The Power of the Call Option

Mar 7, 2022

By Frank Kaberna

The wide world of options can open up an everyday trader’s portfolio to P/L fluctuations unseen in the outright world of shares and futures. You can take advantage of large moves higher while only putting up a small, set amount of capital by buying calls. You can make money from a particular market’s demise without the risk of going short by buying puts. Or you can sell them both and profit from no movement at all.

Here’s your beginner’s guide to the bullish half of the options duo - call options:

The Defined-Risk Bullish Bet

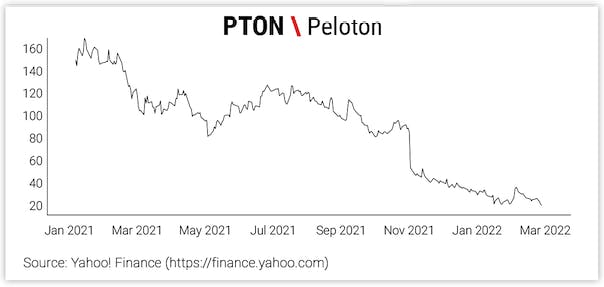

Source: Yahoo! Finance

One of the most popular ways to use call options has been for cheap, defined-risk bullish exposure. Take Peloton stock, for example. You could buy a few shares of PTON at around $25 apiece with the full risk potential of the market collapsing to $0; or, you could buy the 30 strike calls in April for a total of $90, which would entitle you to the potential success of 100 shares of PTON if the price can get back above 30 while only risking $90, no matter how low the stock goes.* The drawback: your probability of profiting from this strategy is much less than your 50/50 odds would be when buying shares.

The Long Stock Hedge with Edge

Source: Yahoo! Finance

Then there’s the part calls play in the oft-used covered call strategy. Say you’re long 100 shares of Tesla from way back, and, while you don’t want to get rid of those shares quite yet, you want to place a hedge on top of your position given how far your stock has come.You can sell a call at a strike price much higher than the stock’s current price and receive a few bucks if the market moves lower, sideways, or even a little higher. The drawback: if TSLA goes on a big bull run past your short call strike price, then you will theoretically lose your shares’ exposure.

The High-Probability Short

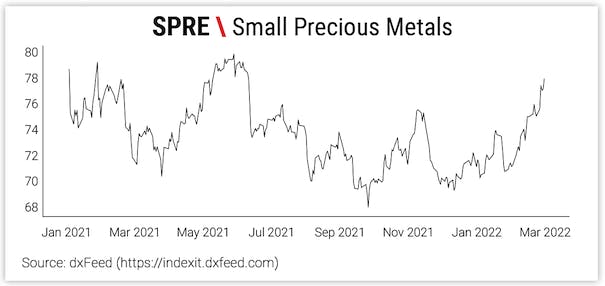

Source: dxFeed

Finally, you can sell the call option alone thereby creating short exposure with a theoretically higher than 50% chance of profiting. For instance, if gold and silver rally back to their highs and you think the market will fall back but aren’t so confident to sell the outright SPRE futures, then you can sell a call at a strike price higher than the futures price. This strategy entitles you to the credit you sold the call for as long as the market is below your strike at expiration. The drawback: the short calls exposure grows to a full contract or 100 short shares as the underlying market encroaches and surpasses your strike price.

Options can giveth and taketh away in many manners, but using calls and puts to downsize risk can be especially helpful in a volatile market.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*All example data taken on 3/4/22