, and rightfully so! The commodity has both broken the $0 bound and bounced back above $80 since the start of 2020. But the modern trader has the tools to remain chill during periods of explosiveness in this market and potentially take advantage of the opportunity in front of them.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.