How to Trade Crude Oil Futures

Apr 14, 2022

By Sage Anderson

Sometime down the road, the world economy will likely be fueled by a mix of green energy (solar, wind) and nuclear power (fission, fusion). But for the foreseeable future, traditional fossil fuels like crude oil and natural gas will remain fixtures in the global energy and transportation sectors. This is clearly illustrated by the fact that 97% of Americans still rely on gasoline to power their vehicles. Moreover, recent geopolitical events in Eastern Europe have also reinforced the importance of affordable and plentiful gasoline in the American economy.

Taken together, this means that commodities like crude oil and natural gas will remain fixtures in the global financial markets. And on any given day, crude oil and natural gas are also two of the highest-volume products traded on Wall Street.

For investors and traders alike, that means the highly liquid energy sector represents a place to potentially diversify one’s portfolio and trading activity.

Moreover, the fact that energy markets are always moving—sometimes dramatically—also means that opportunities in this niche of the financial markets are usually plentiful.

Crude Oil Trading: Supply and Demand

Virtually every commodity experiences price fluctuations that can be tied back to supply and demand dynamics. When supplies of a given product are scarce, prices almost always go up. And when supplies are plentiful in the market, prices usually remain stagnant—or even go down.

Global energy markets are especially sensitive to supply and demand dynamics in the marketplace. For example, the world consumes just under 100 million barrels of crude oil on any given day*. So, any significant disruption to the demand or supply side of the crude oil market can have a big impact on market prices.

This was observed first-hand when the COVID-19 pandemic first took hold in spring of 2020, as demand for crude oil in the global economy declined sharply as a result of global economic lockdowns. At that time, the decline in crude oil demand was so dramatic that it became difficult to find storage tanks to hold excess production. Supplies were so plentiful that prices in the crude oil futures market dropped below zero for the first time in history.

Of course, the opposite situation can also occur—when demand outstrips supply. In those situations, crude oil prices tend to rally—sometimes significantly. That scenario is playing out now as Russia expands its military conflict with Ukraine.

As a result of Russia’s expanded war with Ukraine, crude oil prices rallied as much as 60% during the first quarter of the year. And during that window of time, there was even a single week where crude prices jumped by 20%—only the fifth time in market history that a 20% gain in a single week was observed in the market.

These examples help reinforce how supply and demand dynamics in the crude oil market can change quickly and lead to dramatic moves in the underlying price of this key energy commodity.

How Does OPEC Affect Crude Oil Prices?

Considering the importance of crude oil in the world economy, it probably won’t come as much of a surprise to hear that countries with large reserves of oil play a key role in the global market.

Today, most market participants associate the oil market with an organization known as “OPEC,” or the Organization of Petroleum Exporting Countries. OPEC was first formed back in 1960, when Iran, Iraq, Kuwait, Saudi Arabia and Venezuela all banded together to coordinate on oil policy—particularly relating to production. Currently, OPEC consists of 13 member states that account for roughly 44% of daily global production and approximately 81% of the world’s proven oil reserves.

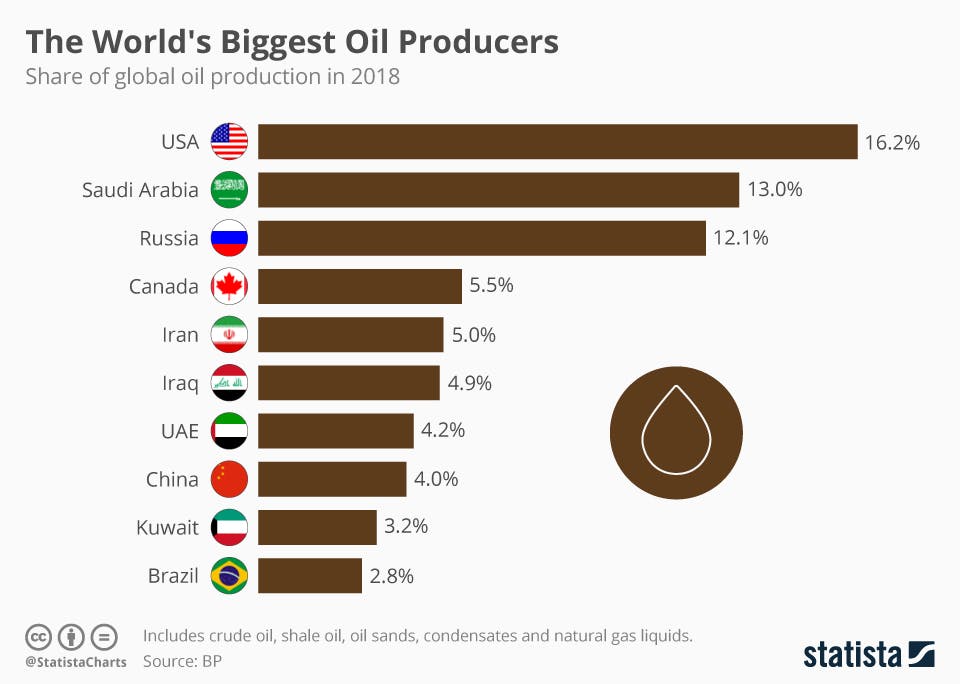

In 2016, OPEC aligned with other top oil-exporting nations to form an even more powerful entity now referred to as OPEC+, or OPEC Plus. OPEC+ consists of the 13 members of OPEC as well as 10 other non-OPEC members. Russia is the most prominent member of the latter group, accounting for roughly 12% of global crude oil production.

