Three Easy Ways to Buy Gold and Silver

Jan 31, 2022

By Frank Kaberna

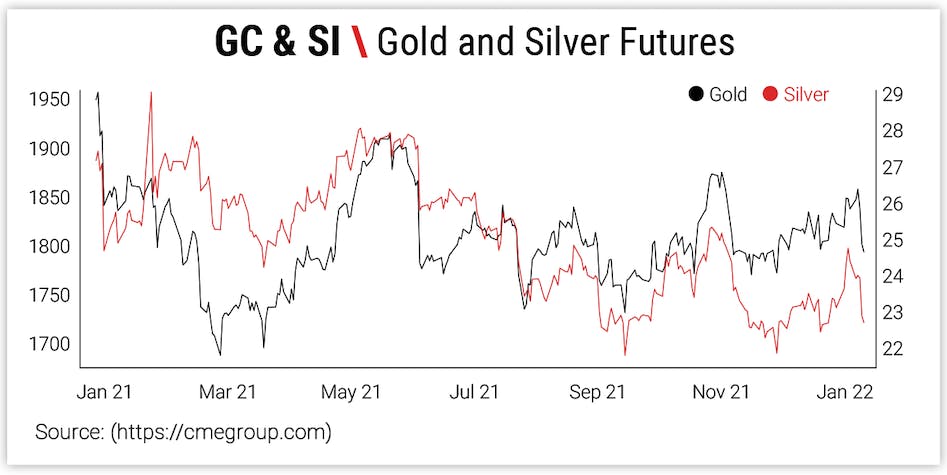

The descent in metals following last week’s FOMC could present an interesting opportunity for those looking to add long gold and silver exposure to their portfolio or at least try their hand at trading this unique asset class diversified from equities on a historical extreme.

Source: CME Group

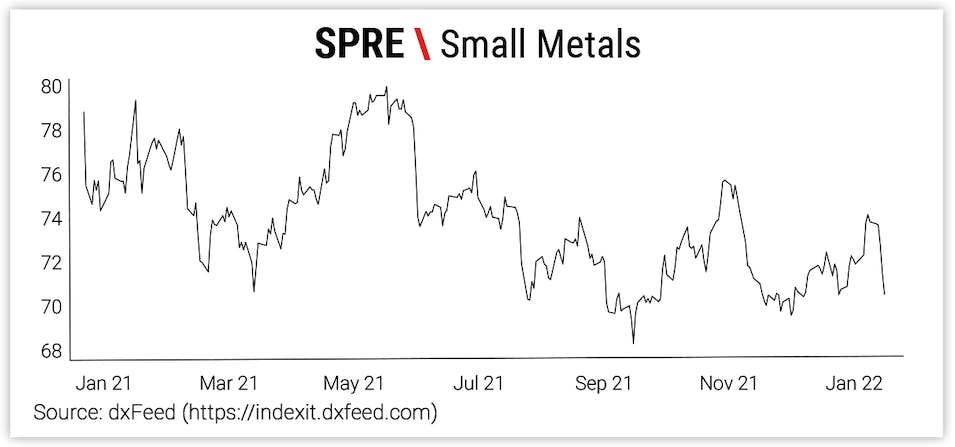

Futures have long been a low-cost, direct route to gaining precious metal investment without having to either physically own the commodity or pay a high capital requirement (50-100% of investment) for an exchange-traded fund or note. The relatively new Small Metals (SPRE®) futures let you access gold, silver, and platinum in one order that costs less than traditional and Micro Gold and Silver futures.

Source: dxFeed

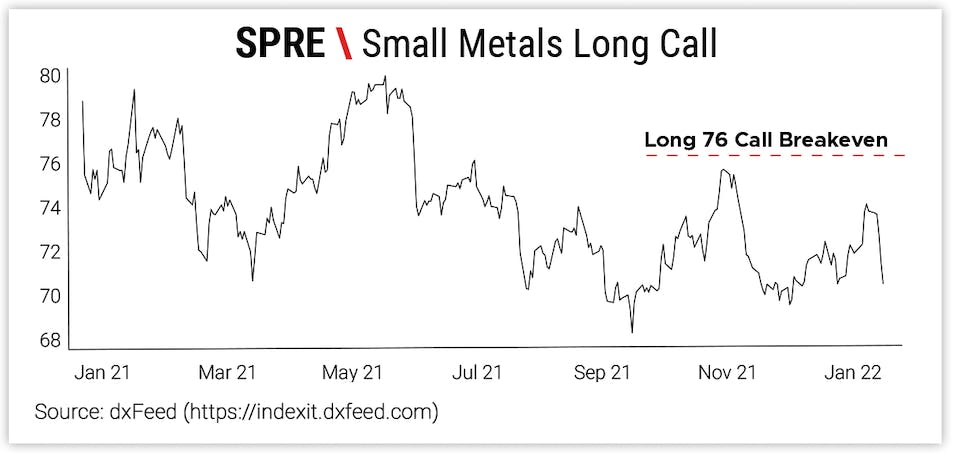

Buying a Market with Long Calls

The long call option can give you close to 1-for-1 exposure in the underlying market if that market’s price is higher than your strike’s, and your loss potential is simply the amount you paid for the call. However, you trade probability of success for a defined amount of risk in this strategy in what is called the premium on the option.

Source: dxFeed

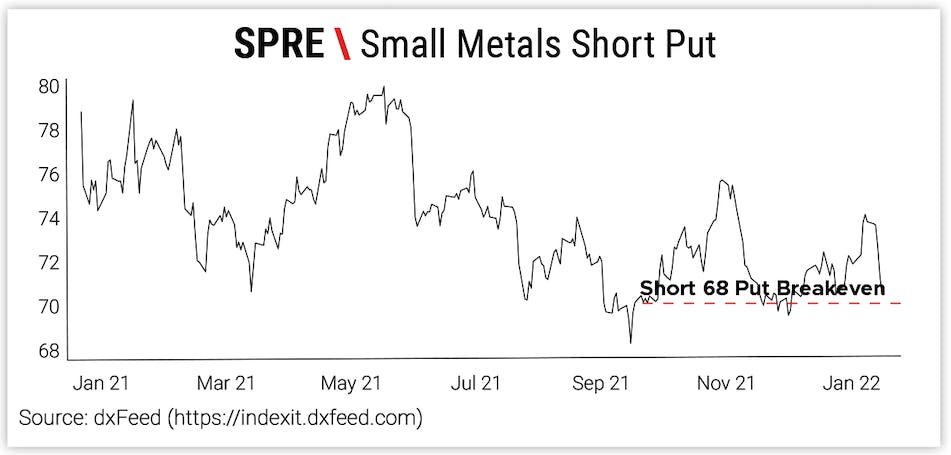

Buying a Market with Short Puts

The short put option can give you close to 1-for-1 exposure in the underlying market if that market’s price is lower than your strike’s, and you take near-full ownership as long as the market exists below your put strike. Since you are on the short side of options, however, your probability of success is boosted north of 50% given you are the seller of option premium. That said, you stand to lose exposure, the premium, and more as the underlying market rises.

Source: dxFeed

Derivatives offer different ways to profit from the same old markets you hear about daily, and each derivative - futures, calls, puts - comes with its own tradeoffs. Gain exposure to gold, silver, and more in the way that best suits your portfolio.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.