What to Do When Markets Slow Down

Jun 7, 2021

By Frank Kaberna

There’s a tale that circulates among traders every year around this time to help “explain” lulls in market activity. It interprets any slowness in stocks and commodities as market participants in the northern hemisphere going on summer vacation.

While the S&P 500 Volatility Index did drop below 16 last week for just the third time in the last year,* active traders shouldn’t necessarily close their platforms for the next three months; however, an adjustment could be made in order to help your day trading acclimate to leaner moves during beach body season.

Adjusting to Smaller Moves

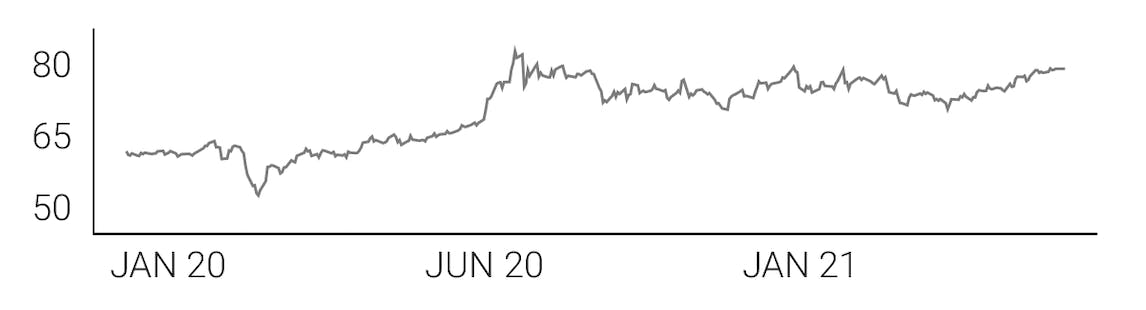

In the last year, the daily range in Small Metals futures has moved from above +/-1.25 to below +/-0.80. This may not seem like a huge deal, but reducing the amount of unique price levels by 35% can put a real damper on day trading opportunities. The remedy for many consists of simply adapting order entries to smaller ranges. Though it may feel awkward at first, trading SPRE® when it’s up or down 75 cents can yield more chances than waiting for a dollar or more.

Small Metals \ SPRE

Source: dxFeed Index Services (https://indexit.dxfeed.com)

Tighter Entries and Smaller Size

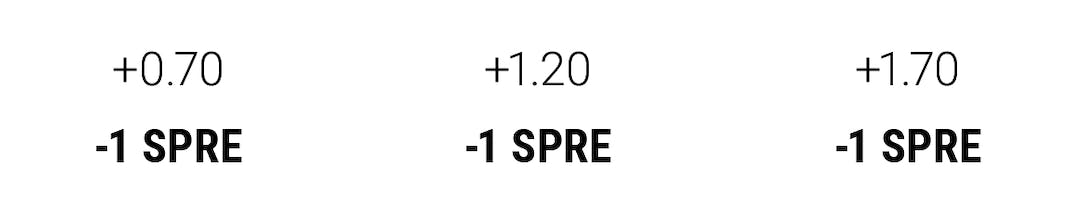

With lower volatility and more aggressive entries, traders often carry fewer units. For example, instead of selling three futures into a +1.20 rally, scalpers can offer one contract into a +0.70 rise. By this strategy, active traders are both keeping their number of opportunities high while not overextending in case of an outlier day.

Getting in earlier doesn’t have to correlate to worse prices thanks to strategies like scaling. In fact, you can have three short futures at the +1.20 mark by selling one at +0.70, +1.20, and +1.70, and this way you still get in on something even if the market never reaches +1.20.

-3 Futures at Average Net Change of +1.20 with Scaling

You don’t have to shut down your trading operations just because some market participants have sidelined their platforms in favor of the Greek Islands, but you can adapt to changing environments.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Values taken from CBOE as of 6/2/21