It's Time to Trade Crude Oil

May 17, 2021

By Frank Kaberna

If the Colonial Pipeline hack taught us anything, it’s that everyday people need greater access to energy (and that the Colonial Pipeline Company needs better cybersecurity). Last week, drivers scrambled to purchase gasoline at many multiples of what they’d been paying at the pump just days prior.

While you can’t put gas in your car from your computer, a trading platform can help you quickly hedge against soaring energy prices as a supply-crunching story develops.

How to Hedge a Pipeline Hack

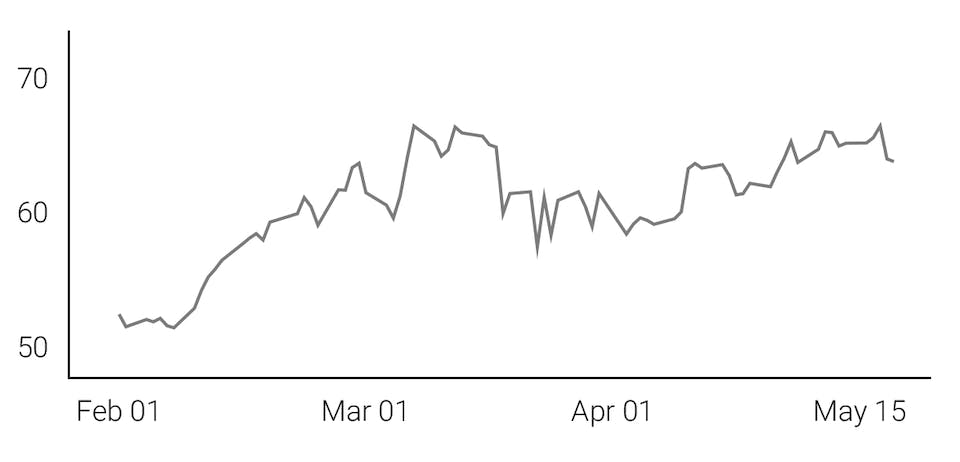

On the morning of May 7th, when the Colonial Pipeline Company announced that it had been hacked, crude oil was trading around $64 per barrel. At the height of the gas shortage scare on May 12th, crude reached almost $67 per barrel. Those looking to hedge against increases in their gasoline prices could have bought crude oil in an effort to profit from the commodity’s appreciation and thus offset higher costs for its byproduct.

Small US Crude Oil \ SMO

Source: dxFeed Index Services

Two Ways to Trade Crude Oil

Futures can be good hedging products given their efficient margins and ease of use, but specific one you choose can vary widely in size. Small US Crude Oil futures offer one of the smallest alternatives fit for the everyday person looking for a few hundred dollars in movement from a pipeline closure, not a few thousand.

Size is relevant in this case because a hedge doesn’t always prove profitable. If the story was overblown and crude oil moved lower by $1 per barrel, then CL would be down $1,000. Jeeps and Hummers may guzzle gas, but not that much.

With the launch of Small US Crude Oil futures, the smaller trader has a new tool for them to hedge and speculate in energy no matter how big or small the news story might end up being.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.