Why Millennials Should Love Futures

Nov 8, 2021

By Michael Gough

As a millennial, the age group now in our 20s and 30s, I can attest to the accuracy of at least one generalization about our generation—we tend to prefer access to ownership and we appreciate the pure play.

We’d rather grab an Uber or Lyft and charge it than commit to onerous car payments and ruinous depreciation. Who needs the parade of bills for gas, oil, tires, batteries, parking, insurance and repairs? Ride sharing offers door-to-door transportation without undue expense—a pure play.

These changes have combined to recast many businesses as low fee, direct and immediate access to the pure play. And yet, while purchasing stocks has become increasingly inexpensive and easy, decades of legacy financial infrastructure still make it difficult to trade the most popular commodities such as oil, gold and interest rates.

It’s a breeze to buy stock in Starbucks. Just open Robinhood or tastyworks, search SBUX and hit “buy.” But to buy oil, what’s the symbol? Well, on a stock trading app there isn’t one.

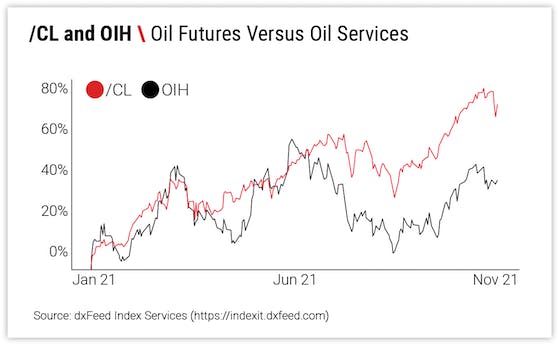

Sure, we could buy Exxon Mobil stock but that’s not the pure play. I don’t care about Exxon’s production capacity or quarterly earnings, I just want to make money when oil moves. I could also buy an oil fund but that’s just a basket of companies plus a ridiculous management fee. Seriously, millennials are great at accessing information, why pay a management fee when we can manage our own money? Take a look at the discrepancy in performance between oil and OIH, an oil services fund. While oil is up 70% since the start of the year, OIH is only up 40%.

With the billions of dollars awarded to fintech companies, it’s time to innovate futures. With their capital efficiencies, tax advantages and pure price exposure, everyone should love futures. It’s time for cost-effective, pure-play, straightforward products for all generations to participate in previously unreachable markets.

Source: dxFeed Index Services

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Data from dxFeed Index Services as of 11/05/21