Decisions made by OPEC+—particularly related to production—tend to hold significant influence over energy markets. For example, in the wake of pandemic-related economic shutdowns, OPEC+ coordinated to cut crude oil production in an effort to boost prices. The group can also theoretically boost production to help offset rising demand. Increased production from OPEC+ can help stabilize prices in the market when they start to rise too quickly. Therefore, participants in energy markets should be aware of any important decisions taken by OPEC+.

It’s important to note that the United States has also increased its influence over the global energy market in recent years. As a result of the shale revolution, the United States is now the largest producer of crude oil in the world, accounting for roughly 16% of annual production.

Source: Statista

However, in terms of total proven crude oil reserves (i.e. the amount of total oil in the ground), the top players in the world remain Venezuela, Saudi Arabia, Canada, Iran, Iraq, Kuwait, United Arab Emirates and Russia (in that order).

Crude Oil Futures: Getting Started

As previously referenced, crude oil is integral to the world economy, and therefore enjoys an extremely high profile in the financial markets.

The liquidity in the crude oil universe also makes it highly attractive to a diverse group of market participants. And because crude oil often trades with a high degree of volatility, that means it’s also viewed opportunistically as a good place to speculate.

The fact that a wide spectrum of news items can be linked to crude oil can also drive volatility, and thus potential trade opportunity, higher. Whether they are economic, geopolitical, or weather-related in nature, a wide range of news developments can have a significant and immediate impact on crude oil prices.

All of these items can make crude oil markets attractive to both day traders and those that take a longer view on their positions/portfolios.

People who elect to trade in the crude oil space usually do so using futures or equities markets (i.e. stocks and ETFs). However, equity products aren’t necessarily ideal for accessing crude exposure, because oil stocks can sometimes move with the broader stock market, as opposed to with crude oil itself. Traditional futures contracts tend to have extremely high notional values, which can be a deterrent for many market participants.

For example, a traditional futures contract equates to 1,000 barrels of oil. With crude currently trading around $100/barrel†, that means the notional value of a single crude oil futures contract would be $100,000 ($100/barrel x 1,000 barrels per contract = $100,000). That’s one reason the traditional futures market tends to be dominated by institutional money.

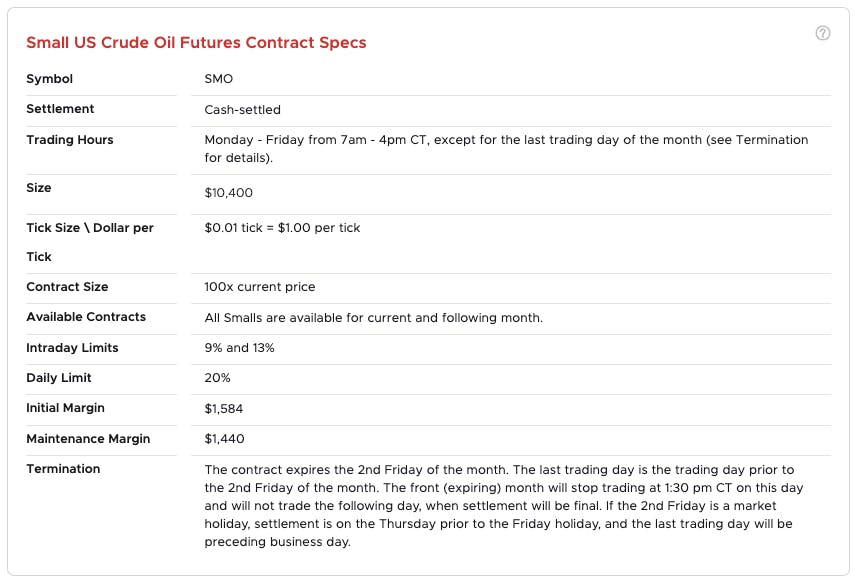

One outlet for investors and traders seeking to express a short-term or long-term directional position in the crude market is the Small US Crude Oil (SMO) product offered by the Small Exchange®.

SMO offers direct exposure to crude oil through a scaled-down notional value that is “right-sized” for retail investors and traders, as illustrated below.

Importantly, the Small US Crude Oil future also offers capital efficiency relative to other choices in the marketplace. For example, when trading a crude oil stock ETF such as the Energy Select Sector SPDR Fund (XLE), the average investor needs to set aside 50% to 100% of the trade’s total value in cash. SMO, on the other hand, requires only 2% to 4% of the product’s value.

Similar to the rest of the Smalls, SMO prices move in increments of 0.01, with each tick representing a dollar.

For more on the “Smalls,” and their niche in the broader financial markets, readers can also tune into the Small Stakes series on tastytrade financial network.

*Source: statista

†As of 3/14/22

Sign up for more articles like this with our free weekly market commentary.